As the trading week draws to a close, the forex markets are experiencing a period of relative calm in today’s Asian session. Key developments include Euro’s attempted resurgence against Dollar overnight, which, despite initial signs of a rally, lost its momentum and settled back into familiar range. This pattern of indecisiveness is mirrored by Swiss Franc, which, after a period of gains against Dollar, is now in a similar phase of consolidation, aligning with other European majors. Commodity currencies displaying a softer stance overall. However, Australian Dollar stands out for its resilience.

For the week, Dollar remains the weakest performer overall. However, it’s noteworthy that Dollar is managing to stay above the previous week’s low against most currencies, except for Euro and Swiss Franc. This observation suggests that Dollar is still in the process of digesting its recent losses. Canadian Dollar and Japanese Yen follow as the next weakest, whereas Australian Dollar stands out as the strongest for the week. However, Aussie’s position is somewhat precarious, as it hasn’t surpassed last week’s high against other rivals, indicating a lack of strong buying momentum. Euro and the British Pound are trailing as the next strongest, while Swiss Franc shows mixed performance.

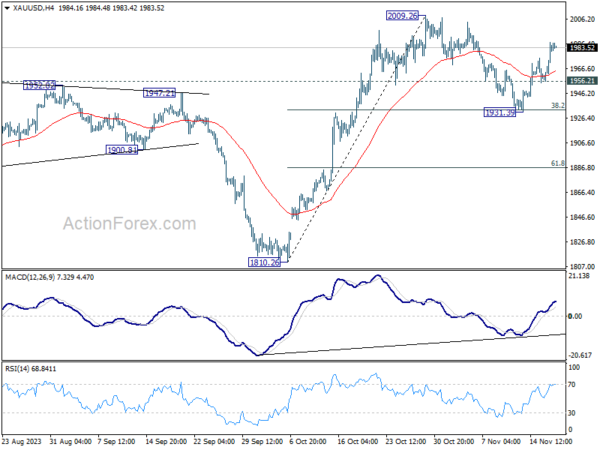

Technically, Gold’s rally from 1931.39 is still in progress. Correction from 2009.26 should have completed after drawing support from 38.2% retracement of 1810.26 to 2009.26 at 1933.24. Further rise is expected as long as 1956.21 support holds. Retest of 2009.26 should be seen next. Firm break there will resume whole rally from 1810.26 to key resistance zone at 2062/74.

In Asia, Nikkei closed up 0.48%. Hong Kong HSI is down -1.98%. China Shanghai SSE is down -0.03%. Singapore Strait Times is down -0.39%. Japan 10-year JGB yield is down -0.030 at 0.761. Overnight, DOW dropped -0.13%. S&P 500 rose 0.12%. NASDAQ rose 0.07%. 10-year yield dropped -0.090 to 4.445.

Fed’s Cook: Soft landing is possible but not assured

Fed Governor Lisa Cook addressed the delicate balance between sustaining economic growth and managing inflation in her conference remarks overnight. Cook acknowledged the possibility of achieving a “soft landing” for the US. economy, highlighting the ongoing disinflationary trends and robust labor market conditions. However, she was quick to note that such an outcome is not guaranteed.

“A ‘soft landing’ is possible, with continued disinflation and a strong labor market, but it is not assured,” Cook stated. She elaborated on the complexities noting, “I see risks as two-sided, requiring us to balance the risk of not tightening enough against the risk of tightening too much.”

She also pointed out the current economic resilience, saying, “The economy is still growing and consumers are still spending,” which could potentially maintain demand-driven pressures in the market. Such momentum, according to Cook, could keep the economy and labor market tight, consequently slowing the disinflation process.

However, Cook also expressed concern over the potential negative impacts of aggressive policy measures, adding, “But I am also attuned to the risk of an unnecessarily sharp decline in economic activity and employment.”

Mester’s perspective from Fed’s crow’s nest: Disinflation progress made, yet more evidence needed

In a CNBC interview overnight, Cleveland Fed President Loretta Mester acknowledged, “We’re making progress on inflation, discernible progress. We need to see more of that.”

But she also highlighted the necessity of observing more concrete data to confirm that inflation is indeed on a timely path back to the desired level.

In her metaphorical reference to the “crow’s nest”, a vantage point on a ship used for spotting distant objects, Mester likened Fed’s current position.

“We’re at the crow’s nest. What does the crow’s nest let you do? It lets you look out on the horizon and see where the data is coming in, where the economy is evolving.”

As for her personal stance on the direction of monetary policy, “I haven’t assessed that yet. Where I think we are right now is we’re basically in a very good spot for policy.”

BoE’s Ramsden signals extended period of restrictive monetary policy ahead

BoE’s Deputy Governor Dave Ramsden emphasized the need for a prolonged phase of restrictive monetary policy to achieve the central bank’s inflation target. Speaking on the future direction of the BoE’s approach, Ramsden stated, “Monetary policy is likely to need to be restrictive for an extended period of time.”

Ramsden further elaborated on the Monetary Policy Committee’s stance, noting, “The MPC have communicated that monetary policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term.”

Additionally, Ramsden, who oversees BoE’s quantitative tightening program, discussed the uncertainty surrounding the optimal size of the central bank’s balance sheet. The ongoing assessment of the necessary reserves supply aims to meet both monetary policy objectives and ensure financial stability.

“We continue to work towards assessing what our future steady state reserves supply looks like, both to meet our monetary policy objectives through quantitative tightening, while ensuring our financial stability objective is also supported,” he explained.

BoJ’s Ueda reiterates patience in maintaining ultra-loose policy

BoJ Governor Kazuo Ueda has once again underscored the central bank’s commitment to maintaining its ultra-loose monetary policy, emphasizing the need for patience in the face of uncertain inflation dynamics.

Speaking to the parliament, Ueda noted, “Trend inflation is likely to gradually accelerate toward our 2% inflation target through fiscal 2025. But this needs to be accompanied by a positive wage-inflation cycle.”

“Uncertainty on whether Japan will see such a positive wage-inflation cycle is high,” he added.

Addressing the behavior of 10-year JGB yields, Ueda expressed that he does not foresee a sharp rise above the 1% reference level, even under upward pressure.

Looking ahead, Ueda clarified the bank’s position on potentially ending its Yield Curve Control and negative interest rate policies, stating, “We will consider ending YCC, negative rate if we can expect inflation to stably, and sustainably hit the price target.”

He added that the order of adjustments to the policy would be contingent on various factors, including economic conditions, price movements, and market developments.

WTI crude oil nosedives to four-month low, more downside ahead

WTI crude oil experienced a significant tumble this week, dropping around -5% yesterday and reaching its lowest point in four months, marking a trajectory for its fourth consecutive week of decline. This marks the commodity’s potential fourth consecutive week of decline.

Despite OPEC and IEA’s predictions of supply tightness in Q4, a confluence of disappointing global economic data and a surge in US crude inventories, coupled with sustained record-level production, has fueled the sharp selloff.

From a technical analysis perspective, the bearish sentiment was cemented earlier this week when WTI failed to reclaim psychological level. The ongoing decline from 95.50 is now expected to continue to 161.8% projection of 95.50 to 81.77 from 91.07 at 68.85. However, we anticipate significant support emerging in 63.67/66.94 support zone, which to trigger reversal.

Overall, WTI is seen as encapsulated in a long-term range-bound pattern, oscillating between the 63/64 and 95/96 zones.

Looking ahead

UK retail sales is the main highlight in European session, while Eurozone will release CPI final. Later in the day, Canada will release IPPI and RMPI. US will release building permits and housing starts.

USD/CHF Daily Outlook

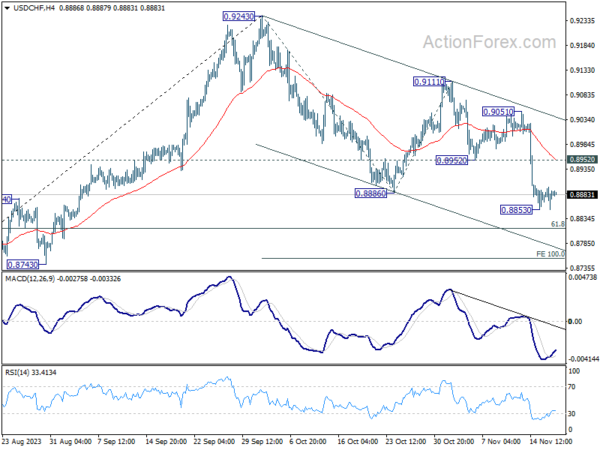

Daily Pivots: (S1) 0.8837; (P) 0.8933; (R1) 0.8988; More….

A temporary low is formed at 0.8853 and intraday bias in USD/CHF is turned neutral for consolidations. Stronger recovery cannot be ruled out. But upside should be limited by 0.8952 support turn resistance to bring another fall. Break of 0.8852 will resume the decline from 0.9243 to 100% projection of 0.9243 to 0.8886 from 0.9111 at 0.8754.

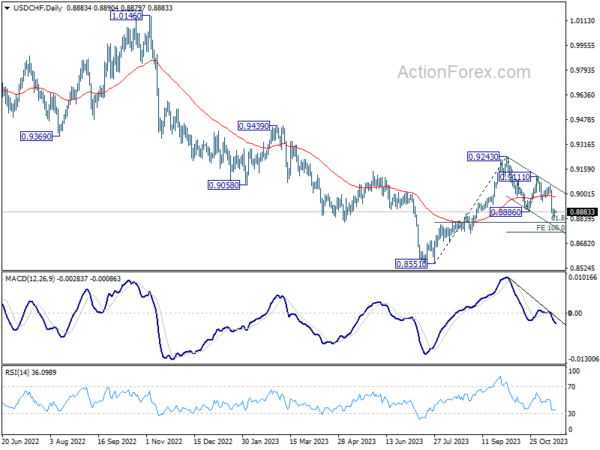

In the bigger picture, price actions from 0.8551 are currently seen as a correction to the decline from 1.0146. Fall from 0.9243 is seen as the second leg for now. Deeper fall would be seen to 61.8% retracement of 0.8551 to 0.9243 at 0.8815. Sustained break there will bring retest of 0.8551 low. For now, this will remain the favored case as long as 0.9111 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q3 | 1.20% | 0.20% | -0.20% | |

| 21:45 | NZD | PPI Output Q/Q Q3 | 0.80% | 0.40% | 0.20% | |

| 07:00 | GBP | Retail Sales M/M Oct | 0.30% | -0.90% | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Sep | 20.3B | 27.7B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct F | 2.90% | 2.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct F | 4.20% | 4.20% | ||

| 13:30 | CAD | Industrial Product Price M/M Oct | 0.20% | 0.40% | ||

| 13:30 | CAD | Raw Material Price Index Oct | -2.00% | 3.50% | ||

| 13:30 | USD | Building Permits Oct | 1.45M | 1.47M | ||

| 13:30 | USD | Housing Starts Oct | 1.36M | 1.36M |