BEIJING — Chinese tech giant Huawei reported revenue figures Friday that showed only a 1% increase in the third quarter from a year ago, according to CNBC calculations.

That’s despite the company’s release of a popular new smartphone in late August and growing sales within its electric car venture.

Huawei said revenue for the first three quarters of the year rose by 2.4% year-on-year to 456.6 billion yuan ($62.33 billion) — the highest for the period since 2020. U.S. sanctions on the Chinese telco maker started in 2019.

Despite those restrictions on Huawei’s ability to access high-end tech, reviews indicated the company’s new Mate 60 Pro smartphone offers download speeds associated with 5G — thanks to an advanced semiconductor chip.

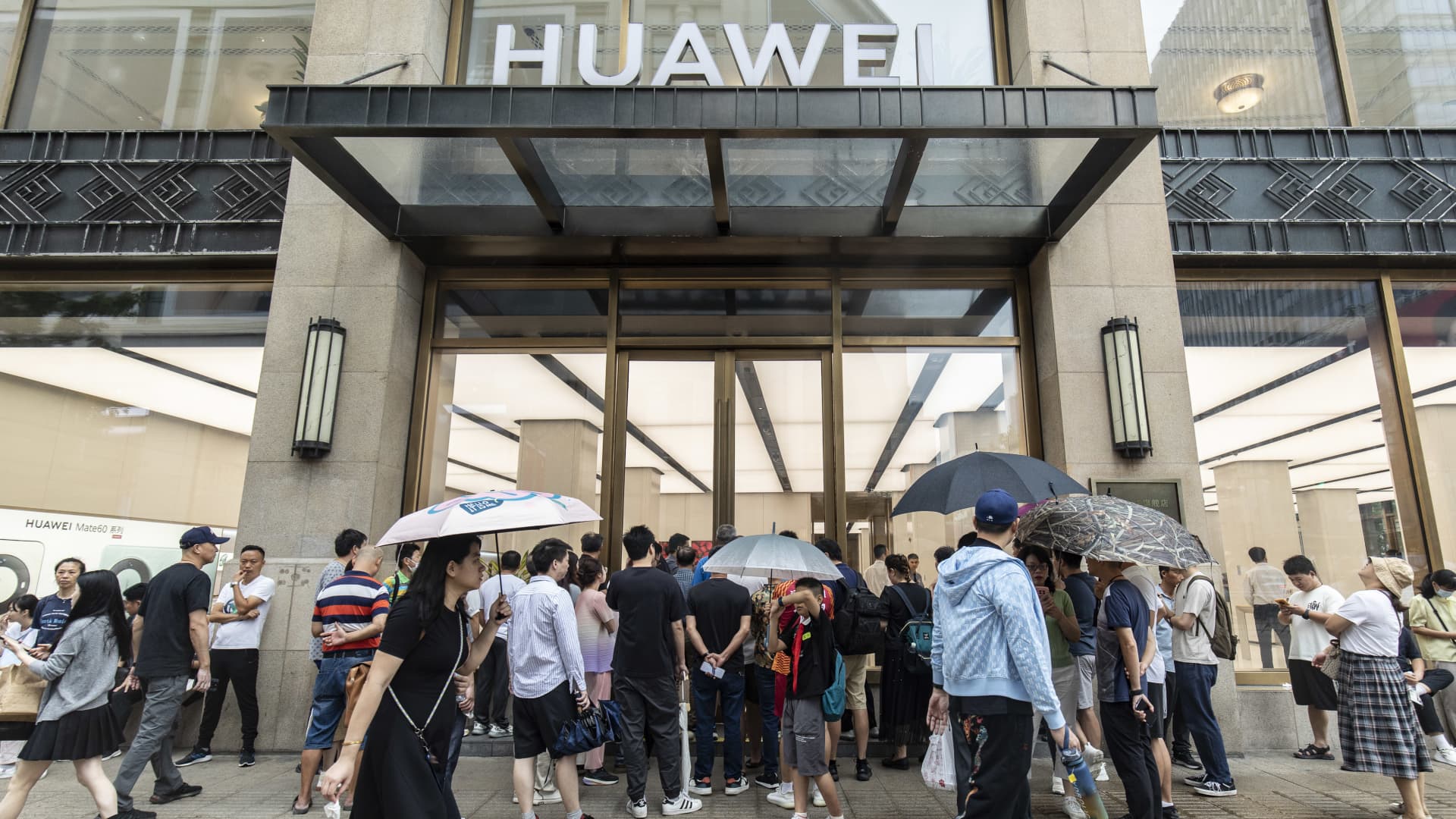

Huawei quietly launched the phone in China in late August, and declined to share more during a seasonal product launch event in late September.

More than 1.6 million Mate 60 series devices were sold during the first six weeks of sales, according to Counterpoint Research.

The research firm estimated that the majority, about 75%, of units sold were Pro models — that’s about 1.2 million units sold.

Apple, which launched its iPhone 15 in September, is expected to sell 10 million units of the new phone in China this year, for an expected total of 45.5 million iPhone sales in the country, according to Shanghai-based CINNO Research estimates.

The U.S. company saw smartphone sales fall by 10% in the third quarter from a year ago, while Huawei’s sales surged by 37%, Counterpoint Research said Thursday.

Electric car brand

Huawei has also built up a presence in China’s fast-growing new energy vehicle market, which includes hybrid and battery-powered cars.

The company sells its operating system and components, such as for driver-assist tech, to car manufacturers.

In December 2021, Huawei launched its own car brand Aito in collaboration with manufacturer Seres.

Orders for Aito’s latest M7 topped 60,000 as of Oct. 16, just about a month after its release, according to a social media post from Richard Yu, who heads Huawei’s car-related and consumer business.

On Wednesday, Aito said pre-orders for its forthcoming M9 SUV had topped 15,000.

Profit margin increase

Huawei is not publicly traded and did not break out revenue by business segment in its latest update.

The telecommunications giant said it recorded partial gains from the sale of certain businesses, but did not specify which ones.

Huawei said its net profit margin for the first three quarters of the year was 16%. That’s up from a profit margin of 15% reported for the first half of the year, when revenue grew by 3.1% to 310.9 billion yuan.

Third-quarter revenue was 145.7 billion yuan, up by 1% from the 144.2 billion yuan in the year-ago period, CNBC calculations of Huawei figures showed.

Huawei continued its efforts to expand its patent licensing business during the third quarter with Xiaomi and Ericsson deals, which covered 5G connectivity.

The telecommunications giant has rolled out 5G-based business applications in mining, ports and manufacturing, but it was unclear from Friday’s release how much revenue, if any, they generated for the company in the third quarter.

Huawei also pressed ahead in international markets by expanding its cloud business to Saudi Arabia in September. The company said this week it opened a research lab in Finland for testing health and fitness wearables.

The U.S. has maintained the Chinese telecommunications giant is a national security risk due to alleged links to the Chinese Communist Party and the country’s military. Huawei has repeatedly denied the existence of any such risk.

— CNBC’s Arjun Kharpal contributed to this report.