The global financial markets found themselves in a flurry of volatility in the past week, underpinned by policy decision of three major central banks in North American, Europe, and Asia. Yen and Nikkei had the wildest roller-coaster ride in reaction to BoJ’s tweak to their Yield Curve Control. In the end, Yen crosses are maintaining their bullish trends, together with Nikkei.

Meanwhile, the western hemisphere saw a divergence in currency trends following expected monetary policy decisions from Fed and ECB. That resulted in extended rally in Dollar index which is now pressing a key resistance level, with future trends hinging on market reactions at this juncture.

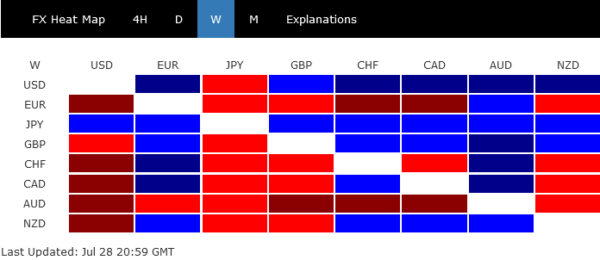

Overall, while Yen was the best performer of the week, it’s near outlook looks shaky. Dollar followed as the second best, and then Sterling. Australian Dollar was the worst performer, followed by Euro, and then Swiss Franc. Canadian and new Zealand Dollar ended mixed.

BoJ’s surprised YCC tweak prompted volatility, but no change in trends

Japanese Yen experienced one of its most volatile periods over the last two days of the week. Initial anticipation of a modification in BoJ yield curve control catalyzed a sharp upmove in Yen, a trend that persisted post BoJ’s announcement. Yet, the gains were entirely wiped out by the week’s end, despite Yen ending higher against all other major rivals.

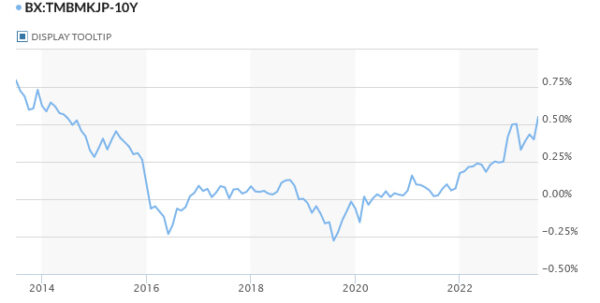

BoJ’s latest monetary policy announcement was a mixed bag. While short-term interest rate remained at -0.1%, and 10-year JGB yield around 0%, the central bank has revised its purchase rate for 10-year JGB to 1.0%, up from 0.5%. The decision is viewed as a signal to allow 10-year JGB to rise within a 0.5%-1.0% range. Only that, as BoJ Governor Kazuo Ueda asserted, “We will not tolerate an increase in the 10-year bond yield above 1% and will step in if it does.” The 10-year JGB yield closed at a nine-year high of 0.55%.

On the equities side, Nikkei, which initially plummeted following BoJ’s perceived steps towards exiting its ultra-loose monetary policy, managed to recoup most of its losses by the week’s close. Japanese investors seem unperturbed by this slight policy shift, even with the banking and insurance index gaining 4.6% on Friday, supported by the expectation that a steeper yield curve could boost lending profits.

From a technical perspective, Nikkei is seen as extending a near term consolidation pattern from 33772.89 for now. Another dip cannot be ruled out, but 38.2% retracement of 25661.89 to 33772.89 at 30674.48 should offer support to bring rebound.

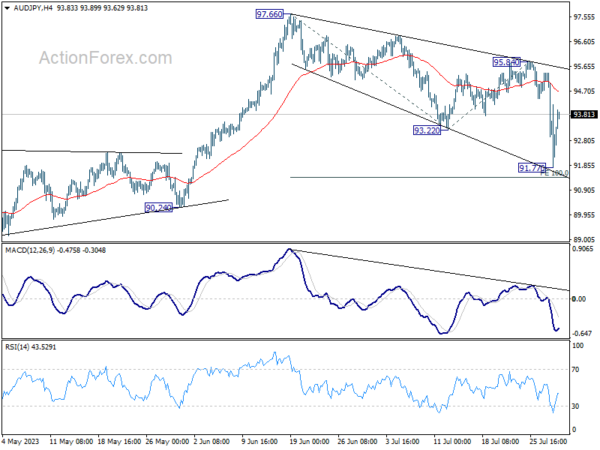

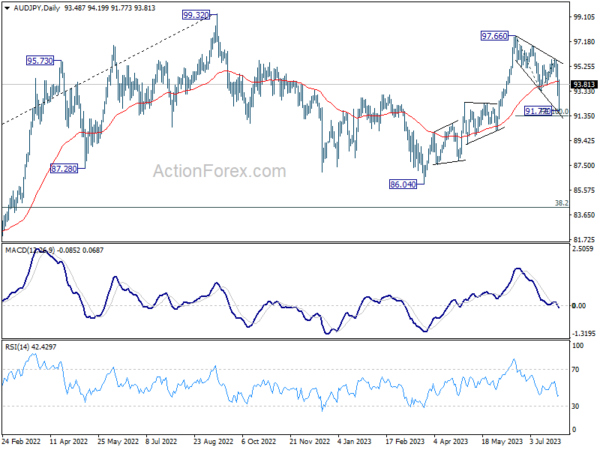

For example, AUD/JPY was the top mover last week, closed down -1.72%. But it was clearly way off weekly low at 91.77. Fall from 97.66 could have completed as a three-wave corrective move, inside 90.24/92.42 support zone (wave four of the five-wave sequence from 86.04 to 97.66). And it just missed 100% projection of 97.66 to 93.22 from 95.84 at 91.40. If this interpretation is correct, rise from 86.04 would be ready to resume through 97.66 any time.

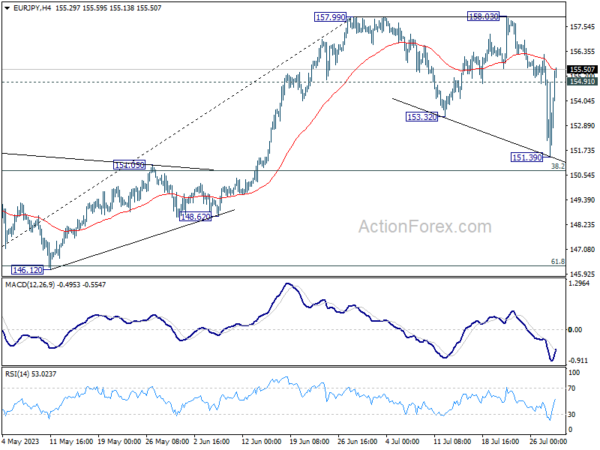

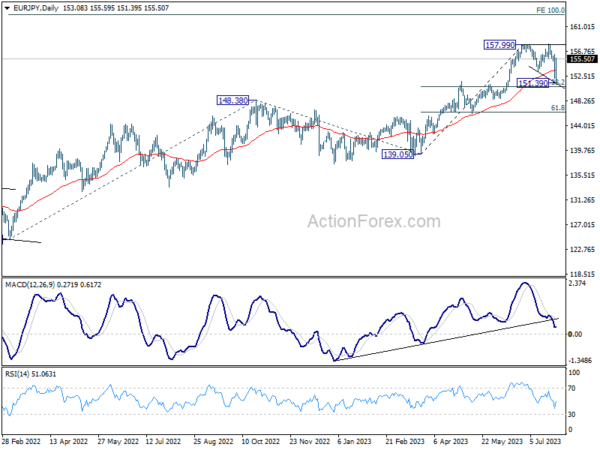

EUR/JPY also rebounded strongly after diving to as low as 151.39. One of the views is that price action from 157.99 are a three-wave corrective pattern, that might have completed with three waves down to 151.39. 38.2% retracement of 139.05 to 157.99 at 150.77 was well defended, and rise from 139.05 could be ready to resume through 157.99 any time too.

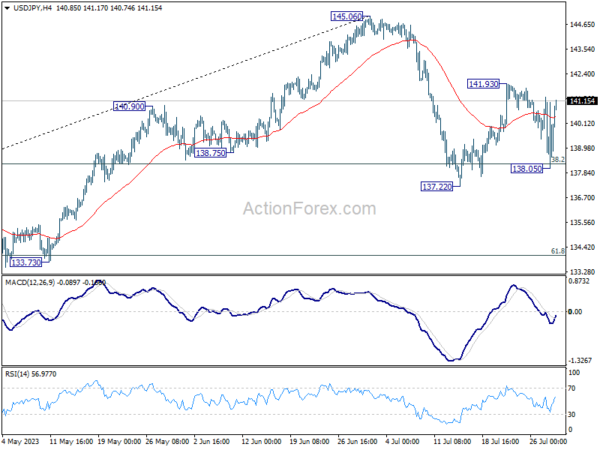

USD/JPY also managed to defend 137.22 support well and rebounded strongly after dipping to 138.05. There is no confirmation that the rally from 127.20 has completed. Indeed, break of 141.93 will resume the rebound from 137.22 to retest 145.06 high, and retain near term bullishness for resuming the rise from 127.20 at a later stage.

Dollar index pressing key resistance after Fed and ECB

After the highly anticipated Fed and ECB rate decision, Dollar and Euro experienced contrasting fortunes. The difference in market responses triggered an extended recovery in Dollar Index, which is now pressing a critical resistance level. Reactions from there would decide whether Dollar would need to head lower before forming a medium term bottom.

Fed’s rate decision was largely as expected. Rate hike of 25bps was delivered, with the accompanying statement almost a carbon copy as June’s. Chair Jerome Powell’s left the door open for another rate hike in September, without giving any indication of preference. Dollar initially weakened after the event, but rebounded with help from stronger than expected Q2 GDP data. Yet it failed to extend gains towards the end of the week.

Meanwhile, ECB’s announcement was largely the same as Fed’s, with 25bps hike delivered, without any concrete guidance for next meeting in September. But markets have taken the decision as a dovish one after President Christine Lagarde highlighted that every change in the statement was deliberate. In particular, ECB’s new wording implies that future decisions will ensure key interest rates are “set” at, rather than “brought to” sufficiently restrictive levels, possibly opening the case for a pause at the next meeting, depending on incoming data.

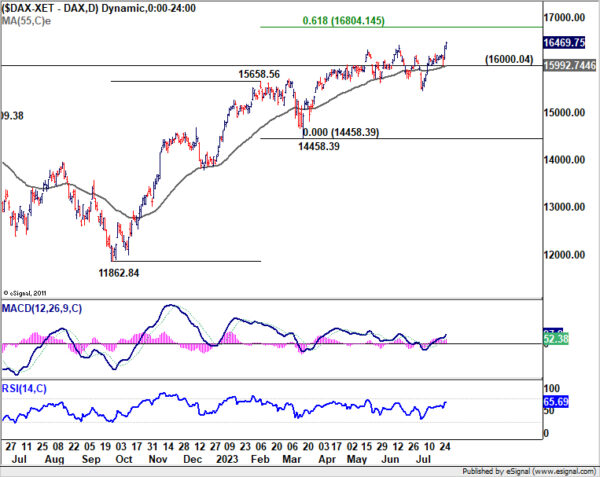

An important development to note is that German DAX surged sharply since Thursday to close at new record high. Recent economic data from Germany and Eurozone were really encouraging, except that inflation is on track going down. And just as Lagarde described, the economic outlook for Eurozone has “deteriorated” in the near term. DAX’s bullish run is clearly mainly in response to the “relatively dovish” ECB event. Technically speaking, near term outlook in DAX will stay bullish as long as 16000.04 support holds. Next target is 61.8% projection of 11862.84 to 15658.56 from 14458.39 at 16804.14.

Dollar ended as the second strongest currency, while Euro was the second from bottom. The development was reflected in the extended recovery in Dollar index. DXY is now pressing an important resistance level at 101.92, which is also close to 55 E MA (now at 102.08). Rejection by this resistance zone will likely push DXY through 99.57 to resume the decline from 114.77. In this case, DXY might only be able to bottom after a test on key support zone around 98.

However, considering bullish convergence condition in D MACD, sustained break of the mentioned resistance zone around 102 will argue that a medium term bottom was already formed. Rise from 99.57 could then be at least a correction to whole fall from 114.77. Stronger rally would be seen to 104.69 resistance and possibly above.

The above mentioned 98 support zone represents 61.8% retracement of 89.20 (2021 low) to 114.77 at 98.96, 55 M EMA at 98.09, and 38.2% retracement of 70.69 to 114.77 at 97.93.

Development in US benchmark 10-year yield would be a factor that’s supporting the greenback, or at least, limiting it’s downside in case of another selloff. It seems that TNX is not giving up on 4% handle after drawing notable support from rising 55 D EMA (now at 3.781). Another attempt would likely be seen in the near term to retest 4.091 structural resistance. Decisive break there should confirm completion of the corrective pattern from 4.333 at 3.253. Retest of 4.333 should be seen next with prospect of up trend resumption. This will remain the favored case as long as 55 D EMA holds.

EUR/USD Weekly Outlook

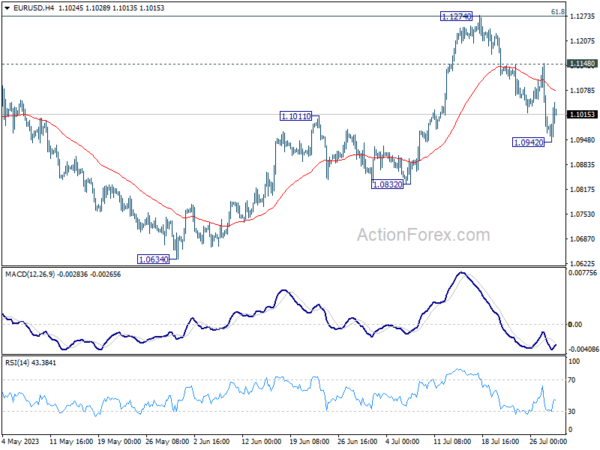

EUR/USD’s fall from 1.1274 short term top extended last week and hit as low as 1.0942. Further fall is expected this week as long as 1.1148 resistance holds. Below 1.0942 will target 1.0832 support next. Nevertheless, break of 1.1148 will argue that the decline has completed and bring retest of 1.1274 high.

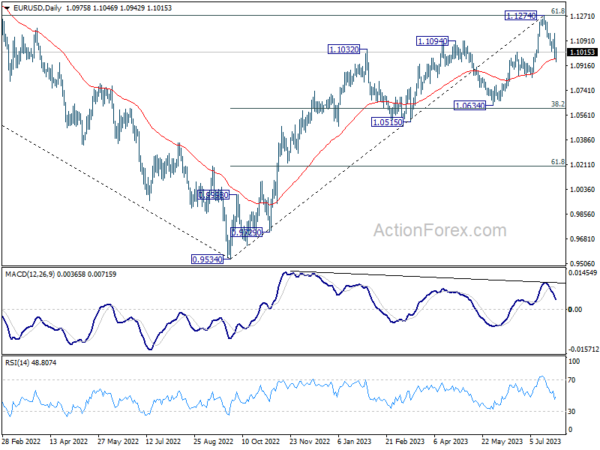

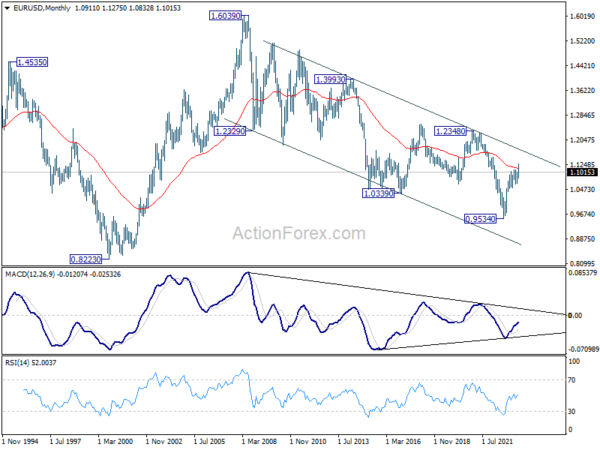

In the bigger picture, a medium term top could be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.0963) will bring deeper correction to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation.

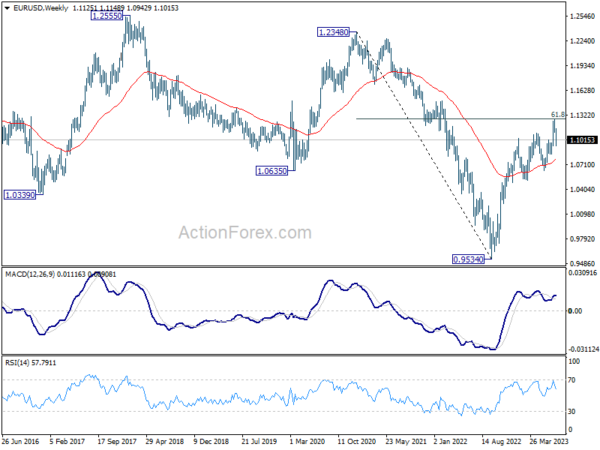

In the long term picture, focus stays on 55 M EMA (now at 1.1141). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading