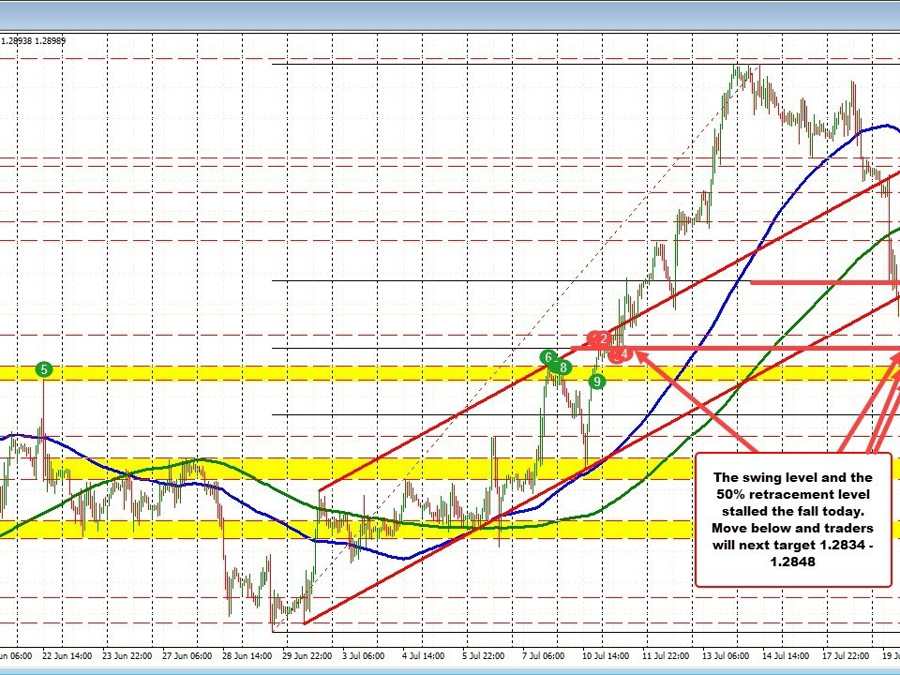

In an early video on the GBPUSD , I spoke to the pair’s next target coming at the key 50% midpoint. More specifically, I wrote:

“On the downside, the next key target comes against the 50% midpoint at 1.28658 (see chart below). The level also corresponds with a modest swing area going back to July 10 and July 11.”

That level was indeed reached and true to the technicals, the buyers leaned. The price of the GBPUSD moved higher.

What now?

The price earlier today moved below the 38.2% retracement at 1.29309 and the old lower channel trend line. That line held resistance today and will be a target near 1.2921 ahead of the 38.2%.

If the sellers today are to keep firm control, staying below those levels is the best-case scenario. Move above, and we could see more upside probing on the selling disappointment below those technical breaks.

PS. The buyers at the 50% would also be more comfortable.

You can watch the earlier video HERE.

GBPUSD tests the 50% and bounces