- GBP/JPY sells-off on BoJ sentiment ahead of Friday’s meeting.

- GBP/JPY drops into a potentially strong area of support in the 177.70/90s as per the hourly structure.

- Bears also eye the Point of Control near 177.00 and then a swing support area at 176.50.

GBP/JPY collapses on a strong hint from Nikkei news that the BoJ will discuss dropping the 0.5% cap in 10Y JGB yields in Friday’s meeting. The article has shaken up the sentiment surrounding the Bank of Japan whereby it was otherwise recently telegraphed by the BOJ Governor Ueda that there was “still some distance to sustainably achieve 2% inflation target” and that unless their assumptions on need to sustainably achieve 2% target changes the BoJ’s “narrative on monetary policy won’t change.”

However, that narrative has flipped in New York trade on Thursday and USD/JPY fell from 141.10 to a low of 139.09 when the Nikkei reported ” the Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree, Nikkei has learned, in what would be a shift toward a more flexible policy approach.” Consequently, GBP/JPY has been dragged deeper below trendline resistance as follows:

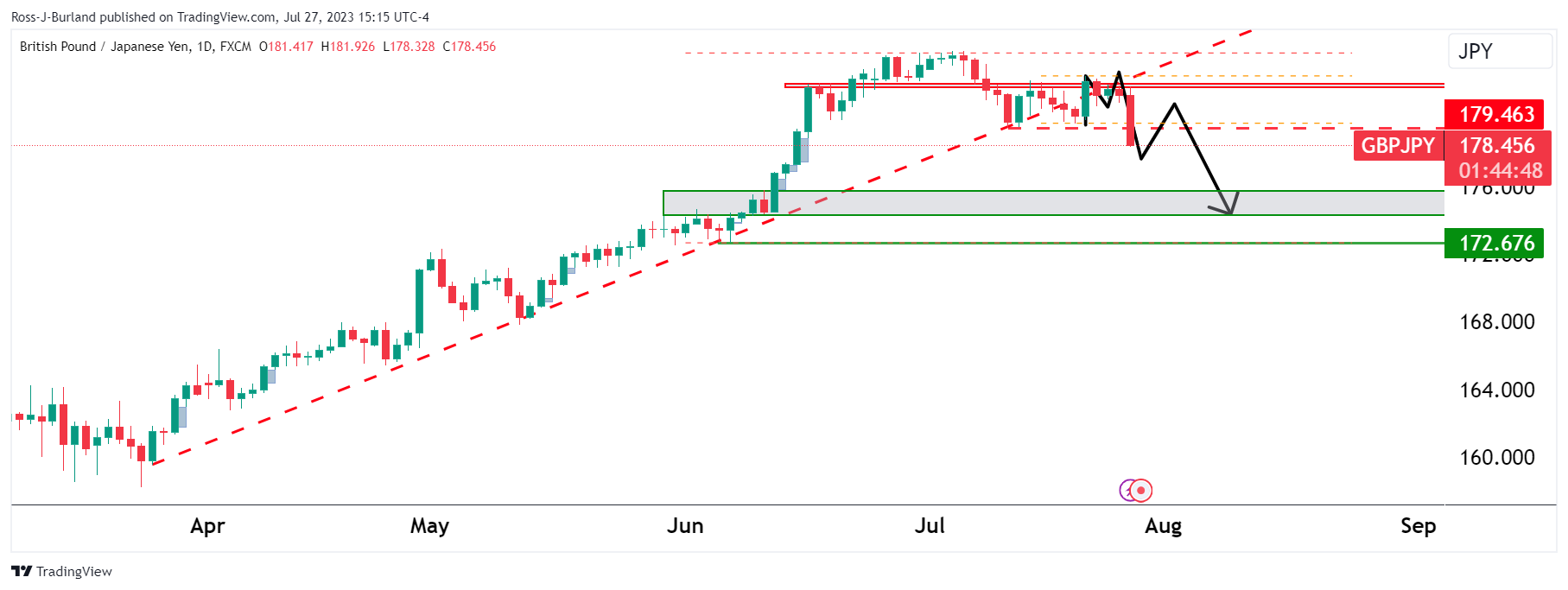

GBP/JPY technical analysis

As can be seen, the price is falling but is leaving an M-pattern on the daily chart. A correction is inevitable but we just don’t know when this horse will settle down.

GBP/JPY H1 chart

We can see a potentially strong area of support in the 177.70/90s as per the hourly structure back in the prior bullish cycle where volumes are starting to deplete. Below there, we have the Point of Control near 177.00 and then a swing support area at 176.50.