Swiss Franc continues to dominate as this week’s top-performing currency, as the global financial markets are under influence of mounting geopolitical tensions. Reports suggest that Israel might be preparing for ground operations against Hamas. The country’s Defence Minister, Yoav Gallant, has reportedly alerted troops that they will soon see Gaza “from inside”, and “the command will come”.

This global unease has also propelled Gold, pushing the precious metal closer to the significant 2000 mark. Furthermore, WTI crude oil has surpassed 90 level. Franc’s surge also seems to bolster Euro, which now ranks as the week’s second strongest currency. In contrast, the British Pound has not managed to keep up the pace.

Following Fed Chair Jerome Powell’s speech, Dollar experienced a mild dip but remained robust, ranking as the third strongest currency for the week. The tenacity of the greenback is attributed to the persistent rise of 10-year yield, which narrowly missed the 5% mark overnight. US President Joe Biden’s call for increased spending to support Israel and Ukraine amplified the selloff in treasuries. Biden’s proposal is reported to be at USD 100B in new spending, subject to Congress approval.

Conversely, New Zealand Dollar is languishing at the bottom of the weekly chart, with Canadian Dollar and Yen trailing closely. It’s uncertain if Japan will intervene in the currency markets again as USD/JPY might probes 150 any time. The country’s top currency diplomat Masato Kanda emphasized the “basic stance” to not to say anything about intervention as that would causes noises in the markets. So, there would be no clue until action is taken.

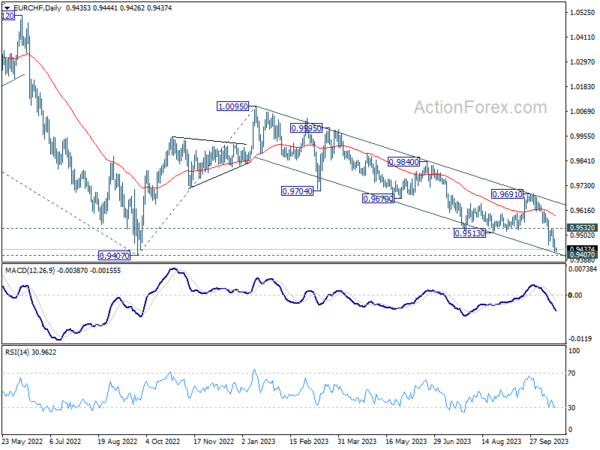

Technically, even though Euro is the second strongest for the week, EUR/CHF still extending the medium term down trend from 1.0095. The cross is now approaching medium term channel support, as well as medium term bottom at 0.9407. A bounce from current level is plausible and break above 0.9532 resistance will indicate short term bottoming. However, decisive break of 0.9407 will confirm resumption of the long term down trend, and could be an indication of renewed decline in EUR/USD too.

In Asia, at the time of writing, Nikkei is down -0.12%. Hong Kong HSI is down -0.41%. China Shanghai SSE is down -0.27%. Singapore Strait Times is down -0.06%. Japan 10-year JGB yield is down -0.0077 at 0.839. Overnight, DOW dropped -0.75%. S&P 500 dropped -0.85%. NASDAQ dropped -0.96%. 10-year yield rose 0.084 to 4.988.

Fed’s Powell signals caution on rate hikes, notes yield surge as de facto tightening

Fed Chair Jerome Powell, in his speech at the Economic Club of New York, asserted that while the option for an additional rate hike remains open, a prudent and careful approach will be the governing principle. Market participants, digesting Powell’s words, now overwhelmingly anticipate an extension of Fed’s pause in November, a sentiment reflected in fed fund futures pointing towards a 100% chance of this outcome. Referring to the recent rise in yields, he said it might have an effect “at the margins” on reducing the necessity for further rate hikes.

Powell suggested that the surge in yields might be linked to growing concerns surrounding fiscal deficits and mentioned that the process of Quantitative Tightening could also be influencing it. Highlighting that the uptick in yields acts as a de facto policy tightening, Powell raised the possibility that this might reduce the need for aggressive rate hikes in the future.

Although inflation metrics have dipped during the summer, Powell emphasized, “inflation is still too high, and a few months of good data are only the beginning.” The inflation outlook remains uncertain, marked by the unpredictability of its stabilization point in the upcoming quarters, and Powell concedes that, “the path is likely to be bumpy.”

With an eye on economic growth and labor market dynamics, Powell indicated that persistent above-trend growth or sustained labor market tightness could trigger a reevaluation of the inflation outlook. Such developments “could warrant further tightening of monetary policy.”

Underscoring the complexities and potential pitfalls ahead, Powell stated, Committee is “proceeding carefully.” “We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks,” he added.

Fed officials stress patience and vigilance amid rising treasury yields

Comments from some key Fed officials overnight underscore the central bank’s cautious approach in the face of evolving economic conditions, particularly the rise in treasury yields and persistent inflation.

Philadelphia Fed President Patrick Harker asserted, “We are at the point where we can hold rates where they are.” He acknowledged the recent data trends, noting, “So far, economic and financial conditions are evolving roughly as I expected,” but added that some indicators have been “a tad stronger than my baseline forecast.” Harker championed patience in monetary policy, suggesting that “a resolute, but patient, stance of monetary policy will allow us to achieve the soft landing that we all wish for our economy.”

Dallas Fed President Lorie Logan emphasized the natural tightening effect of the recent uptick in treasury yields, stating they have “done some of this tightening work for us.” While Logan recognized some progress in inflation management, she conceded, “it’s still too high.” Stressing the importance of the broader economic environment, she remarked, “It’s important that we have continued restrictive financial conditions.”

Chicago Fed President Austan Goolsbee approached the inflation debate from a historical perspective. He noted, “There’s a widely held conventional wisdom that if you get the inflation rate down more than 5 percentage points you will have to have a big recession to do that.” Contrary to this belief, Goolsbee expressed optimism, saying, “So far, we haven’t had that recession, I’m still hopeful we can avoid it entirely.”

Lastly, Atlanta Fed President Raphael Bostic laid clear his priorities, stating, “As for inflation, that is job one for now.” He elucidated the broad impacts of inflation, observing that “Across the economy and demographic groups, inflation is the force that is most painful and drives more people to precariousness.”

Japan’s core CPI slips below 3% mark to 2.8% yoy

Inflationary momentum in Japan showed signs of easing in September, with all-item CPI decelerating to 3.0% yoy, down from 3.2% yoy in the prior month. Core CPI, which strips out the volatile food prices, also showed a downtrend, registering at 2.8% yoy, a dip from 3.1% yoy. Furthermore, core-core CPI, which excludes both food and energy prices, declined marginally from 4.3% yoy to 4.2% yoy.

Remarkably, core inflation dipped below the 3% mark for the first time since August 2022. Nevertheless, it remains above BoJ’s 2% target, marking the 18th consecutive month of surpassing this benchmark.

The detailed breakdown of the data indicates that energy prices were a significant drag, plunging by -11.7% yoy. This downturn can be attributed to the government’s proactive measures to trim utility bills, resulting in double-digit falls in electricity and city gas prices. On the contrary, food prices remained on an upward swing, posting 8.8% yoy increase.

There are reports suggesting an upward revision in BoJ’s core CPI forecast for fiscal 2023. Sources familiar with the bank’s deliberations indicate a possible revision from 2.5% to nearly 3.0%. All eyes will now be on BoJ ‘s policy meeting scheduled for Oct 31, where a new outlook report is anticipated.

New Zealand’s exports down -18% yoy in Sep, China leads decline again

New Zealand’s trade balance for September reveals a deficit of NZD -2.3B, driven by a notable fall in goods exports of -18% yoy, bringing the total to NZD 4.9B. The decline in imports was also significant, dropping by -15% yoy to NZD 7.2B.

A striking feature of this downturn is the notable reduction in exports to China, marking a deviation from the consistent growth observed over the past decade. International trade manager Alasdair Allen noted, “Over the past decade, exports to China have been steadily increasing, with a flat period during COVID-19, but in recent months this has started to shift.”

Breaking down the export figures by country, China recorded a 20% yoy drop, equivalent to NZD 332 million, leading the downturn. Exports to Australia, US, EU, and Japan also experienced declines, calculated at -3.3%, -6.7%, -26%, and -12% yoy, respectively.

On the imports front, China once again played a significant role, with imports from the country decreasing by -17% yoy. Imports from EU and Australia also dropped by -1.5% yoy and -21% yoy respectively. Imports from South Korea contracted by -16% yoy. In contrast, imports from US saw a growth of 6.1% yoy.

Looking ahead

UK retail sales and Germany PPI are the main focuses in European session. Canada will release retail sales later in the day.

USD/CHF Daily Outlook

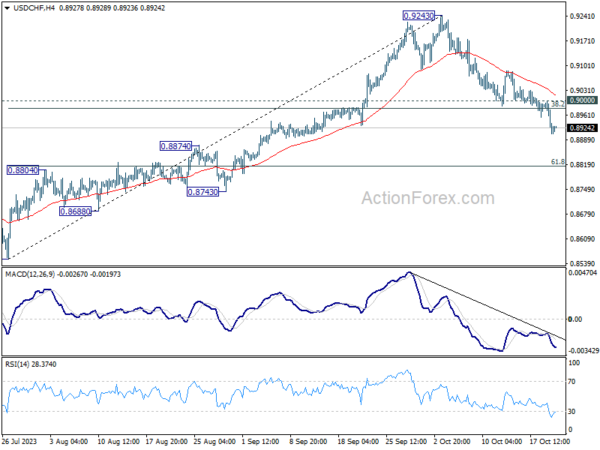

Daily Pivots: (S1) 0.8882; (P) 0.8942; (R1) 0.8975; More….

USD/CHF’s fall from 0.9243 continued and finally took out 38.2% retracement of 0.8551 to 0.9243 at 0.8979 decisively. There is no sign of bottoming and intraday bias is now on the downside for 61.8% retracement at 0.8815. Sustained break there will pave the way to retest 0.8551 low. On the upside, above 0.9000 minor resistance will turn bias neutral and bring consolidations first, before staging another decline.

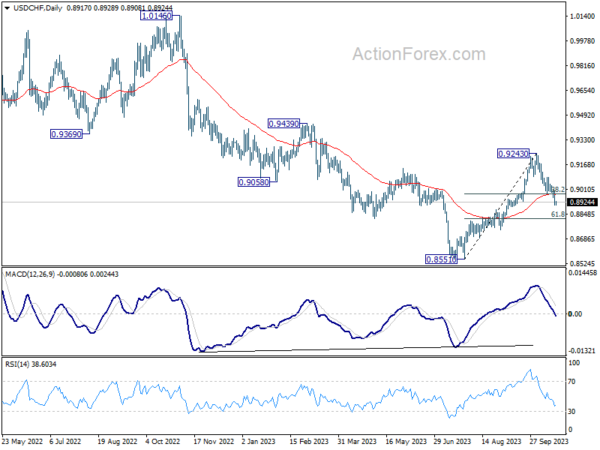

In the bigger picture, the firm break of 55 D EMA (now at 0.8974) argues that rebound from 0.8551 might be completed as a correction at 0.9243. In other words, larger fall from 1.0146 (2022 high) is possibly not over yet. Risk will now stay on the downside as long as 0.9243 resistance holds. Firm break of 0.8551 will confirm down trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Sep | -2329M | -2291M | -2273M | |

| 23:01 | GBP | GfK Consumer Confidence Oct | -30 | -20 | -21 | |

| 23:30 | JPY | National CPI Y/Y Sep | 3.00% | 3.20% | ||

| 23:30 | JPY | National CPI ex-Fresh Food Y/Y Sep | 2.80% | 2.80% | 3.10% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Sep | 4.20% | 4.30% | ||

| 06:00 | GBP | Retail Sales Y/Y Sep | -0.40% | 0.40% | ||

| 06:00 | EUR | Germany PPI M/M Sep | 0.40% | 0.30% | ||

| 06:00 | EUR | Germany PPI Y/Y Sep | -14.20% | -12.60% | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Sep | 17.7B | 10.8B | ||

| 12:30 | CAD | Retail Sales M/M Aug | -0.10% | 0.30% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Aug | -0.10% | 1.00% |