Euro experienced a bounce amidst whispers that ECB forthcoming inflation projections might support an imminent rate hike on Thursday. Nevertheless, this uptick was moderate, as the revelations originated from an anonymous source. Simultaneously, investors worldwide are gearing up for pivotal US CPI data and UK GDP figures set to drop later today, both of which have the potential to create ripples in the market.

According to a Reuters report, insider information suggests that the quarterly economic projections to be handed in to ECB Governing Council today could reveal an inflation rate well surpassing 3% in 2024. This prediction defies anticipations of a marginal downward revision. Notably, the speculated 2024 figure overshadows the bank’s 2% target, showing a leap from the 3% projection made in June. However, uncertainty remains as the source mentioned that this week’s rate decision hangs in the balance, with formal proposals for the meeting yet to be tabled.

Diving into other currency movements, Australian Dollar took a hit, emerging as the day’s poorest performer. Yen trails, with any uplift from BoJ Governor Kazuo Ueda’s influence dissipated swiftly. On the other side, Dollar is holding its ground as the day’s top performer, but that’s part of sideway trading inside familiar ranges against other major currencies. Sterling is claiming the second spot, followed closely by Swiss Franc.

On a technical note, EUR/CHF is making some progress with the break of a near term falling trend line resistance. But risks will stay on the downside as long as 0.9601 resistance holds. That is, larger down trend from 1.0095 (Jan high) is still in favor to resume through 0.9513. However, decisive break of 0.9601 will be the first signal of a more sustainable near term rally, which could push EUR/CHF through 0.9646 resistance. The burning question remains: Will Euro enthusiasts make a premature move ahead of the crucial ECB rate decision?

In Asia, at the time of writing, Nikkei is down -0.39%. Hong Kong HSI is down -0.21%. China Shanghai SSE is down -0.87%. Singapore Strait Times is down -0.06%. Japan 10-year JGB yield is down -0.0021 at 0.708. Overnight, DOW dropped -0.05%. S&P 500 dropped -0.57%. NASDAQ dropped -1.04%. 10-year yield dropped -0.024 to 4.264.

Japan’s CGPI records eighth consecutive month of slowdown in August

Japan’s annual wholesale inflation, as measured by Corporate Goods Price Index, registered a slowdown for the eighth consecutive month in August. CGPI eased to 3.2% yoy, aligning with market expectations and continuing its downward trend from the peak of 10.6% yoy recorded in December.

Export price index recorded a lesser contraction of -0.8% yoy compared to -2.6% yoy in July. Meanwhile, import price index also demonstrated a slight moderation in its decline, posting a -15.9% yoy compared to -16.0% yoy observed in the preceding month.

On a month-on-month basis, PPI saw an uptick of 0.3% mom. Delving into the specifics, export price index witnessed a recovery, improving by 0.5% mom. In contrast, the import price index reported a decline of 0.9% mom. within the same period.

US CPI to bounce to 3.6%, Fed seen firmly on hold next week

Today, all eyes are on US August CPI data, with anticipation of a flare-up in inflation, primarily fueled by escalating oil prices. While broader CPI is expected to witness a surge, core CPI, which excludes volatile food and energy costs, is projected to experience moderated rise annually.

Specifically, CPI is projected to rise by 0.6% mom, a significant jump from July’s 0.2% mom. It would mark an annual inflation rate of 3.6% yoy, up from the previous 3.2% yoy. On the other hand, Core CPI is anticipated to grow by 0.2% mom, translating to year-on-year rate of 4.3% yoy, deceleration from prior 4.7% yoy.

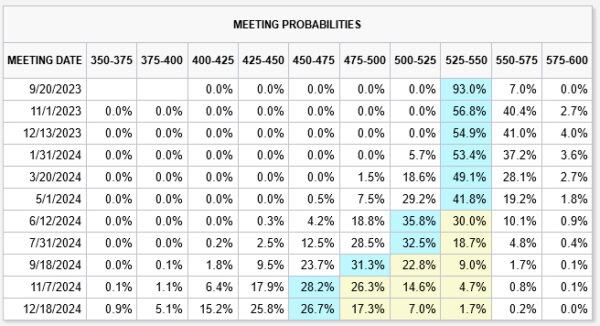

Fed fund futures are decidedly leaning towards a Fed hold next Thursday, with 93% probability of federal funds rate being unchanged at 5.25-5.50%. There’s just over a 50% chance that interest rates will remain at this level by the year-end. Predictions for the initial rate cut before next June stay under the 50% mark.

Further, a recent Reuters poll showcases the dominant stance among economists, with a whopping 95% (or 94 out of 97 economists) foreseeing a hold by Fed in the forthcoming week. Only one-fifth of the economists (17 out of 97) foresee at least one additional rate hike by the close of this year. Out of 87 economists who projected till mid-2024, 28 anticipate the first rate cut to materialize in Q1, while 33 expect it in the following quarter.

Elsewhere

UK GDP, production and goods trade balance, as well as Eurozone industrial production will be featured in European session.

EUR/USD Daily Outlook

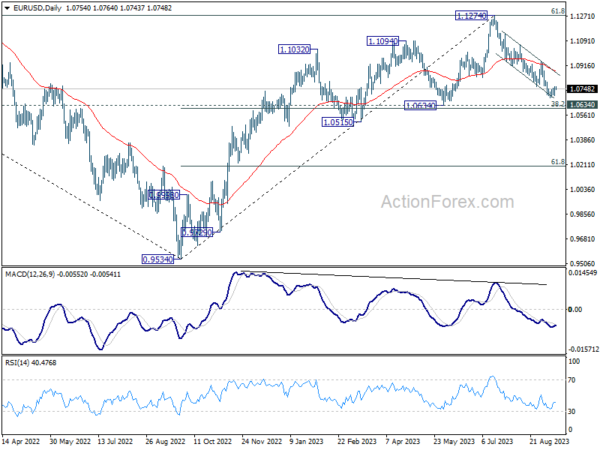

Daily Pivots: (S1) 1.0718; (P) 1.0743; (R1) 1.0781; More…

EUR/USD is still extending the consolidation pattern from 1.0685 and intraday bias remains neutral. While stronger recovery might be seen, outlook will stay bearish as long as 1.0944 resistance holds. On the downside, below 1.0685 will resume the fall from 1.1274 to 1.0609/34 cluster support zone next.

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. Break of 1.0944 will indicate the start of the second leg, and target retest of 1.1274. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Aug | 3.20% | 3.20% | 3.60% | 3.40% |

| 23:50 | JPY | BSI Large Manufacturing Conditions Q3 | 5.4 | 0.2 | -0.4 | |

| 06:00 | GBP | GDP M/M Jul | -0.20% | 0.50% | ||

| 06:00 | GBP | Industrial Production M/M Jul | -0.50% | 1.80% | ||

| 06:00 | GBP | Industrial Production Y/Y Jul | 0.50% | 0.70% | ||

| 06:00 | GBP | Manufacturing Production M/M Jul | -0.90% | 2.40% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Jul | 2.70% | 3.10% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Jul | -15.9B | -15.5B | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | -0.70% | 0.50% | ||

| 11:00 | GBP | NIESR GDP Estimate Aug | 0.30% | |||

| 12:30 | USD | CPI M/M Aug | 0.60% | 0.20% | ||

| 12:30 | USD | CPI Y/Y Aug | 3.60% | 3.20% | ||

| 12:30 | USD | CPI Core M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Aug | 4.30% | 4.70% | ||

| 14:30 | USD | Crude Oil Inventories | -2.2M | -6.3M |