Dollar experienced a pronounced dip as yields fell and stocks surged overnight, with the selling pressure continuing into Asian session. This comes even though Chair Jerome Powell left the door open for more tightening, after leaving interest rates unchanged. Contrastingly, market participants appear to be leaning even more towards the idea that Fed may have concluded its tightening cycle.

Despite this, Dollar hasn’t faced a drastic downturn yet, as it maintains positions above near-term support levels against major counterparts. However, there’s a pressing need for a boost. The greenback will look into the upcoming non-farm payroll data on Friday for reigniting upside momentum.

In the meantime, Sterling has emerged as one of the strongest currencies for the week, trailing behind Australian and New Zealand Dollars. As attention pivots to the Bank of England’s imminent rate decision – where a status quo is anticipated – the intricacies of the meeting will be under scrutiny. This includes an analysis of the official statement, the vote breakdown, and the fresh quarterly projections. For the Pound to fortify its position against Euro and Swiss Franc, it would require a hawkish nudge from the BoE’s deliberations.

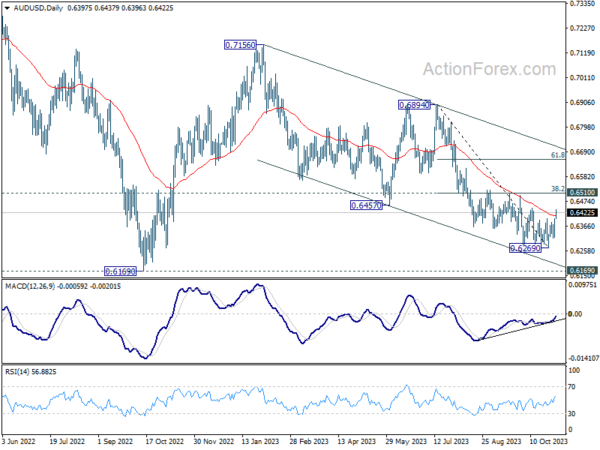

From a technical perspective, AUD/USD’s break of 55 D EMA should confirm short term bottoming at 0.6269, on bullish convergence condition in D MACD. However, it’s still early to confirm bullish trend reversal. Key hurdle lies in 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508). Rejection by this resistance will maintain near term bearishness for another fall through 0.6269 at a later stage.

However, sustained break there will bolster the case that whole fall from 0.7156 has completed in a three wave structure. The fate could be decided by this week’s US NFP and next week’s RBA rate decision.

In Asia, Nikkei closed up 1.21%. Hong Kong HSI is up 0.91%. China Shanghai SSE is down -0.12%. Singapore Strait Times is up 0.14%. Japan 10-year JGB yield is down -0.0414 at 0.918. Overnight, DOW rose 0.67%. S&P 500 rose 1.05%. NASDAQ rose 1.64%. 10-year yield dropped -0.086 to 4.789.

DOW soars and yields tumble in wake of FOMC

US stock market experienced a robust rebound overnight, with DOW recording its most substantial three-day gain since April, following Fed’s decision to maintain the interest rate at the widely anticipated range of 5.25-5.50%. This marks the second consecutive month of rate pause, but Fed has not ruled out the possibility of further tightening in the future.

Treasury yields witnessed a notable decline across the spectrum, a trend initially sparked by Treasury’s refunding plan. 2-year yield ended the day staying below 5% mark, settling at 4.96%, while 10-year yield broke through 4.8% level. closing at 4.789%.

During the post-meeting press conference, Fed Chair Jerome Powell underscored the flexibility of the FOMC. He emphasized, “The idea that it would be difficult to raise [rates] again after stopping for a meeting or two is just not right. The Committee will always do what it thinks is appropriate at the time.”

Further emphasizing the uncertainty of future meetings, Powell stated, “We have yet to finalize our decisions concerning the upcoming meetings.” He elaborated on the Committee’s objective to assess the need and degree of potential policy tightening, aiming to stabilize inflation at around 2% over a period.

Dismissing any speculations of rate cuts, Powell asserted that such discussions are currently off the table. The primary focus remains on evaluating if the present monetary policy is “sufficiently restrictive” to sustainably bring down inflation to 2% target.

Regarding the balance sheet runoff, Powell mentioned that there is no current consideration to alter its pace. The committee is not discussing or considering any changes in this aspect.

Additional readings on FOMC:

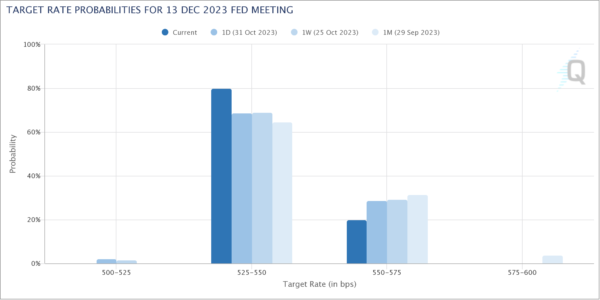

In response to these developments, Fed fund futures indicated a reduced probability of another rate hike in December, now standing at a 20% likelihood, down from the previous day’s 29%.

DOW’s strong rebound this week suggests that a short-term bottom was established at 32327.20 already. Risk is now mildly on the upside for the near term, with possibility of further rally to 55 D EMA (now at 33764.41). If 33764.41 resistance level continues to hold its ground, it could indicate that DOW is merely in a short term consolidation phase, and the decline from 35679.12 might resume at a later stage.

Shifting focus to 10-year yield, corrective pattern from 4.997 extended with yesterday’s fall. Bearish divergence condition in D MACD argues that the consolidation would extend further for a while. . But there is no clear indication of bearish reversal with TNX holding well above 4.532 support as well as 55 D EMA (now at 4.551). Nevertheless, upside potential should be limited for the near term.

Australia’s trade surplus narrows sharply to AUD 6.79B in Sep

Australia’s economic outlook has taken a concerning turn as the trade surplus for September contracted significantly, recording its lowest monthly surplus since March 2021. The data released indicates a shrinkage from prior month’s AUD 10.16B to AUD 6.79B, falling short of the anticipated AUD 9.58B surplus. This sharp decline in trade surplus is fueling concerns that the Australian economy may have slipped into recession in the third quarter.

The primary factor contributing to the reduced surplus is a noticeable -1.4% yoy drop in goods exports, which totaled AUD 45.62B. This decline was primarily driven by a substantial -39.2% reduction in the shipment of metals and non-monetary gold, a critical export commodity for the Australian economy.

On the import side, there was a 7.5% yoy increase to AUD 38.84B. This surge in imports is attributed to a 23.3% jump in import of capital goods. Additionally, there was a noticeable spike in the demand for recreational items.

BoE likely to hold to for the second straight meeting

BoE stands at a critical juncture as it is expected to maintain its policy interest rate at 5.25% today, marking the second consecutive pause in tightening. This decision comes in the wake of September’s UK CPI remaining steady at 6.7%, defying market expectations and signaling a halt in the disinflation process. Conversely, the prevailing weak growth data underscore increasing risks of recession, placing the BoE in a challenging policy dilemma.

Today’s meeting is set to highlight the existing divides within the nine-member MPC. September’s decision, which resulted in no change, saw a tight vote, with 5 members in favour and 4 against. Given the nuanced economic picture, a shift in this balance, although unexpected, is still within the realm of possibility.

The central bank will also unveil its new economic forecasts. Given the recent string of subdued data, BoE is anticipated to downgrade its short-term projections for growth. Yet, looking further out, the bank might elevate its growth expectations for the two- and three-year marks, influenced by factors such as lower interest rates and a depreciated sterling.

One of the prevailing discussions in financial circles revolves around which major central bank will be the first to reduce interest rates. As it stands, market consensus suggests that BoE may trail its counterparts, ECB and Fed. Current projections don’t anticipate a rate cut by BoE with over a 50% likelihood until August 2024. However, should BoE’s upcoming forecasts reflect a significant downward adjustment in inflation outlook, this timeline and market sentiment could be poised for a change.

Some suggested readings on BoE:

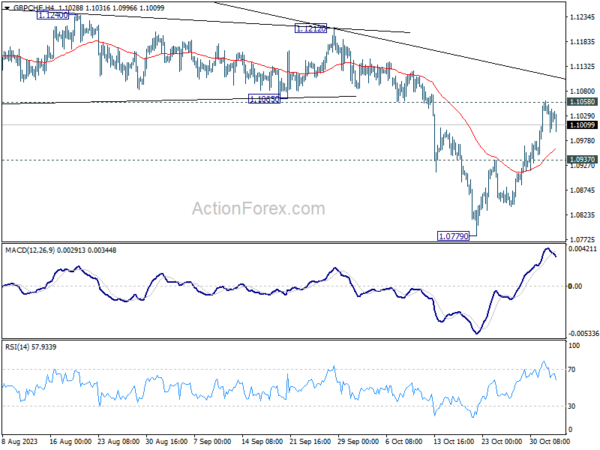

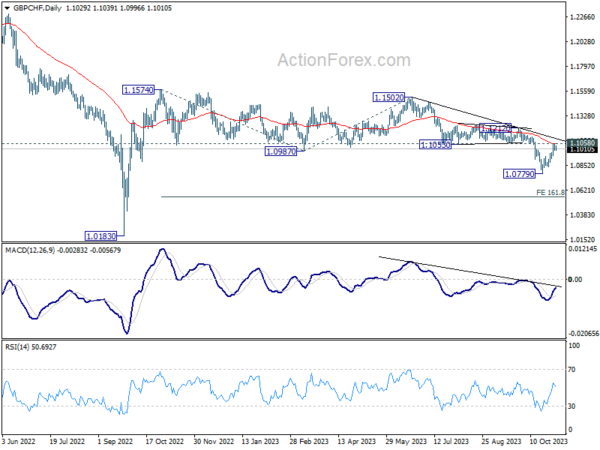

While GBP/CHF’s rebound in the last two week has been strong, it’s capped by 1.1053 support turned resistance, as well as 55 D EMA. Risk stays on the downside for larger decline from 1.1502 to continue. Break of 1.0937 minor support will retain near term bearishness, and bring retest of 1.0779 first. However, sustained break of 1.1058 will raise the chance of bullish reversal, and target 1.1212 structural resistance for confirmation.

Elsewhere

Swiss CPI, Germany unemployment and Eurozone PMI manufacturing final will be released in European session. Later in the day, US will release jobless claims and non-farm productivity.

USD/JPY Daily Outlook

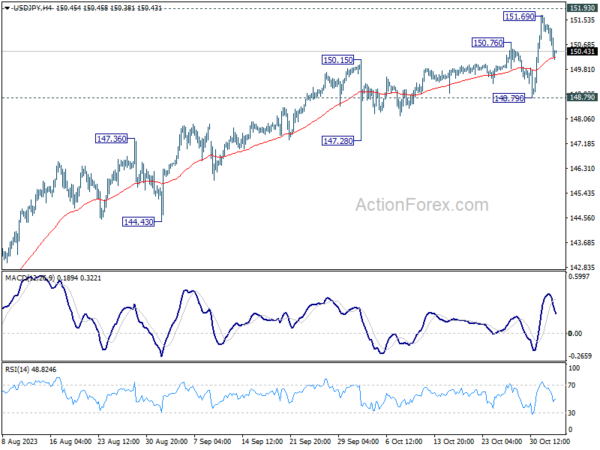

Daily Pivots: (S1) 150.50; (P) 151.10; (R1) 151.54; More…

Intraday bias in USD/JPY is turned neutral first with current retreat. A temporary top was formed at 151.69, just ahead of 151.93 key resistance. Some consolidations would be seen first. For now, further rise remains in favor as long as 148.79 support holds. Decisive break of 151.93 will target 100% projection of 129.62 to 145.06 from 137.22 at 152.66. However, firm break of 148.79 will indicate rejection by 151.93, and bring deeper fall through 147.28 support.

In the bigger picture, immediate focus is now on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Oct | 9.00% | 5.90% | 5.60% | |

| 00:30 | AUD | Goods Trade Balance (AUD) Sep | 6.79B | 9.58B | 9.64B | 10.16B |

| 07:30 | CHF | CPI M/M Oct | 0.10% | -0.10% | ||

| 07:30 | CHF | CPI Y/Y Oct | 1.70% | 1.70% | ||

| 08:45 | EUR | Italy Manufacturing PMI Oct | 46.5 | 46.8 | ||

| 08:50 | EUR | France Manufacturing PMI Oct F | 42.6 | 42.6 | ||

| 08:55 | EUR | Germany Manufacturing PMI Oct F | 40.7 | 40.7 | ||

| 08:55 | EUR | Germany Unemployment Change Oct | 15K | 10K | ||

| 08:55 | EUR | Germany Unemployment Rate Oct | 5.80% | 5.70% | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Oct F | 43 | 43 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Oct | 58.20% | |||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 4–0–5 | ||

| 12:30 | USD | Initial Jobless Claims (Oct 27) | 210K | 210K | ||

| 12:30 | USD | Nonfarm Productivity Q3 P | 4.00% | 3.50% | ||

| 12:30 | USD | Unit Labor Costs Q3 P | 1.10% | 2.20% | ||

| 14:30 | USD | Natural Gas Storage | 81B | 74B |