Dollar softens broadly today, as it seems traders are exercising caution, pivoting their focus towards forthcoming heavy-weight economic data releases from the US in the second half of the week. The greenback’s pull back also extends following much weaker than expected ADP private job data. Interestingly, this “bad news is good news” effect is also reflected in the positive turn of DOW futures, suggesting a potential stabilization in the stock markets following yesterday’s steep decline. Concurrently, 10-year yield is also witnessing a retracement from its peak.

Today, European majors are stealing the spotlight, leading the pack in the forex market. Sterling, in particular, is enjoying additional support following an upward revision in UK’s PMI Services data. In contrast, Yen seems to be losing steam as the unconfirmed intervention by Japan appears to be losing its initial impact. Commodity-linked currencies, on the other hand, are languishing, hampered by a yet-to-recover risk sentiment.

On the technical front, Dollar is expected to undergo further consolidation in anticipation of Friday’s NFP. However, key levels are holding firm, suggesting that the near-term outlook for the greenback remains bullish, priming it for another rally. These pivotal levels include 1.0616 resistance in EUR/USD, 1.2270 resistance in GBP/USD, and 0.9089 support in USD/CHF.

In Europe, at the time of writing, FTSE is down -0.17%. DAX is up 0.35%. CAC is up 0.54%. Germany 10-year yield is down -0.0324 at 2.936. Earlier in Asia, Nikkei dropped -2.28%. Hong Kong HSI dropped -0.78%. Singapore Strait Times dropped -1.41%. Japan 10-year JGB yield rose 0.0442 to 0.808.

US ADP employment rises only 89k, wages growth slows

US private sector witnessed a notable slowdown in employment growth last month, as revealed by the ADP’s latest report. A mere addition of 89k jobs in September fell significantly short of the anticipated 155k.

Dissecting these figures, goods-producing sector experienced a modest increase, adding 8k positions, while services sector contributed the lion’s share with an 81k rise. By establishment size, small companies added 95k jobs, medium added 72k, large cut -83k.

In terms of wage dynamics,for those who remained in their current positions, the median change in annual pay persisted at 5.9% yoy. However, those switching roles saw a deceleration in wage growth, descending from 9.7% yoy to 9.0% yoy.

Nela Richardson, ADP’s chief economist, expressed her concerns on the current employment scenario, stating, “We are seeing a steepening decline in jobs this month.” Adding to the bleak outlook, she commented on the wage scenario, observing, “Additionally, we are seeing a steady decline in wages in the past 12 months.”

ECB’s Lagarde: Rates reached level for timely return of inflation to target

ECB President Christine Lagarde reiterated in a speech today that current interest rates are at the level to return inflation to target in a timely manner. She also laid out three criteria for future decisions.

“Based on our current assessment, we consider that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our medium-term target”, Lagarde said.

Further shedding light on ECB’s decision-making framework, Lagarde stated that their “future decisions will continue to be based on these three criteria.” She detailed these criteria as: “the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission.”

Eurozone retail sales falls -1.2% mom in Aug, EU down -0.9% mom

Eurozone retail sales fell -1.2% mom in August, well below expectation of -0.5% mom. Volume of retail trade decreased by -3.0% for automotive fuels, by -1.2% for food, drinks and tobacco and by -0.9% for non-food products.

EU retail sales was down -0.9% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in the Portugal (-3.0%), France (-2.8%) and Belgium (-1.5%). The highest increases were observed in Luxembourg (+1.9%), Poland (+1.7%) and Denmark (+1.6%).

Eurozone PPI at 0.6% mom, -11.5% yoy in Aug

Eurozone PPI came in at 0.6% mom, -11.5% yoy in August, versus expectation of 0.6% mom, -11.6% yoy. For the month, industrial producer prices increased by 2.5% mom in the energy sector, while prices remained stable for capital goods and for non-durable consumer goods, and prices decreased by -0.1% mom for durable consumer goods and by 0.4% for intermediate goods. Prices in total industry excluding energy decreased by -0.2% mom.

EU PPI came in at 0.5% mom, -10.5% yoy. The biggest monthly increases in industrial producer prices were observed in Ireland (+3.7%), Finland (+2.4%) and Greece (+2.0%), while the largest decreases were recorded in Romania (-1.3%), Slovenia (-0.7%) and Belgium (-0.6%).

Eurozone PMI composite finalized at 47.2, can’t jump on the hope train yet

The latest Eurozone PMI Services data brings both a glimmer of optimism and a note of caution to an economic region. The finalized PMI Services for September stood at 48.7, marking an increment from August’s 47.9. Composite index also saw a marginal uplift to 47.2 from the previous month’s 46.7. While the numbers reflect an uptick, the fragility of the recovery becomes apparent when examining the country-specific data and underlying factors.

A look at the composite PMI output index reveals a contrasting scenario among the countries. Ireland tops the chart with a two-month low of 52.1, while France lags at a 34-month low of 44.1. Germany (46.4) and Italy (49.2), despite being on a multi-month high, are still not out of the woods, pointing towards a segmented recovery pattern.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, offers a balanced perspective. “The HCOB Composite PMI for the Eurozone did rebound a bit. However, we can’t jump on the hope train yet,” he cautioned. The declining new business, especially in powerhouse economies like Germany and France, underscores this sentiment, indicating a continual decline in outstanding business and a drop in business expectations.

In the corridors of ECB, where deliberations over the next interest rate decision are underway, the latest PMI data could act as a double-edged sword. The hawks find solace in the Input Price Index, propelled by wages and energy costs, marking a four-month pinnacle. In contrast, the doves might highlight the moderated pace at which service prices are increasing – the slowest since the summer of 2021.

“Prices are nevertheless still climbing the ladder rather fast, a weird twist when the economy is singing the blues,” de la Rubia noted.

UK PMI services finalized at 49.3, silver lining in easing inflationary pressures

UK PMI Services was finalized at 49.3 in September, a marginal drop from the neutral 50.0 recorded in August. S&P Global’s analysis points to persistent declines in both business activity and new ventures, and notably, the pace of job shedding is at its quickest since January 2021. However, the silver lining lies in easing inflationary pressures, marking their lowest in over two years.

Tim Moore, Economics Director at S&P Global Market Intelligence, cited reductions in non-essential business and consumer expenditure as significant dampeners on service sector activity. “A combination of elevated borrowing costs and subdued economic conditions had led to lower new business intake,” he remarked.

Decline in export sales, particularly influenced by reduced European demand, further contributed to the sector’s woes. Service providers’ response has been cautionary, with hiring significantly scaled back given the current uncertainties.

On a positive note, Moore highlighted the diminishing inflationary pressures in the sector, observing, “headline rates of inflation will continue to moderate in the coming months, with service sector input costs rising at the slowest pace for nearly two-and-a-half years.” This, coupled with the anticipation of consistent decreases in UK consumer price inflation, could potentially revive demand, instilling a sense of optimism for the future.

RBNZ holds rates, hints at longer duration of restrictive policy

RBNZ has opted to keep the Official Cash Rate stable at 5.50%, aligning with broad market anticipations. The minutes of the meeting revealed a consensus among committee members that restrictive interest rate environment might be needed “for a more sustained period of time”.

In the short term, RBNZ is looking at a scenario where domestic demand could exhibit “greater resilience”, spurred by migration. This situation could “slow the pace of expected disinflation”. A related concern is wage inflation, which could take a longer time to ease than initially expected. Recent rise in oil prices could also risk “headline inflation being higher than expected”.

Looking at the medium term, the minuted noted concerns about greater slowdown in global growth. Such a downturn could lead to further reductions in non-oil import prices. Moreover, weakened global demand, with a particular emphasis on China, could exert additional pressure on commodity prices, subsequently affecting New Zealand’s export revenues.

EUR/USD Mid-Day Outlook

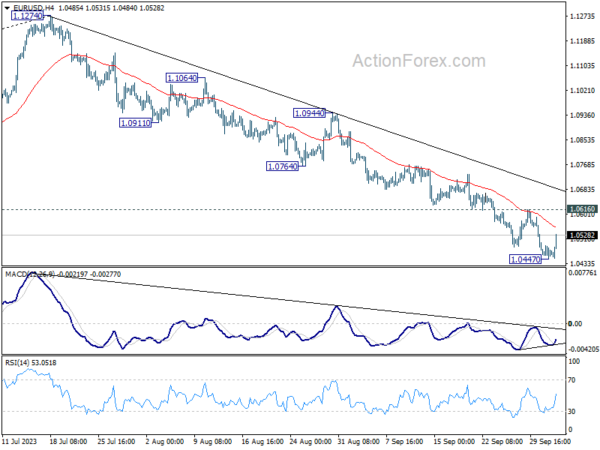

Daily Pivots: (S1) 1.0445; (P) 1.0469; (R1) 1.0491; More…

Intraday bias in EUR/USD is turned neutral first with today’s recovery. Some consolidations could be seen. But outlook will remain bearish as long as 1.0616 resistance holds. Break of 1.0477 will resume the fall from 1.1274 to 1.0199 fibonacci level next. Nevertheless, firm break of 1.06161 will confirm short term bottoming, and turn bias back to the upside for stronger rebound.

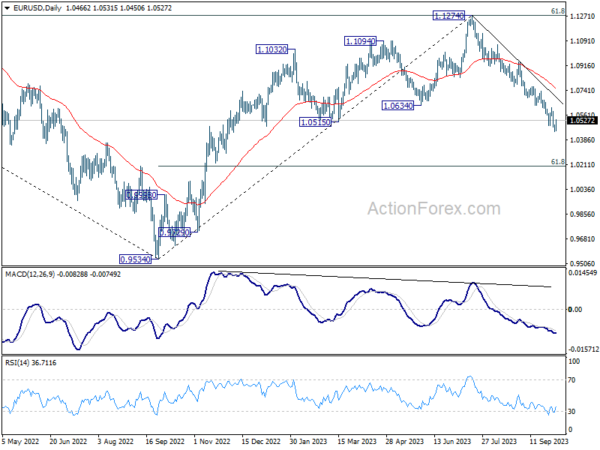

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0759) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 07:45 | EUR | Italy Services PMI Sep | 49.9 | 50 | 49.8 | |

| 07:50 | EUR | France Services PMI Sep F | 44.4 | 43.9 | 43.9 | |

| 07:55 | EUR | Germany PMI Sep F | 50.3 | 49.8 | 49.8 | |

| 08:00 | EUR | Eurozone Services PMI Sep F | 48.7 | 48.4 | 48.4 | |

| 08:30 | GBP | Services PMI Sep F | 49.3 | 47.2 | 47.2 | |

| 09:00 | EUR | Eurozone PPI M/M Aug | 0.60% | 0.60% | -0.50% | |

| 09:00 | EUR | Eurozone PPI Y/Y Aug | -11.50% | -11.60% | -7.60% | |

| 09:00 | EUR | Eurozone Retail Sales M/M Aug | -1.20% | -0.50% | -0.20% | -0.10% |

| 12:15 | USD | ADP Employment Change Sep | 89K | 155K | 177K | 180K |

| 13:45 | USD | Services PMI Sep F | 50.2 | 50.2 | ||

| 14:00 | USD | ISM Services PMI Sep | 53.6 | 54.5 | ||

| 14:00 | USD | Factory Orders M/M Aug | 0.20% | -2.10% | ||

| 14:30 | USD | Crude Oil Inventories | -0.1M | -2.2M |