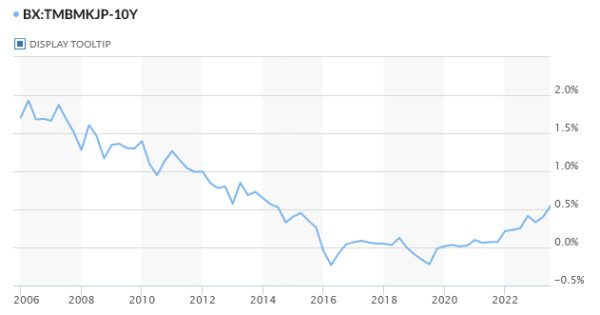

Yen was already rallying ahead of BoJ policy decision, and managed to maintain most of its advances, despite some post-announcement jitters. Initial reactions saw some gains pared back as the policy appeared largely unchanged on the surface. However, some key alterations, including the central bank’s decision to buy 10-year JGB yields at 1% in fixed-rate operations, up from previous rate of 0.5%, caught investors’ attention. Additionally, BoJ’s pledge to conduct yield curve control with “greater flexibility” and to “nimbly respond” to both upside and downside risks was noted. Collectively, these moves signal a shift towards an exit from BoJ’s long-standing ultra-loose monetary policy.

Following Yen, Dollar holds the position of the week’s second strongest currency so far, as it seeks to build on the rally prompted by yesterday’s better than expected GDP data. Market participants will now be looking towards today’s PCE inflation data for cues on Dollar’s next move. Meanwhile, Canadian Dollar is the third strongest for the week, awaiting Canadian GDP data. In stark contrast, Euro is the worst performer, still reeling from the sell-off after yesterday’s ECB announcement. Australian Dollar trails as the next weakest, followed by British Pound.

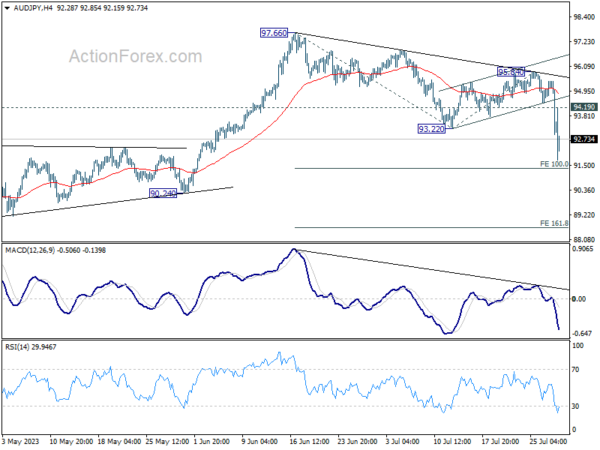

Technically, as a follow up on AUD/JPY, it’s now the second top mover for the week so far. The strong break of 93.22 support formed resumed of the fall from 97.66. Further decline is now expected as long as 94.19 minor resistance holds. Next target is 100% projection of 97.66 to 93.22 from 95.84 at 91.40. Some support could be seen there to bring recovery. But decisive break of 91.40 will pave they way to 161.8% projection at 88.65 rather quickly.

In Asia, at the time of writing, Nikkei is down -1.46%. Hong Kong HSI is up 1.08%. China Shanghai SSE is up 1.66%. Singapore Strait Times is up 0.93%. Japan 10-year JGB yield is up 0.104 at 0.545, hitting the highest level since 2014. Overnight, DOW dropped -0.67%. S&P 500 dropped -0.64%. NASDAQ dropped -0.55%. 10-year yield rose 0.161 to 4.012, back above 4% level.

BoJ keeps policy unchanged, one member wants YCC tweak

BoJ keeps monetary policy unchanged today, despite some speculation of at least a minor tweak to the yield curve control. Short term policy rate is held at -0.10% and 10-year JGB yield target is kept at around 0%, by unanimous vote.

The band for 10-year JGB yield fluctuation is also kept at plus and minus 0.50% from the target level, by 8-1 majority vote. Nakamura Toyoaki dissented with preference for allowing greater flexibility in conducting YCC.

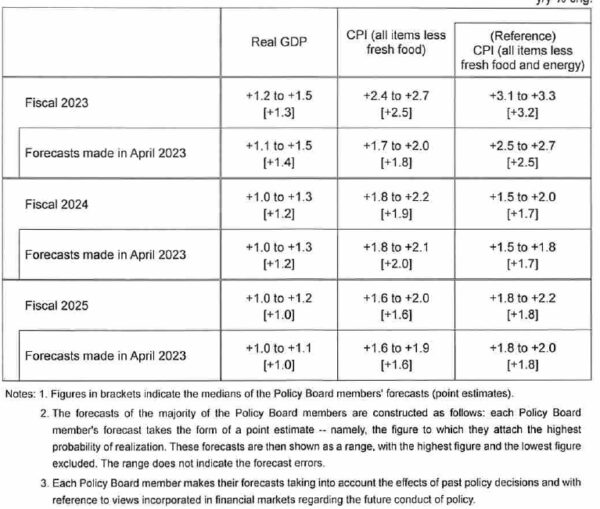

In the new economic forecasts, BoJ upgraded CPI core and CPI core-core forecasts for fiscal 2023, but other projections are kept largely unchanged.

- Real GDP growth at 1.3% in fiscal 2023, downgraded from 1.4% as made in April.

- Real GDP growth at 1.2% in fiscal 2024, unchanged.

- Real GDP growth at 1.0% in fiscal 2025, unchanged.

- CPI core at 2.5% in fiscal 2023, upgraded from 1.8%.

- CPI core at 1.9% in fiscal 2024, downgraded from 2.0%.

- CPI core at 1.6% in fiscal 2025, unchanged.

- CPI core-core at 3.2% in fiscal 2023, upgrade from 2.5%.

- CPI core-core at 1.7% in fiscal 2024, unchanged.

- CPI core-core at 1.8% in fiscal 2025, unchanged.

Australia retail sales down -0.8% mom in Jun, cost-of-living pressures weigh

Australia retail sales turnover fell -0.8% mom in June, much worse than expectation of 0% mom. Sales turnover rose 2.3% yoy compared with June 2022.

Ben Dorber, ABS head of retail statistics, said: “Retail turnover fell sharply in June due to weaker than usual spending on end of financial year sales. This comes as cost-of-living pressures continued to weigh on consumer spending.

“There was extra discounting and promotional activity in May, leading up to mid-year sales events. This delivered a boost in turnover for retailers, but that proved to be temporary as consumers pulled back on spending in June.”

Looking ahead

Swiss KOF economic barometer, Eurozone economic sentiment, and Germany CPI flash will be released in European session. Later in the day, Canada GDP and US PCE inflation will be the main focuses. US will also release employment cost index and Chicago PMI.

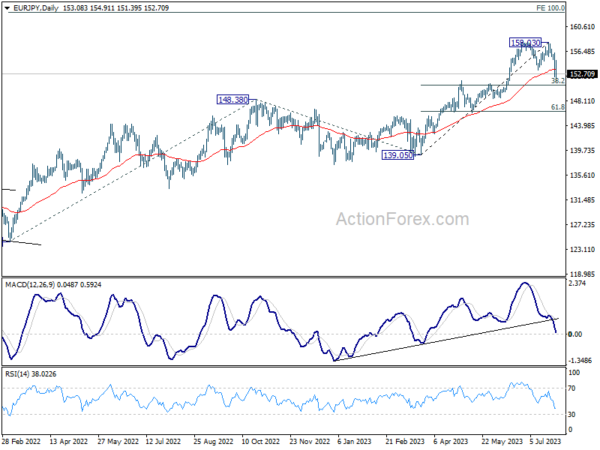

EUR/JPY Daily Outlook

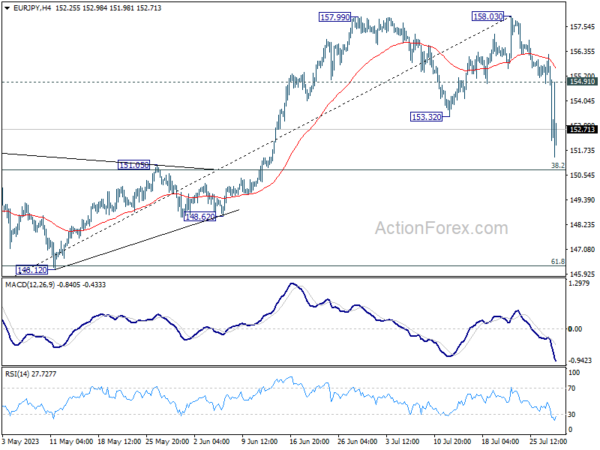

Daily Pivots: (S1) 151.45; (P) 153.84; (R1) 155.50; More….

EUR/JPY’s decline accelerates to as low as 151.39 so far and intraday bias stays on the downside. The break of 153.32 could have completed a double top pattern (157.99, 158.03). Deeper fall is now expected as long as 154.91 minor resistance holds. Next target is 38.2% retracement of 139.05 to 157.99 at 150.77. Sustained break there will target 61.8% retracement at 146.30. On the upside, above 154.91 will turn intraday bias neutral first.

In the bigger picture, as long as 151.60 resistance turned support holds, rise from 114.42 (2020 low) is in progress. On resumption, next target is 100% projection of 124.37 to 148.38 from 138.81 at 162.82. Nevertheless, sustained break of 151.60 will argue that larger correction is already underway. Deeper decline would be seen to 55 W EMA (now at 145.19).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jul | 3.20% | 2.80% | 3.10% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jul | 3.00% | 2.90% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Jul | 4.00% | 3.80% | ||

| 01:30 | AUD | Retail Sales M/M Jun | -0.80% | 0.00% | 0.70% | 0.80% |

| 01:30 | AUD | PPI Q/Q Q1 | 0.50% | 0.90% | 1.00% | |

| 01:30 | AUD | PPI Y/Y Q1 | 3.90% | 3.90% | 5.20% | |

| 03:28 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | CHF | KOF Economic Barometer Jul | 90 | 90.8 | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jul | 95 | 95.3 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -7.5 | -7.2 | ||

| 09:00 | EUR | Eurozone Services Sentiment Jul | 5.3 | 5.7 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Jul F | -15.1 | -15.1 | ||

| 12:00 | EUR | Germany CPI M/M Jul P | 0.30% | 0.30% | ||

| 12:00 | EUR | Germany CPI Y/Y Jul P | 6.20% | 6.40% | ||

| 12:30 | CAD | GDP M/M May | 0.30% | 0.00% | ||

| 12:30 | USD | Personal Income M/M Jun | 0.50% | 0.40% | ||

| 12:30 | USD | Personal Spending M/M Jun | 0.40% | 0.10% | ||

| 12:30 | USD | PCE Price Index M/M Jun | 0.10% | |||

| 12:30 | USD | PCE Price Index Y/Y Jun | 3.80% | |||

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.20% | 0.30% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 4.20% | 4.60% | ||

| 12:30 | USD | Employment Cost Index Q1 | 1.10% | 1.20% | ||

| 13:45 | USD | Chicago PMI Jul | 41.5 | |||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul F | 72.6 | 72.6 |