Australian Dollar advances broadly today, buoyed by optimism surrounding news of stimulus from the Chinese government. This positive outlook has also lifted sentiment for Chinese Yuan and Copper. New Zealand Dollar has similarly benefited from this favorable sentiment, which is providing support to Sterling as well. Meanwhile, Dollar is slightly softening, alongside Yen and Swiss Franc.

Having stabilized from yesterday’s sell-off following the PMI results, Euro now anticipates guidance from Germany’s Ifo Business Climate Index. However, it’s highly probable that traders will refrain from placing significant bets until FOMC and ECB rate decisions on Wednesday and Thursday respectively.

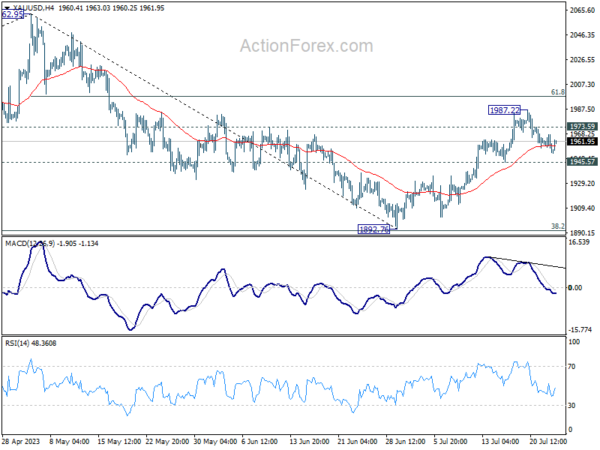

Technically, it could be about time for Gold to finish the pull back from 1987.22. Break of 1973.59 minor resistance will indicate that rebound from 1892.76 is ready to resume through 1987.22 to take on 2000 psychological level. If realized, that might come with renewed selloff in Dollar. On the other hand, break of 1945.57 support could prompt deeper selloff back to 1892.76 low, and that would be accompanied by extended rebound in the greenback.

In Asia, Nikkei closed down -0.15%. Hong Kong HSI is up 3.74%. China Shanghai SSE is up 2.01%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is up 0.0136 at 0.465. Overnight, DOW rose 0.52%. S&P 500 rose 0.40%. NASDAQ rose 0.19%. 10-year yield rose 0.020 to 3.857.

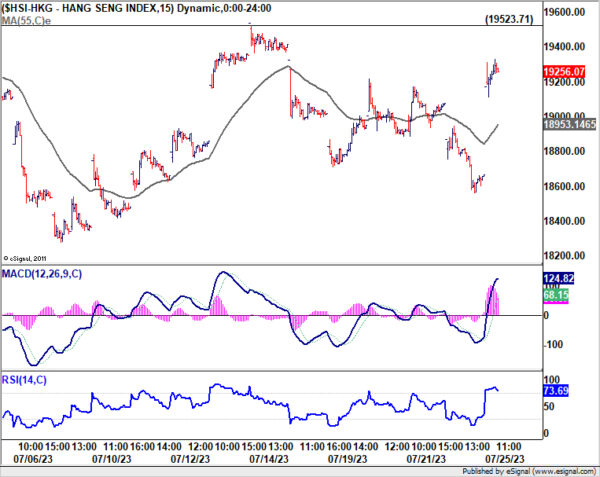

HSI and Yuan surge as China pledges policy adjustments

Hong Kong stocks are having a strong rebound today, concurrently with a surge in Chinese Yuan. These dynamic shifts come in the wake of a promise from China’s Politburo to “adjust and optimize policies in a timely manner” for its troubled property sector. The top decision-making body has also underscored its commitment to promoting stable employment as a strategic objective. Other pledges include efforts to stimulate consumer spending and manage debt risks, and an intention to implement “counter-cyclical” policy.

HSI opened with a substantial gap up and, at the time of writing, is trading over 3% higher. However, from a technical standpoint, HSI will need to convincingly overcome resistance level at 19523.71 and 55 D EMA to neutralize near-term bearish ness. Failing to do so, the decline from 22700.85 – whether it’s seen as a corrective move or part of a larger downtrend – is still expected to extend beyond 18044.85 low.

Meanwhile, USD/CNH is diving notably too. Market rumors suggest that major state-owned banks have been observed selling US Dollars to buy Yuan in both onshore and offshore spot markets to bolster Yuan exchange rate. On the whole, USD/CNH is seen as extending the corrective pattern from 7.2853 only. In case of deeper fall, strong support could emerge at around 38.2% retracement of 6.810 to 7.2853 at 7.1037 to bring rebound.

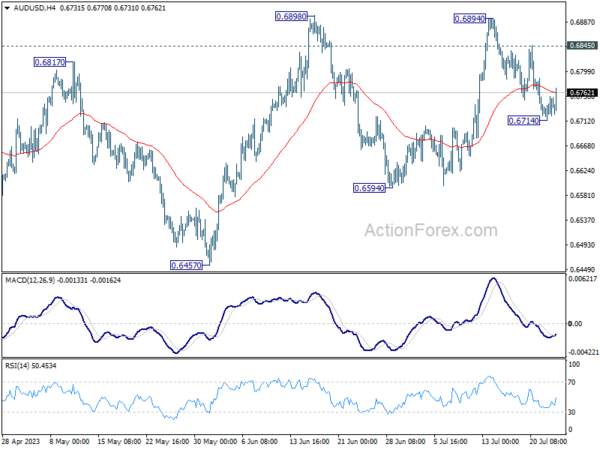

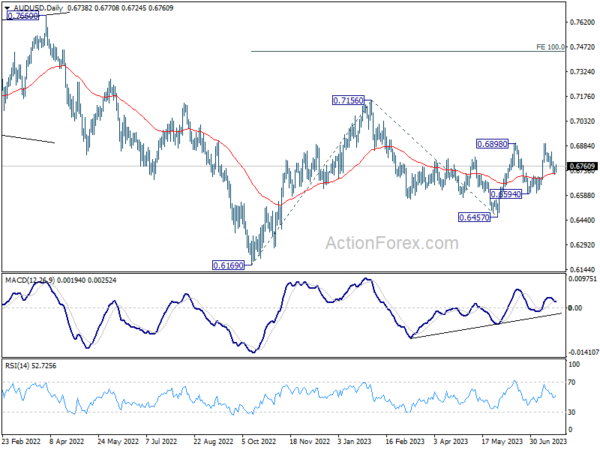

Copper and Aussie rally on China’s stimulus optimism

Copper rises notably today, on optimism of fiscal stimulus in China, or at least some policy adjustment. Australian Dollar is also taken higher too, even though it lags in momentum. The moves come with strong rally in Hong Kong stocks and Chinese Yuan in the background.

As for Copper, immediate focus in now on 3.8787 resistance. Firm break there will confirm that fall from 3.9420 has completed. That would also indicate the completion of the three-wave corrective pattern from 3.9501 at 3.7725. Further rise should then be seen to retest 3.9501 first. Firm break there will resume whole rise from 3.5387 to 61.8% projection of 5.5387 to 3.9501 from 3.7725 at 4.0267 next.

As for AUD/USD, a temporary low was formed at 0.6714 with current recovery. If the rally in Copper continues to gather strength, it could aid AUD/USD in pushing through 0.6845 resistance, or even surpassing 0.6898 to resume the entire rebound from 0.6457.

Looking ahead

Germany Ifo business climate is the main focus in European session. US consumer confidence will be the highlight in US session while house price index will also be released.

EUR/AUD Daily Outlook

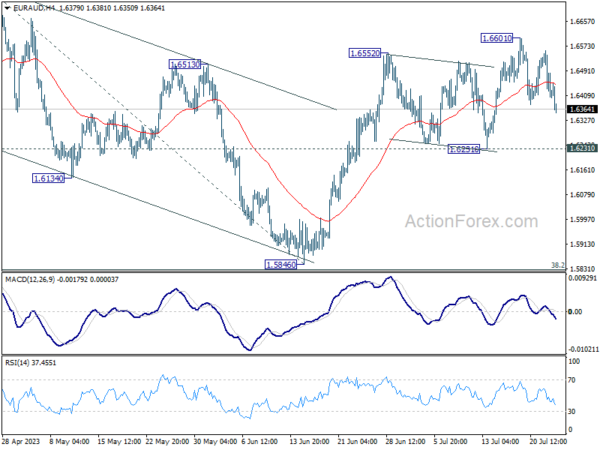

Daily Pivots: (S1) 1.6359; (P) 1.6460; (R1) 1.6516; More…

EUR/AUD’s pull back from 1.6601 extends lower today but stays well above 1.6231 support. Intraday bias remains neutral first and outlook stays cautiously bullish. On the upside, break of 1.6601 will resume the rebound from 1.5846 and target 1.6785 high next. However, firm break of 1.6231 will bring deeper fall to extend the corrective pattern from 1.6785.

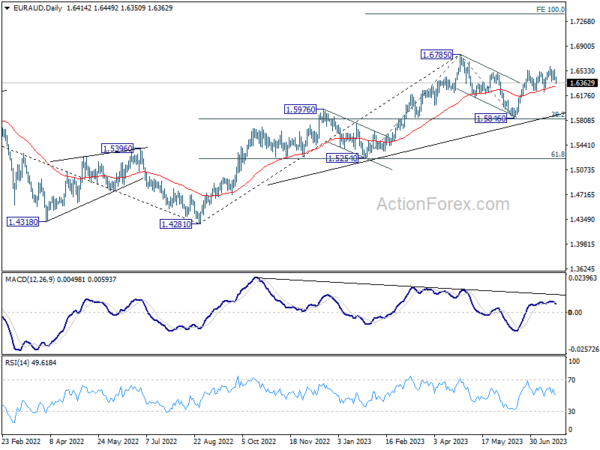

In the bigger picture, with 38.2% retracement of 1.4281 to 1.6785 at 1.5828 intact, rally from 1.4281 is still in progress. Firm break of 1.6785 will confirm rise resumption. Next target is 100% projection of 1.5254 to 1.6785 from 1.5846 at 1.7377. On the other hand, rejection by 1.6785 will extend the corrective pattern with another fall leg. But outlook will stay bullish as long as 1.5828 holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Jul | 88 | 88.5 | ||

| 08:00 | EUR | Germany IFO Current Assessment Jul | 93 | 93.7 | ||

| 08:00 | EUR | Germany IFO Expectations Jul | 83 | 83.6 | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y May | -1.40% | -1.70% | ||

| 13:00 | USD | Housing Price Index M/M May | 0.60% | 0.70% | ||

| 14:00 | USD | Consumer Confidence Jul | 112.1 | 109.7 | ||

| 14:00 | USD | Richmond Fed Manufacturing Index Jul | -10 | -7 |