- The Euro keeps the bid bias unchanged against the US Dollar.

- Stocks in Europe close the session with a decent advance across the board.

- EUR/USD faces immediate target at the 1.0600 hurdle.

- The USD Index (DXY) meets initial support around 106.30.

- German Wholesale Prices rose 0.2% MoM in September.

- US NY Empire State Manufacturing Index worsens less than expected.

The Euro (EUR) begins the new trading week with a favorable start against the US Dollar (USD), spurring EUR/USD to continue its recovery from the 1.0500 area and reclaim the 1.0550 region on Monday.

The Greenback, as measured by the USD Index (DXY), retreats markedly from last week’s peaks near 106.80, reflecting an improved market sentiment for risk assets. Meanwhile, the Federal Reserve’s (Fed) ongoing commitment to a more conservative monetary policy stance remains unchanged.

Continuing to focus on monetary policy, investors are anticipating that the Fed will maintain its stance of not making any adjustments to interest rates throughout the remainder of the year. At the same time, those in the financial markets are pondering the possibility of the European Central Bank (ECB) putting a halt to policy modifications, even though inflation levels exceed the bank’s target and concerns are growing regarding the potential for a future economic downturn or stagflation in the region.

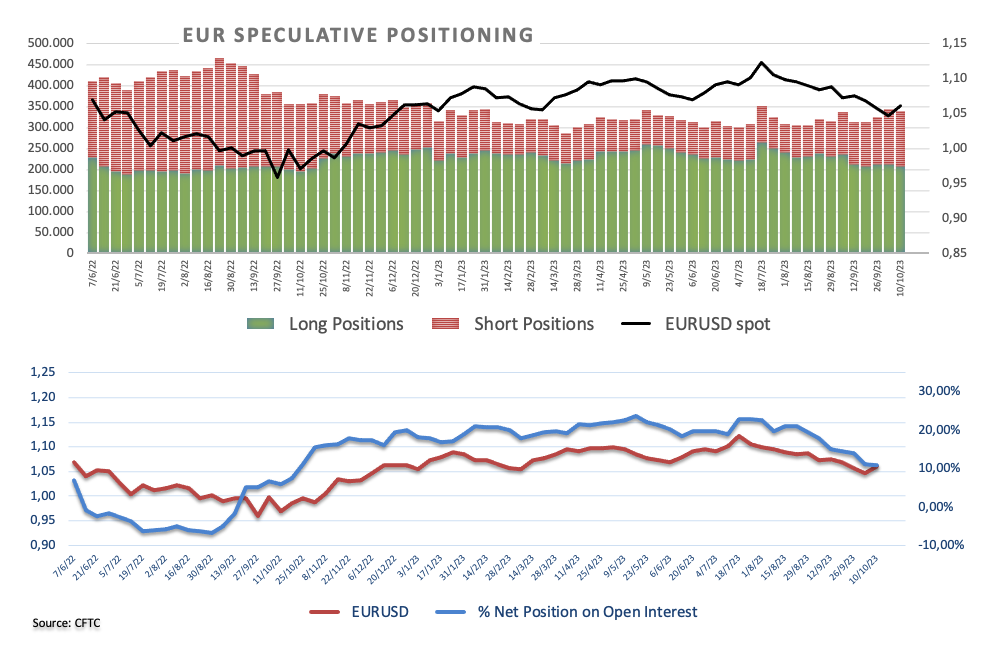

On another front, the speculative community kept trimming their net long positions during the week ended on October 10, this time reaching levels last seen in late October 2022. Market participants continued to factor in the likelihood that the ECB’s hiking cycle might have reached a peak against the persistent view that the Fed could maintain its restrictive stance for a longer period than initially anticipated.

On the domestic calendar, Wholesale Prices in Germany rose 0.2% MoM in September and contracted 4.1% over the last twelve months, while the trade surplus in the broader euro bloc widened to €6.7B in August.

In the US, the regional manufacturing gauge tracked by the NY Empire State Index dropped to -4.6 for the current mont, less than initially projected. Later in the session, the September’s Monthly Budget Statement is due along with the speech by Philly Fed Patrick Harker (voter, hawk).

Daily digest market movers: Euro’s daily rebound falters ahead of 1.0550

- The EUR gathers extra steam against the USD.

- US and German yields start the week with humble gains.

- Markets anticipate that the Fed will keep rates unchanged.

- Investors expect the ECB will extend the pause in its rate rise campaign.

- Geopolitical tensions in the Middle East remain high.

- The PBoC keeps its One-Year LPR unchanged at 2.50%.

- BoE’s Huw Pill suggests there is further job to do when it comes to tackle inflation.

- Potential FX intervention remains on the cards around USD/JPY.

Technical Analysis: Euro risks further losses once 1.0500 is cleared

EUR/USD leaves behind part of the recent two-day lows and manages to gather fresh steam beyond 1.0500 on Monday.

If the upward momentum continues, there is a possibility that EUR/USD could revisit the September 20 high of 1.0736 and potentially reach the significant 200-day Simple Moving Average (SMA) at 1.0822. Breaking above this level may lead to testing the August 30 peak at 1.0945, approaching the psychological threshold of 1.1000. Further breakthroughs beyond the August 10 high of 1.1064 could potentially push the pair towards the July 27 top at 1.1149 and even reach the 2023 peak of 1.1275 seen on July 18.

On the downside, if selling pressure resumes, there is a possibility of retesting the 2023 low at 1.0448 from October 3 and potentially challenging the significant psychological level of 1.0400. If this level is breached, it could pave the way for a retest of the weekly lows at 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

As long as the EUR/USD remains below the 200-day SMA, there is a potential for sustained downward pressure.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.