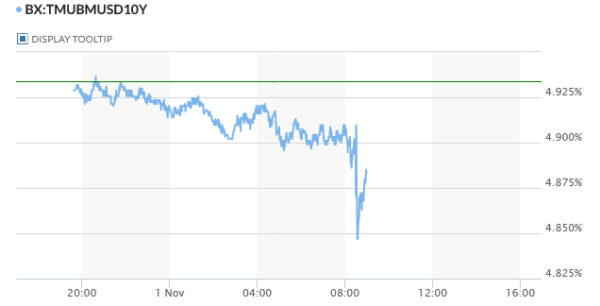

US 10-year yields is seeing a notable drop after Treasury unveiled its auction plan. In a closely monitored move, the department announced a USD 2B/month increase in 10-year bond sales. This increment was below market’s anticipated USD 3B hike. The decision appears to bolster 10-year treasury price, subsequently pressing down 10-year yield. US stock futures echoed this positive sentiment with a rebound, though the currency market remains largely unaffected at this stage.

Attention now shifts to the impending ISM services data, but the main event on investors’ radar is the Federal Open Market Committee (FOMC) rate decision. While no changes in interest rates are expected today, market participants are keen to discern the tone of the statement and Chair Jerome Powell’s stance on the necessity of further tightening. Powell’s views on the correlation between rising longer-term yields and the potential reduction in tightening necessities will be under scrutiny. However, it’s widely believed that December’s meeting, which will present new economic forecasts, holds more significance, rendering today’s decision potentially uneventful.

The currency arena presents a diverse picture today. Both Aussie and Yen are witnessing upward movement, the latter buoyed by verbal interventions from Japan. Swiss Franc is also on an upward trajectory. Conversely, Euro and Sterling find themselves on the softer end of the spectrum. Dollar ranks as the third weakest performer, showing a muted reaction to the ADP private job data.

Technically, an extended recovery in NASDAQ might be seen today, subject to the outcome of FOMC. But near term outlook will stay bearish as long as 13170.39 resistance holds. Fall from 14446.55 is in favor to continue. More importantly, another decline and firm break of near term channel support could trigger downside acceleration to 61.8% retracement of 10088.82 to 14446.55 at 11753.47 next.

In Europe, at the time of writing, FTSE is up 0.29%. DAX is up 0.38%. CAC is up 0.35%. Germany 10-year yield is up 0.018 at 2.832. Earlier in Asia, Nikkei rose 2.41%. Hong Kong HSI dropped -0.06%. China Shanghai SSE rose 0.14%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield rose 0.0101 to 0.959.

US ADP jobs grows 113k, slowing wage momentum

US ADP private sector employment gains in October fell short of expectations, with an addition of 113k jobs as opposed to the anticipated 135k. A breakdown by industry shows a modest increase of 6k in goods-producing jobs, while service sector added 107k. When considering the size of establishments, small firms contributed 19k jobs, medium-sized businesses accounted for 78k, and large enterprises added 18k.

A notable trend emerged in the wage segment. Employees who remained in their current positions reported a year-over-year pay growth of 5.7%, marking the slowest rate since October 2021. On the other hand, individuals who switched jobs experienced an 8.4% rise in wages, which is the least impressive figure since July 2021.

Nela Richardson, ADP’s Chief Economist stated, “October didn’t see a particular industry taking the lead in hiring. Moreover, the significant wage hikes we observed in the post-pandemic phase seem to be waning.”

She further added, “The data from October offers a comprehensive view of the employment sector. Although there’s a deceleration in the job market, it’s still adequately robust to sustain vigorous consumer expenditure.”

UK manufacturing downturn persists: PMI edges up but optimism plummets

UK PMI Manufacturing data was finalized at 44.8 in October, marking a modest improvement from September’s 44.3. However, the report by S&P Global underscores some concerning aspects: declining output, a drop in new orders, and shrinking employment. Furthermore, business optimism has plunged to a ten-month low.

Rob Dobson, Director at S&P Global Market Intelligence, underscored the severity of the situation. “The UK manufacturing downturn persisted at the outset of the final quarter, exacerbating the economy’s flirtation with recession,” he said.

“The ongoing contraction in production for eight straight months, the longest since the 2008-09 period, is primarily due to subdued domestic and international demand, resulting in a continued downturn in new order intakes.”

Dobson highlighted the skewed risks towards a negative outlook, with businesses’ growing caution leading to employment cuts, reduced purchasing, and lower inventory levels.

Although there’s a silver lining with a slight ease in input prices and output charges, Dobson warned that this faint inflation relief comes with an increased risk of recession, stemming from the prevailing weak demand.

Japan PMI manufacturing: Slump continues, yet optimism shines for 2024

Japan’s PMI Manufacturing for October was finalized at 48.7, a slight uptick from 48.5 in September. Despite the improvement, the index languished below the critical 50 threshold for the fifth consecutive month.

S&P Global’s analysis revealed that a significant decline in output occurred due to persisting sales reductions. This challenging environment also led to the first drop in employment figures since the beginning of 2021. On the brighter side, confidence remains robust regarding a potential return to growth in 2024.

NZ employment down -0.2% in Q3, unemployment rate jumps to 3.9%

New Zealand’s employment figures for Q3 came in weaker than anticipated. Employment contracted by -0.2%, sharply diverging from the forecasted growth of 0.40%.

Unemployment rate made a noticeable leap, rising from 3.6% to 3.9%, a figure that met market expectations. Additionally, both employment rate and labor force participation rate registered declines, moving from 69.8% to 69.1% and from 72.5% to 72.0% respectively.

Wage data presented a mixed picture. The all-sector wage inflation stood firm at 4.3% yoy.

The public sector experienced a particularly sharp uptick in salaries and wages, registering a 5.4% yoy increase. This significant rise is notable for being the steepest since the data series commenced in 1992, surpassing 4.2% yoy growth observed in Q2.

In contrast, the private sector saw wage cost inflation moderating to 4.1% yoy in Q3, slightly down from the 4.3% recorded in the previous quarter.

China’s Caixin PMI manufacturing slips to 49.5, business optimism continues to wane

China’s Caixin PMI Manufacturing index slipped from 50.6 in September to 49.5 in October, falling below market expectations set at 50.8. This marks a renewed contraction in the nation’s manufacturing sector.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted several challenges facing the manufacturing industry. “Overall, manufacturers were not in high spirits in October,” he said. The decline in the sector was multifaceted – supply, employment, and external demand all experienced reductions, while domestic demand saw a slower pace of expansion.

The manufacturing environment was further complicated by rising costs and output prices. This was coupled with decrease in purchases and accumulation of inventories of finished goods. Reflecting the various pressures, “business optimism continued to wane”.

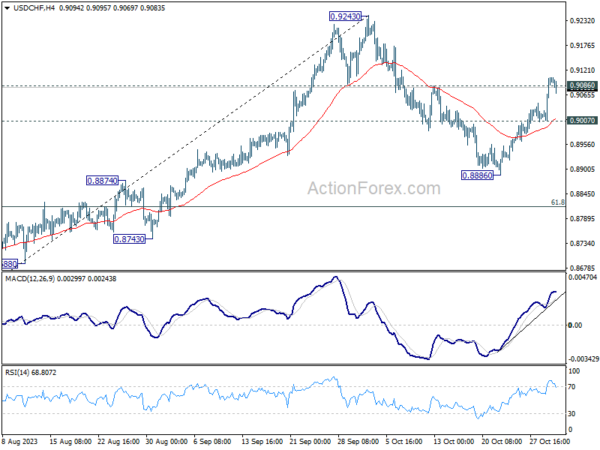

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9040; (P) 0.9074; (R1) 0.9139; More….

Despite current retreat, intraday bias in USD/CHF stays on the upside first. Sustained trading above 0.9086 resistance will pave the way back to 0.9342 resistance next. In any case, further rally will remain in favor as long as 0.9007 support holds. But firm break of 0.9007 will turn bias to the downside for 0.8886 support instead.

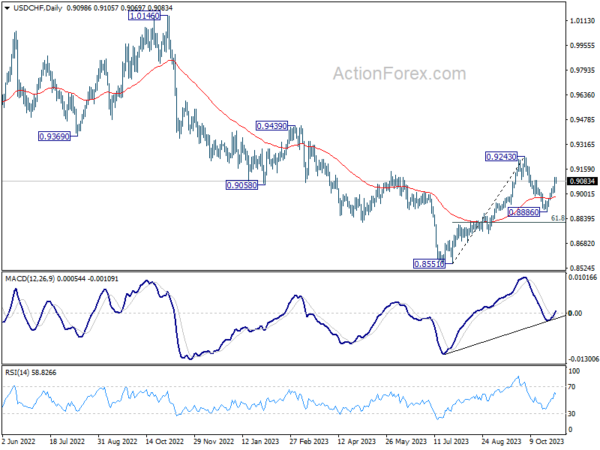

In the bigger picture, outlook is mixed up by the deeper than expected pull back from 0.9243. Yet there was no follow through selling after hitting 0.8886. On the upside, break of 0.9243 resistance will revive the case of medium term bottoming at 0.8851, and turn outlook bullish. However, sustained break of 61.8% retracement of 0.8551 to 0.9243 at 0.8815 will argue that larger decline from 1.0146 is ready to resume through 0.8551 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q3 | -0.20% | 0.40% | 1.00% | |

| 21:45 | NZD | Unemployment Rate Q3 | 3.90% | 3.90% | 3.60% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 0.80% | 1.00% | 1.10% | |

| 00:30 | AUD | Building Permits M/M Sep | -4.60% | 2.60% | 7.00% | 8.10% |

| 00:30 | JPY | Manufacturing PMI Oct F | 48.7 | 49 | 48.5 | |

| 01:45 | CNY | Caixin Manufacturing PMI Oct | 49.5 | 50.8 | 50.6 | |

| 08:30 | CHF | Manufacturing PMI Oct | 40.6 | 45 | 44.9 | |

| 09:30 | GBP | Manufacturing PMI Oct F | 44.8 | 45.2 | 45.2 | |

| 12:15 | USD | ADP Employment Change Oct | 113K | 135K | 89K | |

| 13:30 | CAD | Manufacturing PMI Oct | 47.5 | |||

| 13:45 | USD | Manufacturing PMI Oct F | 50 | 50 | ||

| 14:00 | USD | ISM Manufacturing PMI Oct | 49 | 49 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Oct | 44.5 | 43.8 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Oct | 51.2 | |||

| 14:00 | USD | Construction Spending M/M Sep | 0.40% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | 1.5M | 1.4M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |