USDJPY moves above 151.00

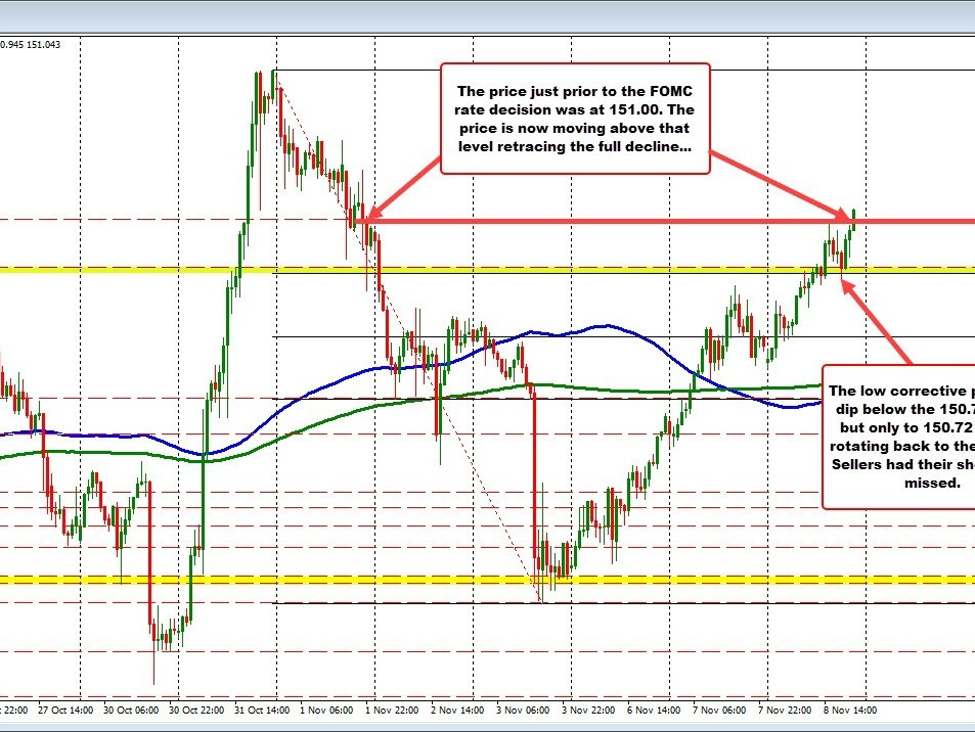

In an earlier post, I spoke to the sellers near the 151.00 level. That level corresponded with the price just prior to the FOMC rate decision last Wednesday. The price trended down reaching a low on Friday at 149.180.

The inability to get above the 151.00 level opened the door for the high potentially being in place. However getting below the 150.774 swing high going back to October 26, and the broken 61.8% retracement at 150.742 would be needed to give sellers more confidence.

The low-price in the USDJPY did extend below those levels, but only to 150.72 before rotating back to the upside over the last 3 hours of trading. Sellers were disappointed. The last 3 hours has now seen the price move above the 151.00 level (with a high of 151.047). Buyers are still in control.

What next?

The aforementioned support area near the 150.74 level remains in play and a close risk/bias-defining level for traders. Staying above it is more bullish.

The upside has targets near 151.23 and 151.38 before the high from October 31 at 151.707.