The currency markets faced significant shifts today, notably with Sterling and Swiss Franc, which are enduring considerable selloffs. Both BoE and SNB opted to maintain their current interest rates, prompting speculation that these institutions might have peaked in their tightening cycles. However, Australian Dollar bore the brunt of today’s market sentiment, emerging as the day’s biggest loser, possibly due to escalating risk aversion. This sentiment has been echoed in major global indexes, most likely influenced by Fed hawkish hold yesterday coupled which also triggered soaring treasury yields.

On the flip side, Japanese Yen is shining as the day’s top performer. This strength is, in part, attributed to 10-year JGB yield surpassing 0.75% mark. Market participants are also possibly adjusting their positions in anticipation of a potentially hawkish surprise from BoJ in the upcoming Asian trading session. Following closely,Dollar maintains its robust position, though USD/JPY pair continues to show signs of strain ahead of 150 mark. Euro is also gaining a bit traction, but only benefiting from trades against the beleaguered Swiss Franc and Sterling. Meanwhile, Canadian Dollar’s performance is mixed, retracting much of the gains driven by this week’s CPI data.

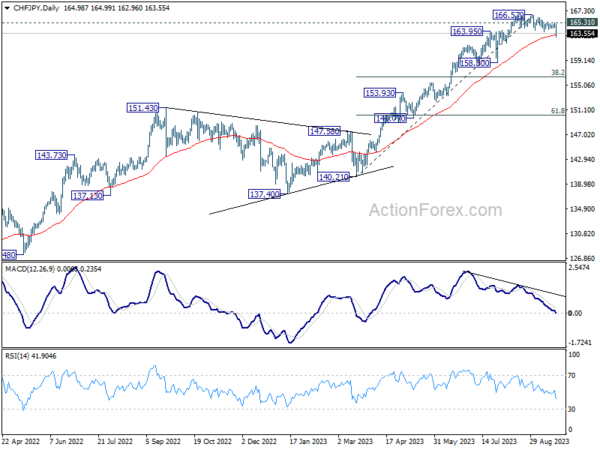

Technically, CHF/JPY’s fall from 166.57 resumes today on broad-based Swiss Franc weakness. Considering bearish divergence condition in D MACD, this decline is probably corrective whole rise from 140.21. Sustained trading below 55 D EMA (now at 163.27) will add more credence to this case. Deeper fall should then be seen to 158.80 support, or possibly further to 38.2% retracement of 150.21 to 166.57 at 156.50.

In Europe, at the time of writing, FTSE is down -0.43%. DAX is down -1.39%. CAC is down -1.72%. Germany 10-year yield is up 0.0658 at 2.771. Earlier in Asia, Nikkei fell -1.37%. Hong Kong HSI fell -1.29%. China Shanghai SSE fell -0.77%. Singapore Strait Times fell -1.21%. Japan 10-year JGB yield rose 0.0285 to 0.754.

In Europe, at the time of writing, FTSE is down -0.43%. DAX is down -1.39%. CAC is down -1.72%. Germany 10-year yield is up 0.0658 at 2.771. Earlier in Asia, Nikkei fell -1.37%. Hong Kong HSI fell -1.29%. China Shanghai SSE fell -0.77%. Singapore Strait Times fell -1.21%. Japan 10-year JGB yield rose 0.0285 to 0.754.

US initial jobless claims drop to 201k, vs exp 222k

US initial jobless claims fell -20k to 201k in the week ending September 16, well below expectation of 222k. Four-week moving average of initial claims dropped -8k to 217k. Continuing claims fell -21k to 1662 in the week ending September 9. Four-week moving average of continuing claims fell-9k to 1687k.

BoE on hold at 5.25%, heavyweights win tight vote

BoE opts to keep its Bank Rate unchanged at 5.25%. The decision, however, came after a razor-thin 5-4 vote that showed divisions within the central bank’s ranks. Notably, the influential figures – Governor Andrew Bailey, Deputies Ben Broadbent and Dave Ramsden, along with Chief Economist Huw Pill, sided with Swait Dhingra in favour of retaining the rate at its current level.

In its accompanying statement, BoE underscored the need for a vigilant approach, stating, “Monetary policy will need to be sufficiently restrictive for sufficiently long”. Furthermore, the central bank emphasized its readiness to consider more rate hikes, signaling that “Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.”

Amid these cautions, Bank’s staff adjusted their growth outlook, expecting only a slight uptick in GDP for the third quarter of 2023. They also anticipate that the underlying growth for the second half of the year will likely underperform previous expectations.

On the inflation front, the bank projected a notable decline in CPI in the near future. Despite recent spikes in oil prices, the central bank expects this drop due to “lower annual energy inflation” and anticipated further reductions in food and core goods prices.

Yet, the BoE warned that the services sector could buck this trend, foreseeing that “Services price inflation, however, is projected to remain elevated in the near term, with some potential month-to-month volatility.”

Also, in a unanimous decision, the MPC agreed to reduce the stockpile of UK government bond purchases, cutting it down by GBP 100B over the coming year, bringing the total to GBP 658B.

SNB bucks expectations and keeps interest rate steady

In an unexpected move that diverged from the market’s anticipations, SNB held its policy rate steady at 1.75%, side-stepping the anticipated hike to 2.00%. The conditional inflation projections have undergone downward revision. While inflation could surge above 2% target in upcoming quarters, it’s projected to retract back to 1.9% in 2025 based on current interest rate, without further tightening.

Despite this, SNB did not completely distance itself from a hawkish tone, and maintained the further tightening “may become necessary”. It also reiterated the willingness to intervene in the market with focus on “selling foreign currency

Delving into the specifics of the conditional inflation projections, based on steady 1.75% policy rate, inflation is forecasted to ascend to 2.0% by the end of this year. It will scale up to its apex at 2.2% in the second quarter of 2024, before experiencing a slight dip to 1.9% at the onset of 2025, maintaining that level thereafter.

On the economic growth front, SNB’s projections lean towards the cautious side, forecasting tepid growth for the remainder of the year. The annual growth is projected to hover around a modest 1%.

ECB’s Nagel uncertain if rate plateau is reached

ECB Governing Council, Joachim Nagel, Bundesbank head, posed a crucial question in his speech in Frankfurt, “Have we reached the plateau” on interest rates? He answered by stating that it “cannot yet be clearly predicted”. He continued, elaborating that “the forecasts still only show a slow decline toward the target level of 2%.”

Nagel’s comments hinted at the continuous monitoring of economic indicators, suggesting that while borrowing costs are expected to “remain at a sufficiently high level for a sufficiently long time,” the exact interpretation hinges on the incoming data.

Addressing concerns about Germany’s economic health, he remarked that characterizing Germany as the ‘sick man’ “seems exaggerated.” He attributed the present sluggish growth to specific influences such as the global economic deceleration, Russia’s conflict with Ukraine, and reduced public expenditure. Offering a silver lining, Nagel projected, “Once we get past the worst of these special factors, the weak growth should also ease. We expect the economy to grow again in 2024.”

On the other hand, Latvia’s central bank chief, Martins Kazaks, highlighted the structural nature of recent oil price hikes. He pointed out, “The recent oil price increase in my view is not a temporary or transitory, it’s very much a structural issue.” Such dynamics, according to Kazaks, present heightened inflation risks. Regarding the anticipated rate cuts, he expressed skepticism about their timing, asserting, “I think expecting rate cuts mid next year is somewhat too early.”

New Zealand’s Q2 GDP outperforms expectations with 0.9% qoq growth

New Zealand’s GDP surged by 0.90% qoq in Q2, doubling the expected growth rate of 0.4%. This notable growth is significantly attributed to substantial boost in the business services sector, specifically within the realm of computer system design.

Despite a setback in the primary industries, which contracted by 1.9%, goods-producing industries and service sectors pulled their weight, recording a growth of 0.7% and 1.0% respectively. The service sector emerged as a strong pillar of economic advancement.

The quarter also saw manufacturing sector shake off its lethargy, reversing a trend of decline sustained over five consecutive quarters to contribute positively to the economic pie.

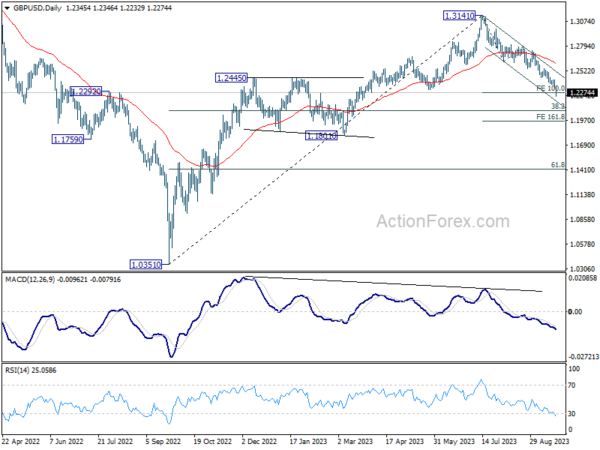

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2310; (P) 1.2366; (R1) 1.2399; More…

GBP/USD falls to as low as 1.2232 so far today and intraday bias stays on the downside. 100% projection of 1.3141 to 1.2618 from 1.2799 at 1.2276 is already met but there is no sign of bottoming. next target would be 1.2075 fibonacci level. On the upside, above 1.2423 minor resistance will turn intraday bias neutral again. But near term outlook will stay bearish as long as 1.2618 support turned resistance holds, in case of strong recovery.

In the bigger picture, fall from 1.3141 medium term top is seen as a correction to up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3141 at 1.2075. Strong support would be seen there to bring rebound on first attempt. However, sustained break of 1.2075 will raise the chance of bearish trend reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q2 | 0.90% | 0.40% | -0.10% | 0.00% |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Aug | 10.8B | 9.8B | 3.5B | |

| 07:30 | CHF | SNB Interest Rate Decision | 1.75% | 2.00% | 1.75% | |

| 11:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.50% | 5.25% | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 4–0–5 | 8–0–1 | 8–0–1 | |

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.10% | 0.00% | -0.10% | |

| 12:30 | USD | Initial Jobless Claims (Sep 15) | 201K | 222K | 220K | 221k |

| 12:30 | USD | Philadelphia Fed Survey Sep | -13.5 | -0.7 | 12 | |

| 12:30 | USD | Current Account (USD) Q2 | -212B | -220B | -219B | |

| 14:00 | USD | Existing Home Sales Aug | 4.10M | 4.07M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Sep P | -16.5 | -16 | ||

| 14:30 | USD | Natural Gas Storage | 65B | 57B |