Asian markets commenced the week in a muted tone, with trading activity dampened due to public holidays in New Zealand and Hong Kong. The tepid trading ambiance is expected to persist through the day, given the sparse economic calendar. However, market participants are bracing for a resurgence in volatility, as a flurry of Purchasing Managers’ Index (PMI) data from several major economies is slated for release tomorrow.

The limelight will progressively shift towards BoC and ECB rate decisions later in the week, both events capable of injecting significant dynamism into the market. Additionally, the unveiling of US GDP and PCE inflation data will be keenly observed.

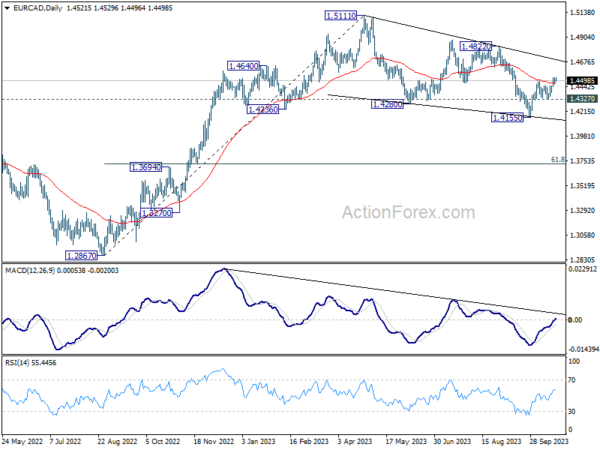

From a technical standpoint, EUR/CAD is shaping up to be a focal point for traders this week. Current analysis slightly leans towards the case that corrective decline from 1.5111 has wrapped up with three waves down to 1.4155. . Further rally is expected as long as 1.4327 support holds. Firm break of trend line resistance (now at 1.4703) will strengthen this case and target 1.4822 resistance next. However, break of 1.4327 will argue that corrective fall from 1.5111 is ready to resume through 1.4155.

In Asia, Nikkei closed down -0.83%. Japan 10-year JGB yield rose 0.0145 to 0.859. China Shanghai SSE is down -1.67%. Singapore Strait Times is down -0.39%.

Bitcoin firms its grip on 30k handle, yet a warm summer remains uncertain

Bitcoin, in today’s subdued Asian trading session, has shown promising signs of firmly grasping 30k level finally. Last week, the digital currency experienced a brief yet sharp ascent, triggered by a false report of the SEC approving a Bitcoin spot ETF. Although this ascent was short-lived, the subsequent pullback was moderate, underscoring the resilience of the ongoing rally.

Expectations surrounding the approval of a Bitcoin spot ETF continue to percolate through the crypto community. Most analysts harbor hopes for a green light sometime in 2023. The ephemeral spike in Bitcoin’s value last week underscores the market’s sensitivity to such developments, suggesting that potential approval is not yet fully accounted for in current prices. This dynamic could lead to heightened responsiveness to positive news, refocusing investor attention on cryptocurrencies ahead of the much-anticipated “halving” slated for April next year.

On the technical front, bullish sentiment in the near term is likely to prevail as long as 28071 support level remains intact, with eyes set on retesting 31815 high.

More comprehensive insights emerge when viewing the broader picture: robust support from 55 W EMA (now at 27115) coupled with 38.2% retracement of 15452 to 31815 at 25564 augments the bullish narrative.

Nevertheless, the real test lies ahead. For market enthusiasts to be convinced that Bitcoin’s “summer” is in full swing, a significant hurdle awaits. The cryptocurrency will need to convincingly break through long-term Fibonacci resistance at 38.2% retracement of 68986 to 15452 at 35901.

China’s market woes weigh on Copper and Aussie

Chinese Shanghai SSE Composite continue its descent below the psychological 3000 handle today, Copper has been dragged along in the downward spiral. The string of arrests and the investigation, over the weekend, into Foxconn Technology Group , Apple Inc.’s primary collaborator and one of China’s largest employers, have further dampened foreign investors’ confidence in the Chinese market.

Interestingly, this pessimistic trend emerged against the backdrop of optimistic economic data. Last week’s releases paint a rather favorable economic portrait for China, boasting GDP growth in Q3 that exceeded expectations, accompanied by robust performances in retail sales and industrial production for September. However, these optimistic numbers have not translated into positive momentum for the SSE, which plummeted by -2.89% over the week, underscoring a pervasive bearish sentiment.

Copper, not immune to these developments, now teeters precariously, with its immediate future hanging in the balance. The metal’s price is homing in on last week’s low at 3.5129. Decisive break of this support could unleash a torrent of selling pressure, igniting resumption of the downtrend from 4.3556. Under this scenario, the next stop for Copper would be 100% projection of 4.3556 to 3.5387 from 4.0145 at 3.1976, which is close to 3.1314 support (2022 low).

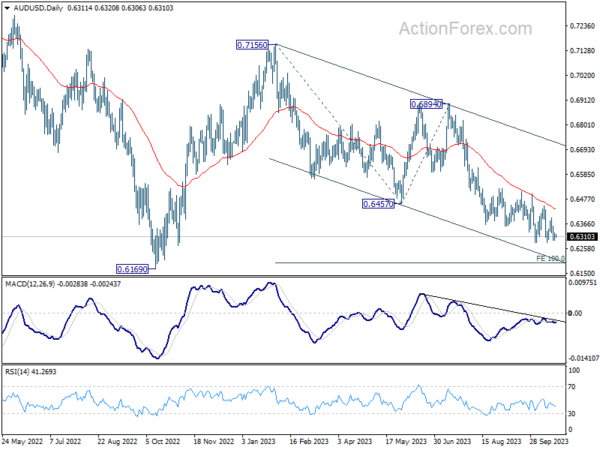

The trajectory of copper is closely entwined with that of AUD/USD, and a continued selloff in the former, spurred by dimming optimism about China, could unleash a cascade of selling pressure on the currency pair. Break of this month’s low at 0.6284 will resume AUD/USD’s down trend from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 support (2022 low).

BoC and ECB to stand pat, eyes on PMIs, US GDP, and Australia CPI

BoC is anticipated to maintain interest rate unchanged at 5.00% this week. This stance appears solidified following last week’s September CPI which displayed faster deceleration to 3.8%. Market observers are now pondering whether the BoC will hint at an end to its tightening phase or adopt a hawkish stance, leaving the door open for potential future hikes. Meanwhile, a recent Reuters poll highlighted that two-thirds of economists are already expecting at least one rate cut by mid-2024. Yet, a clear indication from BoC is unlikely at this stage.

Meanwhile, across the Atlantic, ECB is poised to retain its main refinancing rate at 4.50% and its deposit rate at 4.00%. Several ECB officials have voiced the need for a pause, allowing prior tightening to permeate the European economy. ECB President Christine Lagarde has consistently expressed that the current rate level, if maintained for a “sufficiently long duration”, will steer inflation back towards its target in a timely manner. But the definition of “sufficiently long” remains ambiguous. In a separate Reuters poll, out of 83 economists, 48 (accounting for 58%) forecast the inaugural rate cut to materialize in the third quarter of 2024. But any official indication from Lagarde on this timeline is not anticipated at the moment.

In terms of economic indicators, PMI figures from major economies will be under the microscope come Tuesday, with components such as activity, orders, employment, and prices being crucial for analysts’ assessments. Other pivotal releases this week include US GDP and PCE inflation data. Down under, all eyes will be on Australia’s CPI, a metric that will be scrutinized to evaluate the likelihood of a November rate hike by the RBA, especially given the central bank’s stated minimal tolerance for unexpected upticks in inflation.

Here are some highlights for the week:

- Monday: Eurozone consumer confidence.

- Tuesday: Australia PMIs, Japan PMIs; Germany Gfk consumer sentiment; Eurozone PMIs; UK employment, PMIs; US PMIs.

- Wednesday: Australia CPI; Germany Ifo business climate; BoC rate decision; US new home sales.

- Thursday: Japan corporate service prices; Australia import prices; ECB rate decision; US GDP, jobless claims, durable goods orders, goods trade balance, pending home sales.

- Friday: Japan Tokyo CPI; Australia PPI; US PCE inflation, personal income and spending.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.8906; (P) 0.8921; (R1) 0.8938; More….

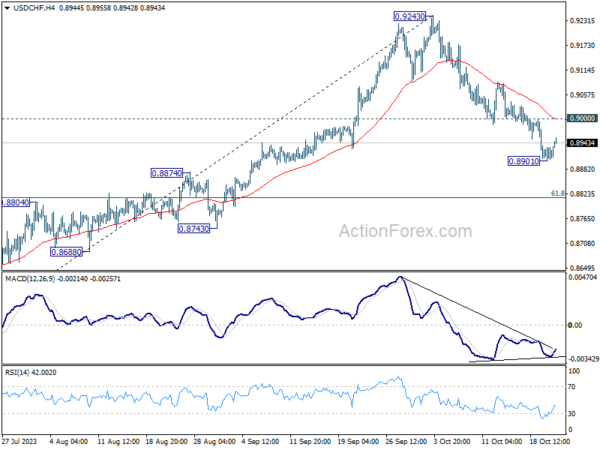

Intraday bias in USD/CHF is turned neutral first with today’s recovery. But further decline is still expected as long as 0.9000 resistance holds. Below 0.8901 will resume the fall from 0.9243 to 61.8% retracement of 0.8551 to 0.9243 at 0.8815 next. Sustained break there will pave the way to retest 0.8551 low. Nevertheless, break of 0.9000 will turn bias back to the upside for stronger rebound.

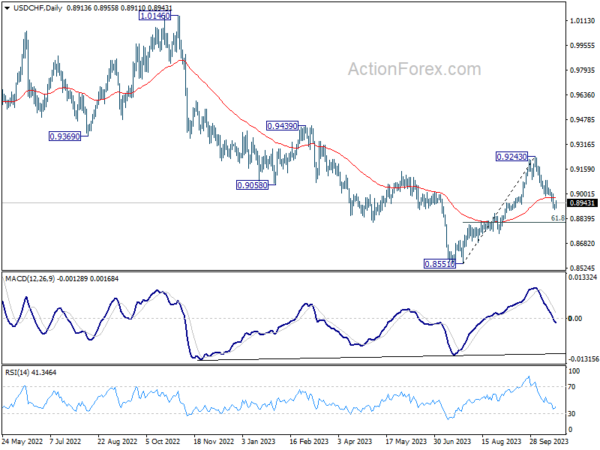

In the bigger picture, the firm break of 55 D EMA (now at 0.8974) argues that rebound from 0.8551 might be completed as a correction at 0.9243. In other words, larger fall from 1.0146 (2022 high) is possibly not over yet. Risk will now stay on the downside as long as 0.9243 resistance holds. Firm break of 0.8551 will confirm down trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 10:00 | EUR | German Buba Monthly Report | ||||

| 14:00 | EUR | Eurozone Consumer Confidence Oct P | -18 | -18 |