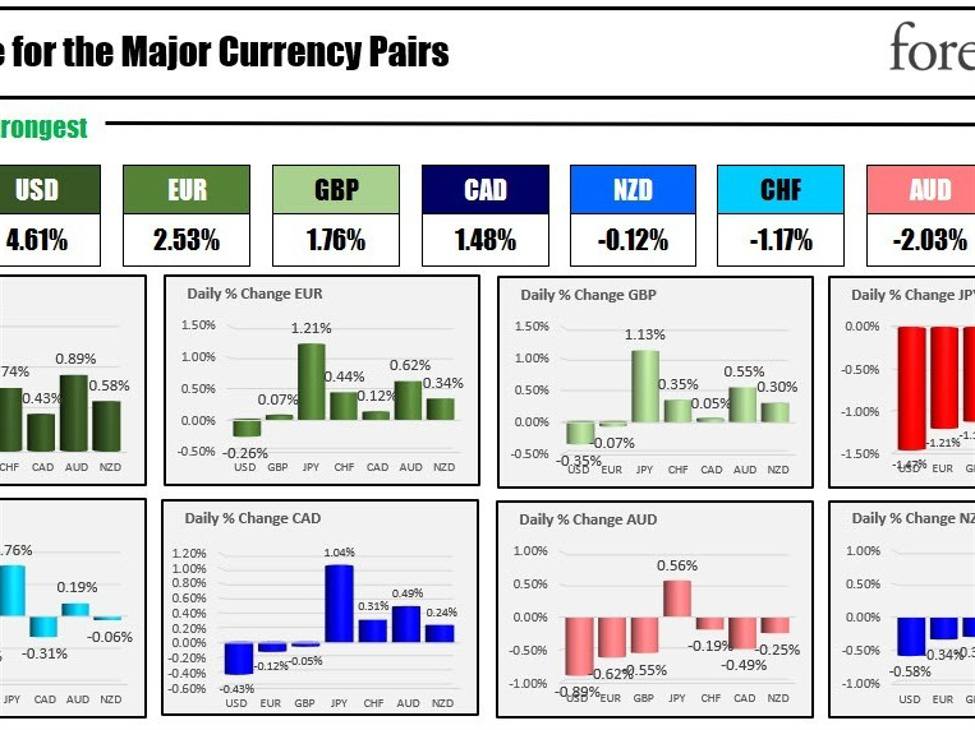

The USD is now the strongest of the major currences

The USD continues its run to the upside in the US session and is now the strongest of the major currencies. At the start of the New York session, the greenback was near the middle of the “strongest to the weakest” table with the rise in the USDJPY leading the upside.

The USDJPY is still the biggest gainer with a rise of 1.47%, but the greenback is also higher by 0.89% versus the AUD and 0.74% versus the CHF.

Meanwhile, the JPY is weaker by over 1% versus the USD (1.47%), EUR (1.21%), GBP (1.13%) and CAD (1.04%). The JPY is lower by 0.56% vs the AUD.

EURUSD: The EURUSD has now retraced all of its range from the Asian low, and is also moving below the 200-hour moving average at 1.0589. Its 100-hour moving average is below at 1.05759.

GBPUSD: The GBPUSD has also now retraced all of its prior range and then some. The pair has now fallen below its 200-hour moving average at 1.2148, and its 100-hour moving average at 1.21272. The next target area comes near 1.2105 – 1.21109. Below that and traders will look toward the 1.2088 – 92 area. Close risk is now the 100 hour moving average at 1.2127, but staying below the 200 hour moving average (at 1.2148) would also keep the sellers at least in play (the market would be more neutral between the 2 hourly moving averages).

USDJPY. The USDJPY has now moved above the high from last week at 150.774 and that opens the door for further upside potential with the high price from 2022 at 151.938 as the next major target. That high represents the multi-decade high (going back to 1990). Risk is now the high from last week at 1.50774.

USDJPY getting closer to the 2022 high

The AUDUSD and the NZDUSD are now both below their 100/200 hour MAs. For the AUDUSD, the MA are near each other at 0.6337. The price is currently trading at 0.6325. The NZDUSD 100-hour moving average is at 0.5819 and its 200-hour moving average is at 0.5828. The current price trades at 0.58108. It would take a move above the moving averages to tilt the bias back to the upside for each of those currency pairs. Absent that, and the sellers are more in control.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)