As we are now in the traditional summer quiet period, market activities appear largely subdued, a pattern expected to persist into first half of the week. US Dollar is attempting to gain momentum to revive its recent rally, but it’s still kept way off last week’s peak against other major currencies. Definitive direction for the greenback might only materialize after Thursday’s release of US CPI data, unless a notable surge in risk market volatility precedes this.

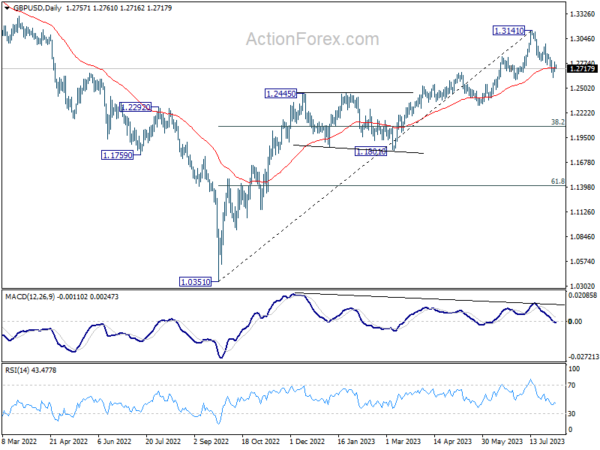

GBP/USD is in the spotlight this week, considering the anticipation surrounding US inflation and UK GDP data releases. From a technical viewpoint, the pair is currently seeking support from the 55 D EMA. A robust rebound from the current level would indicate that the pullback from 1.3141 is merely a correction to the rise from 1.1801.

However, sustained trading period below 55 D EMA could signal that the pair is correcting the overall uptrend from 1.0351, thereby increasing the risk of a sharp fall back into the 1.1801/2445 support zone.

In Asia, Nikkei closed up 0.19%. Hong Kong HSI is down -0.14%. China Shanghai SSE is down -0.84%. Singapore Strait Times is up 0.50%. Japan 10-year JGB yield is down -0.0124 at 0.634.

Fed Bowman: Additional rate hikes likely needed

Fed Governor Michelle Bowman projected the necessity of further rate hikes during a weekend speech, asserting they are likely needed to push inflation back down to the Fed’s 2% target.

Bowman expressed her support for Fed’s rate hike in July and stated, “I also expect that additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2 percent target.”

However, Bowman was careful to emphasize that Fed policy is “not on a preset course”. Further decisions will be based on “incoming data and its implications for the economic outlook,” she stated.

She said, “We should remain willing to raise the federal funds rate at a future meeting if the incoming data indicate that progress on inflation has stalled.”

While recent lower inflation reading was seen as positive, Bowman asserted the necessity of consistent evidence of inflation moving meaningfully toward the 2% goal when contemplating additional rate hikes and the duration of restrictive federal funds rates.

BoJ opinions: Flexible YCC needed while maintaining monetary easing

In the Summary of Opinions at the July 27-28 meeting, BoJ reinforced its commitment to monetary easing but highlighted a pressing need for more “flexibility” in its yield curve control approach policy.

The bank’s primary stance was evident among board members: Achieving a 2% price stability target “has not yet come in sight”, necessitating continued monetary easing and the preservation of the current YCC framework.

“There is still a significantly long way to go before revising the negative interest rate policy, and the framework of yield curve control needs to be maintained,” one member noted.

However, there will be potential market disruptions by strictly capping 10-year JGB yields at 0.5%, another opinion noted.

Also, given the “increasingly significant upside and downside risks” to prices outlook, flexible YCC is needed for allowing market-driven interest rates, ensuring liquidity, and preventing abrupt rate shifts.

The bank also remarked on the current inflation trends, suggesting they primarily stem from import inflation. A rise in earning power, especially for small and medium-sized firms, was emphasized as crucial before instituting broader YCC flexibility.

At the meeting, BoJ permitted a rise in the 10-year yield beyond its usual 0.5% limit, reaching up to 1%.

US inflation data in the spotlight

As we move into a new week, US inflation data emerges as a critical highlight, with implications for Fed’s monetary policy. In a shift of focus, Fed officials are anticipated to pay closer attention to the monthly core CPI gains, besides the headline numbers. This measure, which strips out the volatile components of food and energy, is considered a more pertinent indicator of the underlying inflation trend, offering a clearer view devoid of base effect distortions.

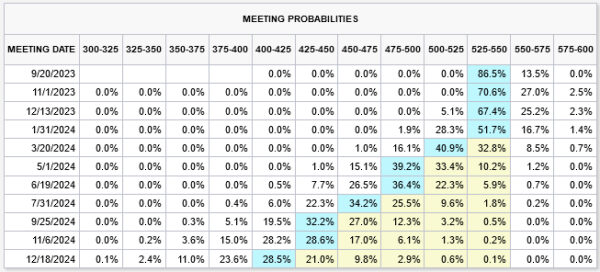

Currently, Fed funds futures are pricing in a less than 30% likelihood of further Fed rate hikes going forward. Market participants will be closely eyeing the forthcoming CPI data, hoping for solid evidence to reinforce these expectations.

However, the week’s economic calendar isn’t just confined to US inflation data. Other significant indicators on the radar will include UK’s GDP figures and Eurozone’s Sentix investor confidence index.

Down Under, Australian consumer sentiment and business confidence figures are due for release. Meanwhile, New Zealand’s inflation expectations will be another focal point. Lastly, investors will be keeping an eye on China’s CPI and PPI data too.

Here are some highlights for the week:

- Monday: BoJ Summary of Opinions, Japan leading indicators; Swiss unemployment rate, foreign currency reserves; Germany industrial production; Eurozone Sentix investor confidence.

- Tuesday: Japan average cash earnings, household spending, current account; Australia Westpac consumer sentiment, NAB business confidence; China trade balance; Germany CPI final; France trade balance; Canada trade balance; US trade balance.

- Wednesday: China CPI, PPI; New Zealand inflation expectations; Canada building permits.

- Thursday: Japan PPI; ECB monthly bulletin; US CPI, jobless claims;.

- Friday: New Zealand BusinessNZ manufacturing index; UK GDP, production, trade balance; US PPI, U of Michigan consumer sentiment.

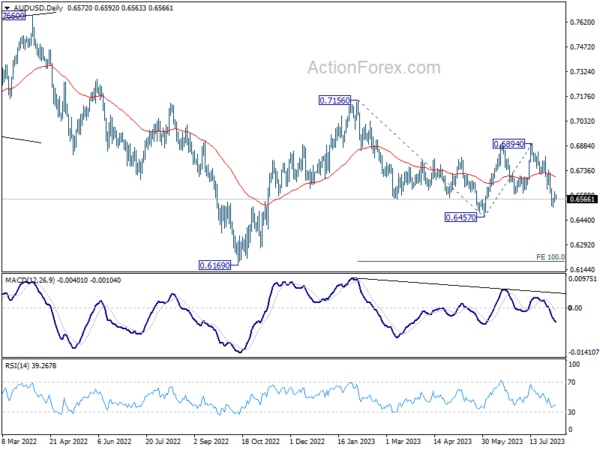

AUD/USD Daily Report

Daily Pivots: (S1) 0.6536; (P) 0.6573; (R1) 0.6605; More…

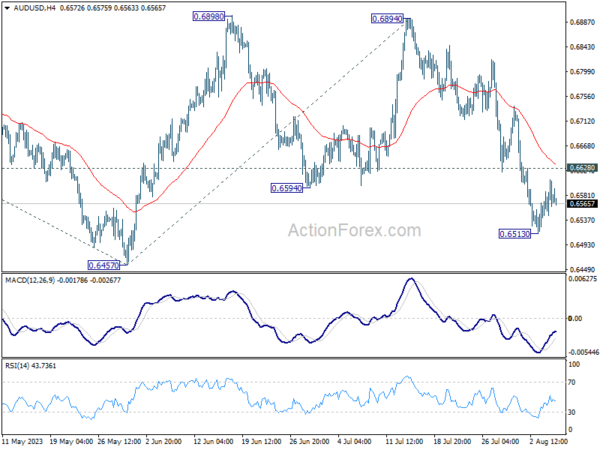

Intraday bias in AUD/USD remains neutral for consolidation above 0.6513. Current development argues that larger fall from 0.7156 is still in progress. Below 0.6513 will bring retest of 0.6457 support first. Firm break there will confirm this case and target 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195. Nevertheless, on the upside, above 0.6628 minor resistance will mix up the outlook and turn bias back to the upside for stronger rebound.

In the bigger picture, outlook is mixed for now as AUD/USD failed to sustain above both 55 D EMA (now at 0.6696) and 55 W EMA (now at 0.6769). On the upside, break of 0.6894 resistance will solidify the case that down trend from 0.8006 (2021 high) has already completed, and target 0.7156 resistance for confirmation. However, break of 0.6457 will likely resume the down trend through 0.6169 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 05:00 | JPY | Leading Economic Index Jun P | 108.9 | 108.9 | 109.2 | |

| 06:00 | EUR | Germany Industrial Production M/M Jun | -1.50% | -0.40% | -0.20% | -0.10% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jul | 725B | |||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Aug | -25 | -22.5 |