Dollar continues to languish as one of the weakest performers of the week, sharing the lower rungs of performance with Yen and Swiss Franc. This dynamic comes in the wake of a robust rally in global stock markets and a pronounced pullback in treasury yields. Investors and policymakers alike are now poised for the release of US non-farm payroll report, hoping for a “goldilocks” outcome—data that is not too hot or cold, which could reassure Fed while sustaining investor optimism. Yet, the balance is indeed delicate.

In stark contrast, commodity currencies remain robust, seemingly unfazed by recent lackluster data out of China. Australian Dollar, in particular, finds itself buoyed by market anticipation of another rate hike from RBA next week. Canadian dollar, meanwhile, awaits its own impetus from domestic employment figures due later in the day. Both Euro and British pound exhibit mixed performance, though they hold onto their advances against Swiss Franc.

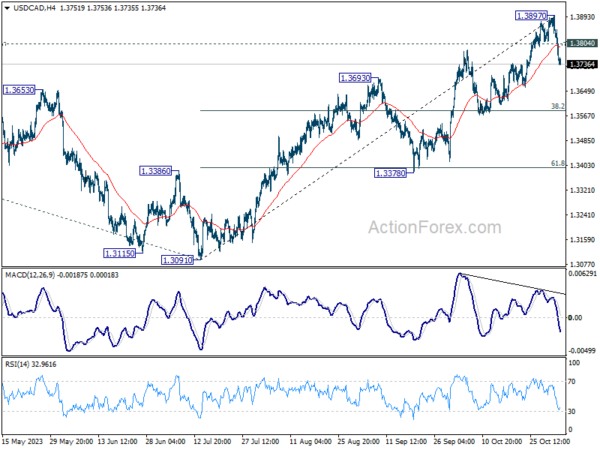

From a technical standpoint, a short term top should be in place in USD/CAD at 1.3897, with bearish divergence condition in 4H MACD. In case of deeper pull back, strong support should emerge at 38.2% retracement of 1.3091 to 1.3897 at 1.3589 to bring rebound. Meanwhile, break of 1.3804 minor resistance will bring retest of 1.3897. The currency pair’s response to the dual employment releases from US and Canada today will be telling of its near-term trajectory.

In Asia, at the time of writing, Nikkei is up 1.10%. Hong Kong HSI is up 2.32%. China Shanghai SSE is up 0.77%. Singapore Strait Times is up 1.98%. Japan 10-year JGB yield is down -0.044 at 0.916. Overnight, DOW rose 1.70%. S&P 500 rose 1.89%. NASDAQ rose 1.78%. 10-year yield dropped -0.120 to 4.669.

ECB’s Schnabel: We cannot close the door to further rate hikes

ECB Executive Board member Isabel Schnabel warned in a speech that the “last mile” in disinflation process is the hardest, more uncertain, slower and bumpier. Inflation expectations are fragile, and ECB cannot close the door for further rate hikes.

In a candid analogy, Schnabel compared the disinflation process to a marathon, signifying the strenuous and prolonged effort required to bring inflation back to target levels.

“Disinflation really does seem like a long-distance race,” Schnabel stated, “When the runner enters the last mile, the hardest work begins” which requires “perseverance and vigilance”. She added, “The same is true for our fight against inflation.”

Schnabel’s words paint a picture of cautious optimism mixed with a stern warning against premature relaxation in monetary policy. “With our current monetary policy stance, we expect inflation to return to our target by 2025,” she affirmed.

However, she was quick to temper optimism with a dose of reality about the road ahead. “The disinflation process during the last mile will be more uncertain, slower and bumpier”.

“Continued vigilance is therefore needed,” Schnabel cautioned. “After a long period of high inflation, inflation expectations are fragile and renewed supply-side shocks can destabilise them, threatening medium-term price stability.”

“This also means that we cannot close the door to further rate hikes,” she added.

China Caixin PMI services ticks to 50.4, composite fell to 50

China’s service sector showed a glimmer of resilience in October, with Caixin PMI Services edging up marginally from 50.2 to 50.4, meeting expectations. However, this slight uptick could not buoy the overall PMI Composite, which leveled at the neutral 50.0 threshold, down from 50.9 in the previous month.

The slight uptick in the services sector was overshadowed by a dip in manufacturing (which fell from 50.6 to 49.5). The details reveal a mixed scenario: composite new business inched forward at its weakest pace in ten months. Service providers and goods producers alike witnessed decelerated growth in sales.

Employment trends also painted a picture of caution. There was a small overall decline in jobs, with manufacturing bearing the brunt through more pronounced job losses, while employment in the service sector hit a plateau.

On the pricing front, inflationary pressures were somewhat contained. Input costs across the combined sectors rose modestly, maintaining a muted pattern of cost escalation. Despite this, firms nudged their selling prices upwards, continuing a trend that could suggest confidence in passing on costs, albeit the rate of charge inflation was just marginally lower than the 18-month peak seen in September.

NFP to test stock market optimism

The upcoming US non-farm payroll report is set to capture the market’s full attention today, with investors seeking signs that could affirm Fed’s interest rate has already peaked. In light of Fed Chair Jerome Powell’s comments this week emphasizing the need for “some slower growth and some softening in the labor market” to stabilize prices, the details of the job data, particularly wage growth, will be under intense scrutiny.

The market consensus pegs the headline growth of employment at 172k for October, a significant decrease from September’s robust 336,000 figure. Unemployment rate is projected to hold steady at 3.8%, with average hourly earnings expected to notch up by 0.3% mom.

Preceding indicators present a mixed picture: ISM Manufacturing employment showed a notable decline 51.2 to 46.8, ADP reported a modest private employment increase of 113k that fell short of expectations, and initial unemployment claims hovered around the 210k mark on a four-week moving average, indicating stability.

Wage growth emerges as the unpredictable factor in the equation, with the potential to sway Fed’s monetary policy direction. This data point has been particularly scrutinized for inflationary signals and the possibility of triggering another rate hike.

Equity markets have reflected a sense of optimism this week, with strong rebound in DOW and other major indexes. DOW’s correction from August high at 35679.13 could have already concluded at 32327.20. To further strengthen the case, DOW will need to break through 34147.63 resistance decisively. However, rejection by 34147.63 will retain near term bearishness for another decline through 32327.20.

The impending non-farm payroll report could be a critical determinant of the market’s direction in the closing months of the year.

Also featured

Germany trade balance, France industrial production, UK PMI services final, Eurozone unemployment rate will be released in European session. US will release ISM services after NFP, while Canada employment data will also be published.

AUD/USD Daily Report

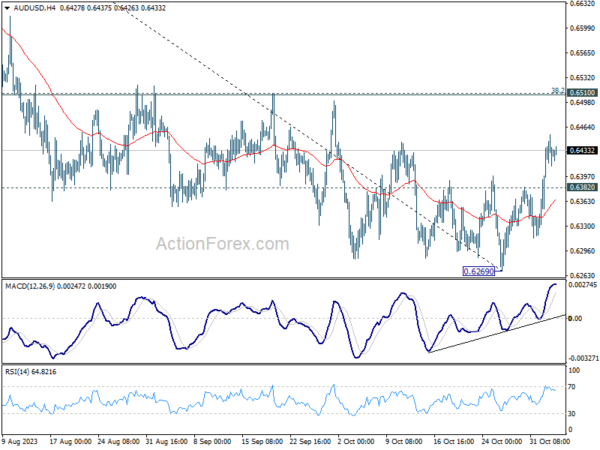

Daily Pivots: (S1) 0.6398; (P) 0.6427; (R1) 0.6463; More…

Intraday bias in AUD/USD remains on the upside at this point. Rebound from 0.6269 short term bottom would target 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508). Rejection by this level will retain near term bearishness or another fall through 0.6269 at a later stage. Below 0.6382 minor support will turn intraday bias neutral first. However, firm break of 0.6510 will argue that whole decline from 0.7156 might be completed with three waves down to 0.6269. Stronger rally should then be seen.

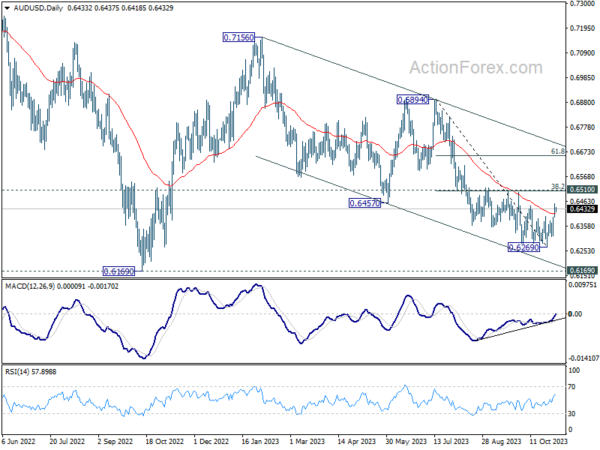

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Oct | 50.4 | 50.4 | 50.2 | |

| 07:00 | EUR | Germany Trade Balance (EUR) Sep | 16.3B | 16.6B | ||

| 07:45 | EUR | France Industrial Output M/M Sep | 0.00% | -0.30% | ||

| 09:30 | GBP | Services PMI Oct F | 49.2 | 49.2 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 6.40% | 6.40% | ||

| 12:30 | USD | Nonfarm Payrolls Oct | 172K | 336K | ||

| 12:30 | USD | Unemployment Rate Oct | 3.80% | 3.80% | ||

| 12:30 | USD | Average Hourly Earnings M/M Oct | 0.30% | 0.20% | ||

| 12:30 | CAD | Net Change in Employment Oct | 25.7K | 63.8K | ||

| 12:30 | CAD | Unemployment Rate Oct | 5.60% | 5.50% | ||

| 13:45 | USD | Services PMI Oct F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Services PMI Oct | 53.2 | 53.6 |