Dollar is making a powerful rally today, breaking through near-term resistance levels against all its major counterparts. This surge is anchored by recent economic data, which paints a picture of a US economy that is cooling but not cracking. This robustness stands in stark contrast to the weakening growth conditions seen in other major economies, as evidenced by today’s disappointing services PMI data from China, Eurozone, and UK. Given the relative strength of the US economy, Fed might eventually find itself being the last among major central banks to initiate interest rate cuts. This scenario becomes increasingly likely if the US continues to demonstrate economic resilience while its global peers falter.

The greenback’s strength today is not just noteworthy but dominant. It reached a new year-high against Yen, while Euro and Sterling plummeted to their lowest levels since mid-June. Australian Dollar, often seen as a proxy for China risk, was the hardest hit, dropping to its lowest point since last November. New Zealand Dollar didn’t fare much better, coming in as the day’s second-worst performer. In a curious twist, Canadian Dollar displayed a bit of resiliency, standing as the second strongest for the day. Among European currencies, Sterling appeared to be the better performer, albeit in a losing game.

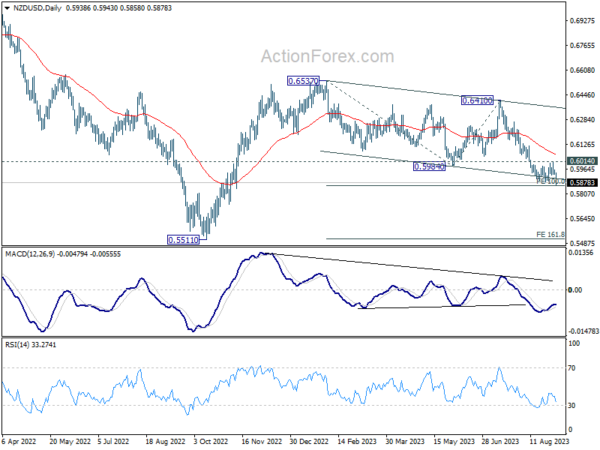

Technically, NZD/USD resumes the fall from 0.6410 today by breaking through 0.5885 support. Immediate attention is now on 100% projection of 0.6537 to 0.5984 from 0.6410 at 0.5857. Decisive break there, together with sustained trading below medium term channel support, could prompt downside acceleration to 161.8% projection at 0.5515, which is close to 0.5511 (2022) low). Even in the event of a strong recovery, the pair’s outlook remains bearish as long as 0.6014 resistance holds.

In Europe, at the time of writing, FTSE is up 0.12%. DAX is down -0.07%. CAC is down -0.08%. Germany 10-yaer yield is up 0.0082 at 2.590. Earlier in Asia, Nikkei rose 0.30%. Hong Kong HSI dropped -2.06%. China Shanghai SSE dropped -0.71%. Singapore Strait Times dropped -0.37%. Japan 10-year JGB yield rose 0.0112 to 0.658.

ECB Lane emphasizes need for timely return to 2% inflation

In an interview with The Currency, ECB Chief Economist Philip Lane offered some guarded optimism about the inflationary environment in Eurozone, despite acknowledging that the current inflation rate is a lofty 5.3%. Lane was keen to highlight a “welcome development” in the latest data, pointing to a slight easing in both goods and services inflation as potentially indicative of changing momentum.

Lane emphasized ECB’s ongoing challenge of steering inflation rate back to its 2% target. “What is a timely manner?” Lane posed, elaborating that the goal is to return to 2% “sufficiently quickly that everyone understands that the current inflation episode is time-limited.”

He underscored the importance of convincing the public that this is a “temporary inflation episode,” and that they should not alter their longer-term behavior in anticipation of persistently high inflation rates. The key objective here is to prevent inflation expectations from becoming unanchored.

ECB consumer survey sees rising 3-yr inflation expectations, more pessimistic growth outlook

ECB has just released its Consumer Expectations Survey for July 2023, offering an inside look into how consumers are viewing the economic outlook.

Most notably, median expectations for inflation over the next year remained static at 3.4%. Even more telling is that forecast for inflation three years out saw a marginal uptick, moving to 2.4% from 2.3% recorded.

On the other hand, mean economic growth expectations for the next 12 months turned a bit more pessimistic, registering at -0.7% as compared to -0.6% in June.

In terms of employment, expectations for unemployment rate a year from now remained stable at 11.0%. Consumers perceive the current unemployment rate to be 10.8%, suggesting an expectation of a broadly stable labor market.

Eurozone PPI down -0.5% mom, -7.6% yoy in Jul

Eurozone PPI fell -0.5% mom -7.6% yoy in July, versus expectation of -0.6% mom, -7.6% yoy. For the month, Industrial producer prices decreased by -1.2% mom for intermediate goods and by -0.9% mom in the energy sector, while prices increased by 0.1% mom for non-durable consumer goods and by 0.2% mom for both capital goods and durable consumer goods. Prices in total industry excluding energy decreased by -0.4% mom.

EU PPI was down -0.6% mom, -6.6% yoy. The largest monthly decreases in industrial producer prices were recorded in Ireland (-8.1%), the Netherlands (-2.6%) and Sweden (-1.8%), while the highest increases were observed in Latvia (+2.2%), Slovakia (+1.7%) and Croatia (+1.3%).

Eurozone PMI services finalized at 47.9, Q3 GDP to contract -0.1%

Eurozone is grappling with weakening economic indicators, as PMI Services for August (final) slipped to a 30-month low of 47.9, down from July’s reading of 50.9. Composite PMI, which combines services and manufacturing data, also sank to a 33-month low of 46.7, down from July’s 48.6.

The fall in PMI scores was particularly evident in Germany (44.6) and France (46.0), which reported 39-month and 33-month lows, respectively. On the other hand, Ireland managed to score a 4-month high of 52.6, showing some resilience amid the general downturn.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, provided a sobering analysis. “The disappointing numbers contributed to a downward revision of our GDP nowcast, which stands now at -0.1% for the third quarter,” he said. According to de la Rubia, the services sector, a stabilizer for Eurozone economy, has turned into a “drag”.

Furthermore, he noted that input price increases have surprisingly accelerated, questioning the outlook for rapidly decreasing inflation. Employers are also becoming cautious about expanding their workforces, hinting that job cuts could be on the horizon.

UK PMI services finalized at 49.5, faltering growth and sticky inflation

UK PMI Services was finalized at 49.5 in August, down from July’s 51.5, and represents the lowest level since January. Furthermore, PMI Composite was finalized at 48.6, down from 50.8 in July, indicating the first contraction since the start of the year.

Tim Moore, Economics Director at S&P Global Market Intelligence, elaborated on the concerning developments. He noted that service sector businesses are “clearly feeling the impact of rising interest rates on client demand”

“Worries about the broader business climate also dampened spending in August,” Moore said, adding that “faltering UK economic growth and sticky inflation” are contributing to more cautious outlook.

A key takeaway from the survey is the pace at which backlogs of work are decreasing—reported as the fastest in over three years. This suggests that businesses are scaling back their operations, perhaps in anticipation of tougher times ahead. The survey also highlighted cooling job market within service sector, as job creation dipped to its lowest point since March.

The report pointed out that competitive pressures may have started to curb inflation within the service economy. The latest round of price hikes was the slowest seen in two years, offering a glimmer of hope that inflation may stabilize or even decline in the near term.

RBA holds rates steady at 4.10%, maintains hawkish bias

RBA held its cash rate target unchanged at 4.10% in a widely expected move, offering additional time to evaluate impact of previous interest rate hikes and evolving economic outlook. Although the central bank maintained hawkish bias, it emphasized that future decisions would be highly data-dependent, particularly scrutinizing global economic trends, household spending, and conditions in labor and inflation.

In its accompanying statement, the RBA noted, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.”

RBA stated that the Australian economy is undergoing a period of “below-trend growth,” a situation expected to persist. Unemployment rate is anticipated to rise gradually to around 4.5% by the end of next year. Recent data suggests that inflation will likely re-enter the 2-3% target range over the forecast horizon.

However, it cautioned that uncertainties abound, including the persistent nature of services price inflation observed overseas, which could manifest similarly in Australia. Other uncertainties revolve around the lag effects of monetary policy, labor market’s response to slower economic growth, and behavior of firms in their pricing and wage-setting decisions.

It also expressed concerns about the household sector. Global uncertainties, particularly those related to the Chinese economy, were noted as an additional risk, given the ongoing stresses in China’s property market.

China’s Caixin PMI services fell to 51.8, waning economic momentum

China Caixin PMI Services for August fell to 51.8, down from 54.1 in July and below market expectations of 53.6. This marks the lowest reading in eight months. According to Caixin, the softer performance was due to a slower increase in business activity and new orders. While employment continued to rise, input cost inflation reached a six-month low.

Composite Output Index, which includes both manufacturing and services sectors, slightly decreased from 51.9 to 51.7. Though it still indicates expansion, the rate of growth was the slowest since January this year. A milder expansion in services sector was partially offset by a modest uptick in factory production.

Wang Zhe, Senior Economist at Caixin Insight Group, attributed the lackluster performance to seasonal fluctuations, extreme weather conditions like high temperatures and flooding, and a complicated global economic environment. These factors are further exacerbated by weak domestic demand.

Wang also warned of the long-term challenges facing the Chinese economy, stating, “Looking ahead, seasonal impacts will gradually subside, but the problems of insufficient domestic demand and weak expectations may form a vicious cycle for a protracted period of time.” He added that given the uncertainty in external demand, downward pressure on the economy may continue to intensify.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0776; (P) 1.0793; (R1) 1.0813; More…

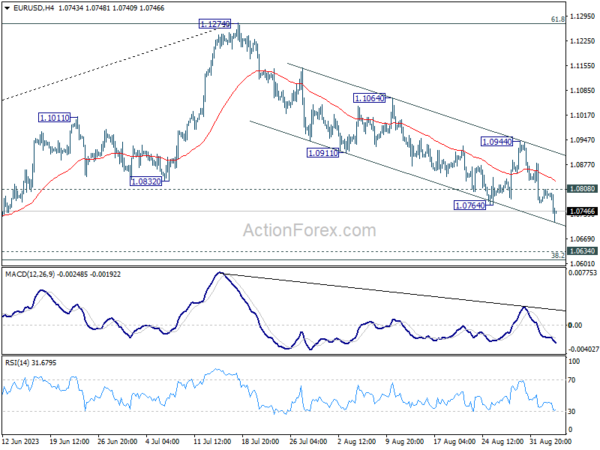

EUR/USD’s break of 1.0764 support confirms resumption of whole decline from 1.1274. Intraday bias is back on the downside for 1.0609/34 cluster support next. On the upside, above 1.0808 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.0944 resistance holds, in case of recovery.

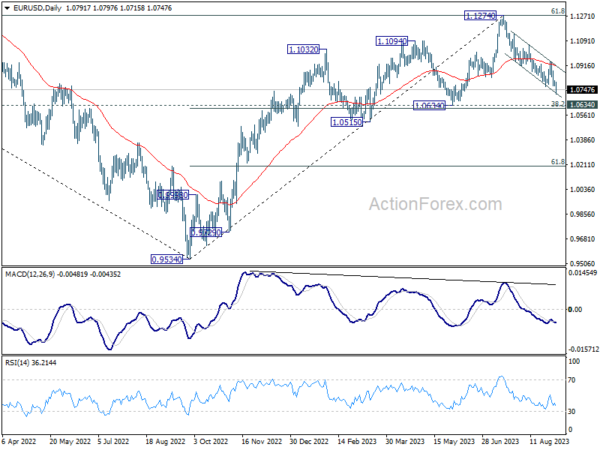

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Deeper decline would be seen to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to bring rebound. Yet, medium term outlook will be neutral for now, as long as 1.1274 resistance holds. However, sustained break of 1.0609/34 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Aug | 4.30% | 2.20% | 1.80% | |

| 01:30 | AUD | Current Account Balance (AUD) Q2 | 7.7B | 8.1B | 12.3B | 12.5B |

| 01:45 | CNY | Caixin Services PMI Aug | 51.8 | 53.6 | 54.1 | |

| 04:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.10% | 4.10% | |

| 07:45 | EUR | Italy Services PMI Aug | 49.8 | 50.2 | 51.5 | |

| 07:50 | EUR | France Services PMI Aug F | 46 | 46.7 | 46.7 | |

| 07:55 | EUR | Germany Services PMI Aug F | 47.3 | 47.3 | 47.3 | |

| 08:00 | EUR | Eurozone Services PMI Aug F | 47.9 | 48.3 | 48.3 | |

| 08:30 | GBP | Services PMI Aug F | 49.5 | 48.7 | 48.7 | |

| 09:00 | EUR | Eurozone PPI M/M Jul | -0.50% | -0.60% | -0.40% | |

| 09:00 | EUR | Eurozone PPI Y/Y Jul | -7.60% | -7.60% | -3.40% | |

| 14:00 | USD | Factory Orders M/M Jul | -2.50% | 2.30% |