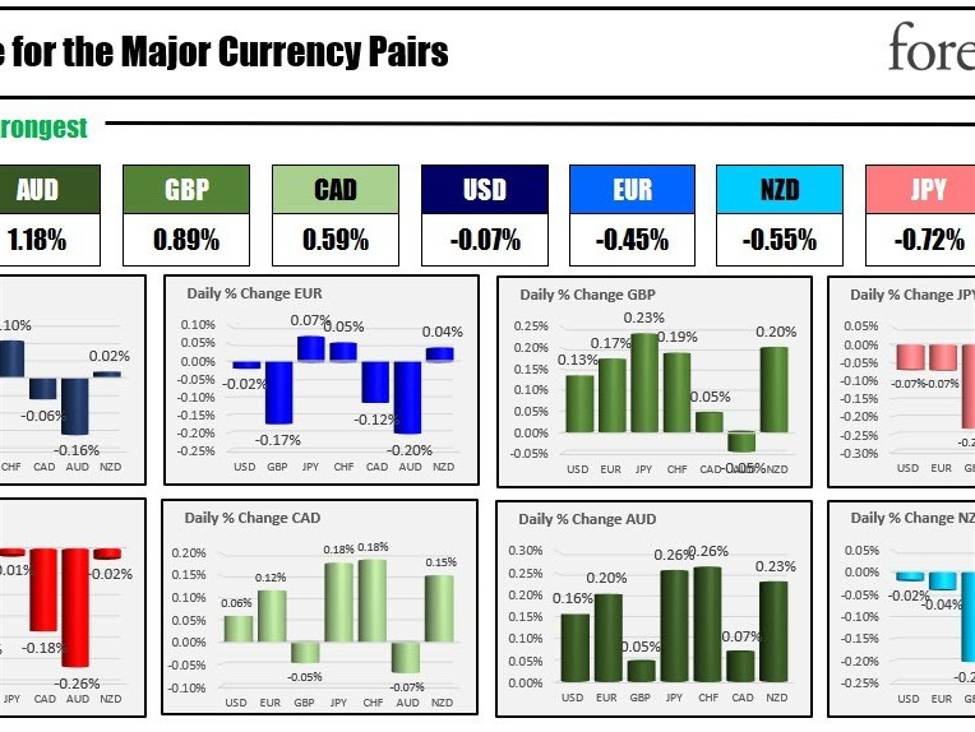

The strongest to the weakest of the major currencies

The AUD is the strongest and the CHF is the weakest as the North American session begins. The US dollar is mixed with modest gains versus the EUR, JPY, CHF and NZD, and modest declines or is the GBP, CAD, and AUD. The biggest mover versus the US dollar is the AUDUSD which has the USD down by -0.16%. That is not a big move at this time of day.

Overall the major currencies are scrunched together as the markets await the Fed Chair Powell at the Jackson Hole Summit at 10:05 AM ET. For those who are wondering the start time in Jackson Hole is 8:05 AM ET. So it is a breakfast speech (wouldn’t you hate missing your alarm if you were an invite to the summit?).

Fed’s Collins and Harker preloaded the Fed chairs speech yesterday. Harker saw the Fed holding steady this year with next year being data-driven. He said that policy was in a restrictive stance now, but would like to see a softening in the labor market, notably in the service sector.

Collins meanwhile said that at this stage it’s appropriate to be patient and she doesn’t think it’s helpful to designate a preset path. She indicated that we may be near a place where we can hold rates for a substantial period of time, but that more Fed rate hikes are possible.

Ahead of the Fed Chairs speech, the University of Michigan final sentiment index for August will be released.

- The preliminary figure came in at 71.2 versus 71.6 last month. The expectations is for it to remain at 71.2.

- One year inflation expectations in the preliminary dipped to 3.3% from 3.4% last month

- The five-year inflation expectations in the preliminary also dipped modestly to 2.9% from 3.0% last month

- Expectations index came in at 67.3 in the preliminary

- Current conditions came in at 77.4

Yesterday the dollars soared in anticipation of the day and a tumbling stock market which gave up early gains, especially in the NASDAQ index after Nvidia’s earnings on Wednesday after the close (NASDAQ index fell -1.87% yesterday, all the NASDAQ closed with a modest gain of 0.10% – it was up over 8% in premarket trading yesterday).

US yield yesterday rose with the shorter end up 7.3 basis points near the 5 PM end of day. The longer and was up less by 2.0 basis points. In train today yields are modestly higher (1 or 2 basis points)

A snapshot of the markets as the NA session gets underway shows:

- Crude oil is trading up $0.96 or 1.21% at $80.02

- Spot gold is trading up $0.59 or 0.03% $1917.51

- Spot silver is trading up $0.08 or 0.34% at $24.19

- Bitcoin is trading at $26,083. At this time yesterday morning the price was trading at $26,455

In the US premarket for US stocks, major indices are trading higher after yesterday’s sharp declines.

- Dow Industrial Average futures are implying a gain of 160 points after yesterday’s -373.56 point decline

- S&P index futures are implying a gain of 9.25 points after a decline of -59.7 points yesterday

- NASDAQ futures are implying a gain of 10 points after tumbling -257.06 points yesterday

In the European equity markets, the major indices are trading higher after falling yesterday

- German DAX, up 0.47%

- France’s CAC, up 0.66%

- UK’s FTSE 100, up 0.50%

- Spain’s Ibex, up 0.67%

- Italy’s FTSE MIB, up 0.93% (delayed)

In the Asian Pacific today, equity markets closed lower

- Japan’s Nikkei 225, -2.05%

- China’s Shanghai Composite, -0.59%

- Hong Kong’s Hang Seng, -1.4%

- Australia’s S&P/ASX 200, -0.93%

In the US debt market, yields are marginally higher

- 2-year yield, 5.036%, +1.8 basis points

- 5-year yield, 4.425% +2.0 basis points

- 10-year yield, 4.241% +0.8 basis points

- 30-year yield, 4.301%, unchanged

In the European debt market, benchmark 10-year yields are trading higher

European 10 year yields