USDJPY trades back below the 100 hour MA. Bearish.

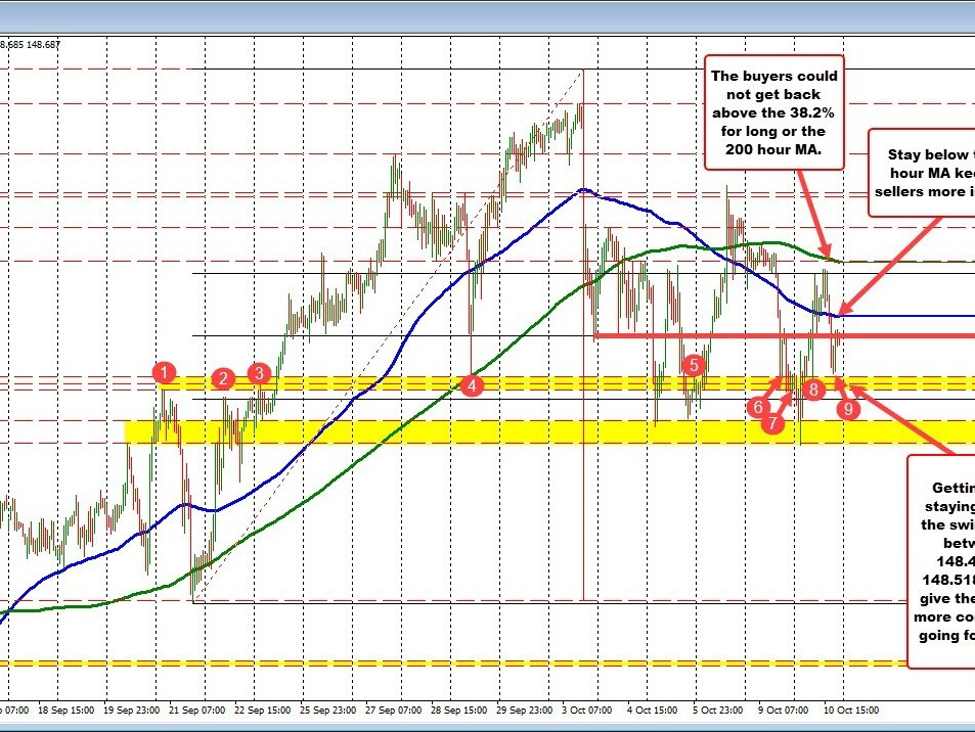

The USDJPY moved higher into the US session today, and in the process moved between the 100-hour MA (blue line at 148.83) and the 200-hour MA (green line at 149.129). The high price reached 149.09 which was just above the broken 38.2% at 149.069.

The inability to get above the 200-hour MA, gave sellers more reason to push lower. When the 100-hour MA was broken at 148.838, the selling started to intensify. The low price extended to 148.535, which was just short of a swing area between 148.449 and 148.518 (see the red number circles on the chart above).

The current price is back off that low but below the 100-hour MA at 148.838. Going into the new trading day, that MA will be the barometer for the buyers and sellers. Stay below, keeps the sellers more in control

ON the downside, the sellers will be looking to break below the 148.45 level and then will look toward another swing area between 148.16 and 148.28. That would be another target area to get to and through to increase a bearish bias.

All the bets are off, if the price moves back above the 100-hour movie average. If it does, the bias is just more into neutral territory with a break of the 200-hour moving average at 149.125, a more bullish shift on a break above.