Australian Dollar advanced during Asian session, bolstered by stronger than anticipated data emanating from China and the injection of CNY 191B of fresh liquidity into the banking system by PBoC. The injection, which involved CNY 34B through 14-day reverse repos at a reduced rate of 1.95%, down from the prior 2.15%, followed the Chinese central bank’s decision to cut reserve requirement ratio for all banks by 25bps a day earlier.

Other commodity currencies are also experiencing a surge, buoyed by improving risk sentiment as analysts expect that the world is nearing the end of current tightening cycle. Adding fuel to the fire, Canadian Dollar received an extra push from the unrestrained ascent of WTI oil prices, which broke through 91 mark and shows no signs of halting.

In contrast, Euro finds itself as the week’s underperformer, suffering a selloff triggered by the dovish ECB rate hike yesterday. While selling pressure witnessed a slight respite during Asian session, substantial rebound appears elusive. Sterling and Swiss Franc are also languishing, holding positions as the next weakest links in the chain.

Dollar and Yen are holding a middle ground, gaining against European majors but losing terrain to commodity currencies. Despite the release of this week’s US CPI data, the greenback remained relatively unmoved, leaving traders to pin their hopes on next week’s FOMC rate decision and economic projections for a more decisive direction.

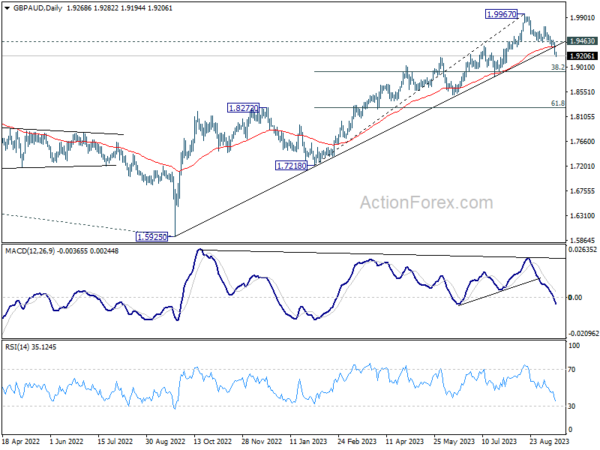

Technically, GBP/AUD’s strong break of 55 D EMA and medium term trend line support this week indicates that it’s at least correcting the rise from 1.7128 to 1.9967. Deeper fall is now expected as long as 1.9463 support turned resistance holds. Next target is 38.2% retracement of 1.7218 to 1.9967 at 1.8917. Reaction from there will reveal whether the cross is in a larger scale correction.

In Asia, at the time of writing, Nikkei is up 1.33%. Hong Kong HSI is up 1.53%. China Shanghai SSE is up 0.01%. Singapore Strait Times is up 1.01%. Japan 10-year JGB yield is down -0.0025 at 0.706. Overnight, DOW rose 0.96%. S&P 500 rose 0.84%. NASDAQ rose 0.81%. 10-year yield rose 0.039 to 4.288.

NZ BNZ PMI falls to 46.1, manufacturing activity slumps to multi-year low

New Zealand’s manufacturing sector experienced a further slowdown in August, with BusinessNZ Performance of Manufacturing Index falling slightly from 46.6 in July to 46.1. This marks the lowest rate of activity for a non-pandemic affected month since June 2009. Furthermore, the latest PMI data sits significantly below its long-term average of 52.9.

A closer look at the August data reveals: Production observed a modest increase, moving from 43.1 to 43.9. Employment metrics improved, rising from 44.8 to 47.7. New orders experienced a minor uptick, growing from 45.5 to 46.6. Finished stock levels retreated slightly from 52.7 to 52.1. Deliveries, however, showed more promise, escalating from 42.9 to 47.7.

Despite the grim headline figure, it is noteworthy that there was a slight decrease in the proportion of negative comments, standing at 66.7%, a marginal relief compared to July’s 72%. However, the level of pessimism mirrored that of May, maintaining the same rate of 66.7%. The pervasive market uncertainty stemming both from domestic and offshore influences, coupled with rising costs and weather-impacted demand, continued to be highlighted as primary drivers for the negative sentiment pervading the industry.

BNZ Senior Economist Craig Ebert expressed concern over the PMI’s latest results, noting that while the headline figure had seen much lower points during previous recessions, the composition of August figures brought little consolation. Ebert pinpointed new orders and production as substantial drags on the performance, trailing behind the standard levels by 8.0 and 9.5 points respectively.

China’s Economic Data Surpasses Forecasts, but Challenges Persist

China’s economic indicators for August showcased a mixed picture but, on the whole, exceeded analyst expectations in key areas. Industrial production exhibited growth of 4.5% yoy, edging out forecast of 4.0% yoy. Retail sales also outperformed predictions, registering 4.6% yoy increase compared to anticipated 3.0% yoy. However, fixed asset investment lagged slightly, presenting a 3.2% rise year-to-date year-on-year, just shy of the 3.3% expected.

The official communique from the NBS acknowledged the data as revealing a “marginal improvement.” Emphasizing the resilience and progress of the national economy, the statement underscored that “high-quality development” was on track and the accumulation of positive factors was evident. However, it also stressed caution. While the recovery is in motion, the bureau pointed out that there are still several “unstable and uncertain factors in the external environment” that China has to contend with.

Looking ahead

Eurozone trade balance will be released in European session. Later in the day, US will release Empire State manufacturing, import price, industrial production and U of Michigan consumer sentiment.

EUR/USD Daily Outlook

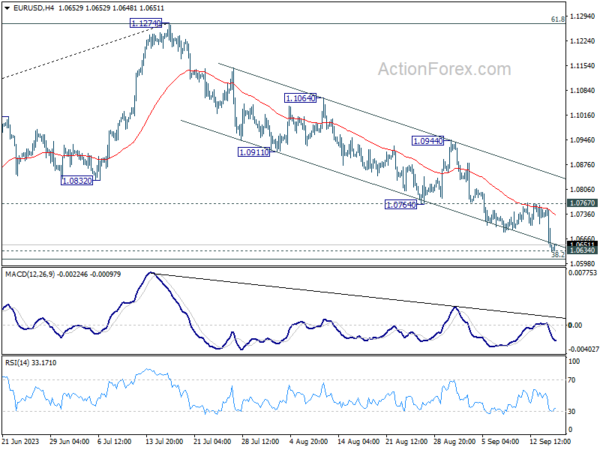

Daily Pivots: (S1) 1.0600; (P) 1.0676; (R1) 1.0720; More…

Intraday bias in EUR/USD remains on the downside for the moment, as EUR/USD is pressing 1.0609/34 cluster support zone. Strong rebound from current level, followed by break of 1.0767 resistance, should confirm short term bottoming. Intraday bias will be back on the upside for 1.0944 resistance. However, sustained break of 1.0609/34 will carry larger bearish implication, and target 1.0515 support next.

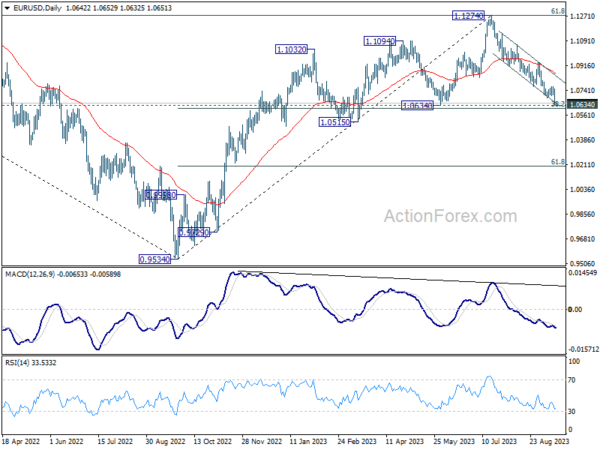

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. Break of 1.0944 will indicate the start of the second leg, and target retest of 1.1274. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Aug | 46.1 | 46.3 | 46.6 | |

| 02:00 | CNY | Industrial Production Y/Y Aug | 4.50% | 4.00% | 3.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Aug | 3.20% | 3.30% | 3.40% | |

| 02:00 | CNY | Retail Sales Y/Y Aug | 4.60% | 3.00% | 2.50% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jul | 0.90% | 0.20% | -0.40% | -0.70% |

| 08:30 | GBP | Consumer Inflation Expectations | 3.50% | |||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 13.5B | 12.5B | ||

| 12:30 | CAD | Manufacturing Sales M/M Jul | -1.70% | |||

| 12:30 | USD | Empire State Manufacturing Sep | -10 | -19 | ||

| 12:30 | USD | Import Price Index M/M Aug | 0.30% | 0.40% | ||

| 13:15 | USD | Industrial Production M/M Aug | 0.20% | 1.00% | ||

| 13:15 | USD | Capacity Utilization Aug | 79.30% | 79.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 69.5 | 69.5 |