As the new trading week opens, the forex markets present a scene of relative tranquility during the Asian session. Dollar is attempting a modest recovery from last week’s downturn, yet the impetus for a decisive rally seems absent. In contrast to the upbeat sentiment in Asian equity markets, spurred by Friday’s surge on Wall Street, currencies such as the Australian and New Zealand Dollars are not following suit, entering a phase of consolidation instead. Yen has shown vulnerability in response to BoJ Governor Kazuo Ueda’s reaffirmation of a dovish policy outlook. Meanwhile, Swiss Franc has edged ahead, together with Euro, as the British Pound trails its continental counterparts.

Today’s economic calendar will feature Eurozone PMI services final and Sentix investor confidence, complemented by UK’s construction PMI and Canada’s Ivey PMI. These figures, however, are not expected to be the catalysts for significant market movement. Market participants seem poised to hold their breath for more definitive events, such as tomorrow’s widely anticipated rate decision by RBA and the forthcoming Japanese wage statistics, which could provide fresh directional inspirations.

In this context, AUD/JPY currency pair stands out as one to watch. Technically speaking, AUD/JPY’s triangle consolidation from 97.66 is likely completed already and rise from 86.04 is ready to resume. Break of 97.66 resistance will confirm this bullish case and target 99.32 high. Firm break there will resume larger up trend from 59.85 (2020 low). Next target will be 61.8% projection of 86.04 to 97.66 from 94.21 at 101.39. However, break of 96.48 will delay the bullish case and bring retreat first.

In Asia, at the time of writing, Nikkei is up 2.23%. Hong Kong HSI is up 1.71%. China Shanghai SSE is up 0.83%. Singapore Strait Times is up 0.49%. Japan 10-year JGB yield is down -0.040 at 0.876.

ECB’s Lagarde determined to bring inflation down to 2%

In an interview with Kathimerini, ECB President Christine Lagarde enunciated the bank’s determined path: “We are determined to bring inflation down to 2%. According to our projections, we will get there in 2025.”

This determination comes against a backdrop of soaring prices affecting economies worldwide, with ECB focusing not just on the broader inflationary metric but also on its constituent parts. “When we measure inflation, we pay attention to the headline rate,”

Delving into the specifics, Lagarde acknowledged the significant volatility in food prices, a primary concern for policy-makers and consumers alike. She highlighted a future clouded by environmental uncertainty: “Is the price of food going to be higher in the future? That’s a possibility if you look at the impact of climate change.”

Lagarde also touched on the societal impact of inflation, particularly the strain on the vulnerable populations. “Let me say that our mandate is to ensure price stability, and this is the best contribution we can make to social peace and to society, to the most vulnerable of its members in particular.”

BoJ Governor Ueda affirms commitment to easing amid uncertain inflation-wage dynamics

BoJ Governor Kazuo Ueda reaffirmed today the central bank’s commitment to its accommodative stance.

“We’re seeing more positive signs than before in corporate wage and price-setting behavior,” Ueda stated, acknowledging the nascent signs of a healthier inflation-wage cycle. However, he also underscored the prevailing uncertainties, admitting, “there’s still uncertainty on whether the positive cycle will strengthen, as we predict.”

With an eye on supporting economic activity, Ueda emphasized the central bank’s resolve, “We will patiently maintain monetary easing,” indicating no immediate shift from BoJ’s long-standing dovish position.

Last week’s decision to relax the 1% cap on 10-year JGB yield, allowing greater movement in long-term borrowing costs, was a nod to flexibility in BoJ’s approach. Today, Ueda elaborated, “We will conduct nimble market operations when interest rates rise, depending on the level and speed of moves of long-term rates.”

Ueda also sought to temper market expectations regarding the potential for sharp rises in long-term yields. “Even if long-term rates come under upward pressure, don’t expect the 10-year JGB yield to sharply exceed 1%,” he stated.

The Governor’s comments reflect a deep consideration of the “real” interest rate, which factors in inflation expectations. He explained, “Long-term rates may rise somewhat but what’s important is to look at the real interest rate that takes into account inflation expectations.”

He reassured markets, “Even if long-term rates rise, real interest rates will move in negative territory so monetary conditions will be sufficiently accommodative.”

Japan’s PMI services finalized at 51.6, growth is on the wane

Japan’s PMI Services was finalized at 51.6 in October, down from previous month’s 53.8. PMI Composite figure similarly declined to 50.5 from September’s 52.1.

Andrew Harker of S&P Global Market Intelligence highlighted the subdued performance: “While the PMI data continue to make positive reading for the Japanese service sector, the recent trends suggest that growth is on the wane.”

He elaborates that the slowdown is notably marked by the softest increases in activity and new orders witnessed since the year’s inception, which could herald a persistent deceleration as we edge closer to the year’s end.

This softening expansion has raised concerns regarding the service sector’s capacity to buoy the broader economy, particularly as manufacturing continues to lag. Harker notes the stagnation of new orders in October, halting an eight-month stretch of growth and presenting a cautionary backdrop for the upcoming months.

This week’s market movers: RBA , BoJ opinions, Fed comments, and UK GDP

RBA gears up for a widely anticipated rate hike amidst stubbornly strong inflation figures. With inflation showing no signs of a slowdown, indicated by a quarterly CPI jump of 1.2% and a monthly CPI acceleration to 5.6% yoy, all eyes are on the RBA’s rate decision and its subsequent implications on monetary policy.

Investors and analysts alike are bracing for a 25 basis point increase to 4.35%, but the larger narrative lies in RBA’s inflation forecasts and the strategic path set for future rates. The uncertainty is palpable, and the forthcoming Statement on Monetary Policy is expected to shed light on these pivotal questions.

Simultaneously, BoJ is slated to release Summary of Opinions from its late October meeting. The bank’s subtle shift in language, hinting at a more flexible stance on the 1% yield cap, has stoked interest in the details of this adjustment and the broader implications for Japan’s protracted negative interest rate policy. Upcoming cash earnings data from Japan will also be scrutinized as wages growth is a prerequisite to sustainable inflation.

Adding to the mix, BoC and ECB will also be under examination as they publish summaries of deliberation and an economic bulletin, respectively. Additionally, as the Fed’s blackout period ended, the financial world awaits policymakers’ insights, particularly their perspectives on the timing and extent of future rate reductions.

On the data front, UK’s GDP figures are expected to be a highlight too, with current indicators hinting at the UK skirting the edges of a recession. Negative deviations from expected GDP outcomes could solidify the narrative that BoE’s rate hikes have reached their peak already.

Lastly, as the global economic pulse is continually assessed, China’s upcoming reports on trade balance, CPI, and PPI will provide valuable data points, offering a glimpse into the resilience of the world’s second-largest economy amid widespread deflation and slowdown concerns.

Here are some highlights for the week:

- Monday: BoJ minutes; Germany factory orders; Eurozone PMI Services final, Sentix investor confidence; UK PMI construction; Canada Ivey PMI.

- Tuesday: Japan average cash earnings, household spending; China trade balance; RBA rate decision; Swiss unemployment rate, foreign currency reserves; Germany industrial production; Eurozone PPI; Canada trade balance; US trade balance.

- Wednesday: New Zealand inflation expectations; Germany CPI final; France trade balance; Italy retail sales; Eurozone retail sales; Canada building permits; BoC summary of deliberations.

- Thursday: BoJ summary of opinions; China CPI, PPI; ECB monthly bulletin; US jobless claims.

- Friday: UK GDP, production, trade balance; US U of Michigan consumer sentiment.

GBP/USD Daily Outlook

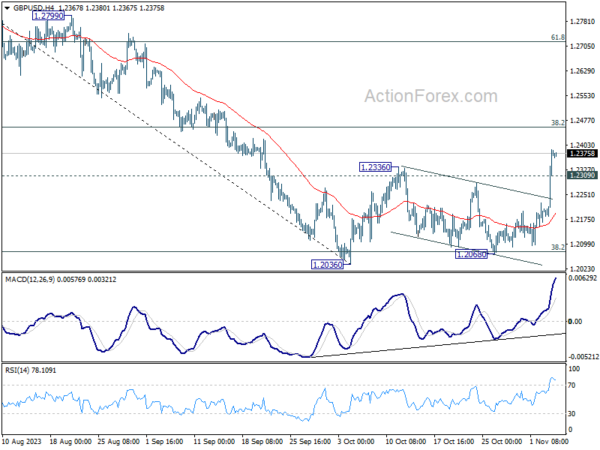

Daily Pivots: (S1) 1.2247; (P) 1.2318; (R1) 1.2452; More

GBP/USD retreats mildly today intraday bias stays on the upside at this point. Further rally should be seen to 38.2% retracement of 1.3141 to 1.2036 at 1.2458. Sustained break there will pave the way to 61.8% retracement at 1.2783. On the downside, below 1.2309 minor support will turn intraday bias neutral first.

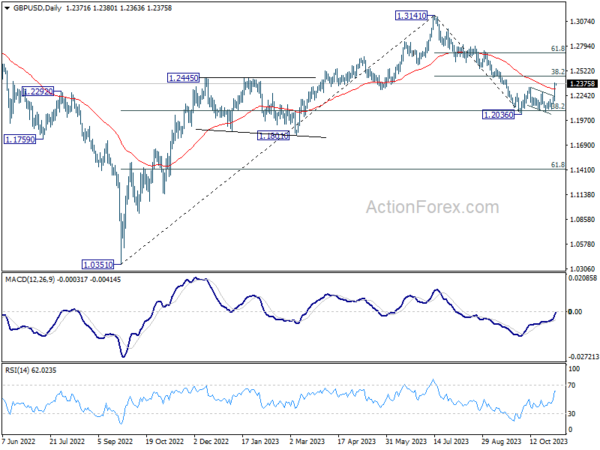

In the bigger picture, the strong rebound from 38.2% retracement of 1.0351 to 1.3141 at 1.2075 argues that price action from 1.3141 are merely a correction to rise from 1.0351 (2022 low). Current rally from 1.2036 is tentatively seen as the second leg of the pattern. Hence, while further rally is in favor, upside should be limited by 1.3141 to start the third leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 00:00 | AUD | TD Securities Inflation M/M Oct | -0.10% | 0.00% | ||

| 07:00 | EUR | Germany Factory Orders M/M Sep | -1.40% | 3.90% | ||

| 08:45 | EUR | Italy Services PMI Oct | 48.5 | 49.9 | ||

| 08:50 | EUR | France Services PMI Oct | 46.1 | 46.1 | ||

| 08:55 | EUR | Germany Services PMI Oct | 48 | 48 | ||

| 09:00 | EUR | Eurozone Services PMI Oct | 47.8 | 47.8 | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Nov | -22.5 | -21.9 | ||

| 09:30 | GBP | Construction PMI Oct | 46.2 | 45 | ||

| 15:00 | CAD | Ivey PMI Oct | 54 | 53.1 |