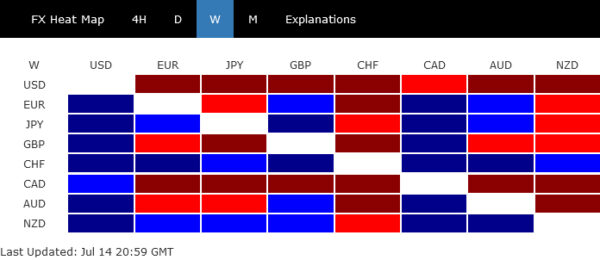

Following the release of data indicating a steeper than anticipated slowdown in inflation, Dollar saw a marked decline last week, securing its position as the week’s most significant loser in the currency markets. Concurrently, surge in stocks and tumble in benchmark treasury yields accompanied Dollar’s descent.

At this juncture, it remains too premature to determine whether Fed will conclude its tightening cycle following this month’s anticipated rate hike, or if another increase will be on the horizon within the year. Regardless of the outcome, it is expected that Dollar will continue to face pressure in the short term while investors wait for clarity on inflation and rate outlooks.

Elsewhere in the currency markets, Canadian Dollar trailed behind the US counterpart as the second-worst performer for the week. This dip is attributed to speculation that the last week’s rate hike might mark the end of BoC’s current tightening cycle.

Swiss Franc emerged as the champion of the week, outpacing Yen, which has been consolidating its recent gains. The vigorous rally of Franc in European crosses exerted downward pressure on both Euro and Sterling.

Meanwhile, New Zealand Dollar put on an impressive performance, securing its place as the second strongest currency for the week. Australian Dollar, on the other hand, delivered a mixed performance, failing to rally alongside its trans-Tasman neighbor.

Two Fed hikes still on the cards?

Last week’s release of the US June CPI and PPI reports sparked enthusiasm among global investors, leading to rallies in major stock indexes while pushing down benchmark yields and hammering Dollar. Market consensus was unchanged on a 25 bps hike by Fed this month, with over a 90% chance priced in throughout the week. Traders did try to price out an additional hike this year.

However, this sentiment started shifting towards the end of the week, particularly after the speech by Fed Governor Christopher Waller. He insisted that two additional 25 bps rate hikes are still necessary this year to steer inflation back towards target.

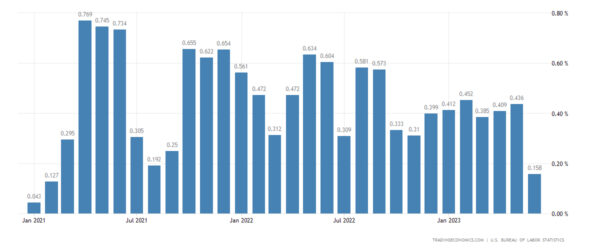

More importantly, Waller highlighted the fact that monthly reading of core CPI was at 0.4% mom or higher for five consecutive months before it halved to 0.2% mom in June. And, “one data point does not make a trend”. Additionally, he also drew attention to how inflation had “briefly slowed” in the summer of 2021 before escalating again.

source: tradingeconomics.com

Waller’s comments suggest that Fed officials are now scrutinizing monthly reading of core CPI more closely to determine the need for further tightening. This is primarily due to the annual readings being significantly influenced by base effects.

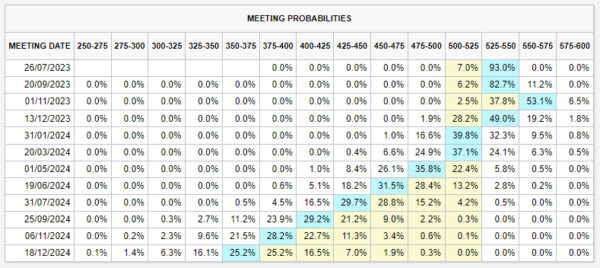

Meanwhile, the outlook depicted by fed fund futures is rather puzzling. By the end of the week, markets were pricing in 93.0% chance of a 25bps hike to 5.25-5.50%, which aligns with expectations.

But post-September, predictions become murkier: there’s 59.6% chance of another 25bps hike to 5.50-5.75% in November, followed by 79.1% chance of a rate cut back to 5.25-5.00% in December, with 57.4% chance of another cut in January to 5.00-5.52%.

Given the high degree of uncertainty beyond July, it’s not necessary to dwell too much on these predictions for now. After all, both Fed and markets need some more time to make sense of the evolving inflation landscape.

Dollar index resumed down trend, 98 to provide enough support?

Dollar index nose-dived through 100 handle last week, in tandem with strong rally in stocks and steep pull back in benchmark yields. The development confirmed resumption of whole down trend from 114.77 (2022 high). Near term outlook will now stay bearish as long as 101.92 support turned resistance holds, even in case of strong recovery.

For now, the fall from 114.77 is still seen as a corrective move only. Strong support is likely at around 98 handle to contain downside to bring a sustainable bounce or even reversal. There is 61.8% retracement of 89.20 (2021 low) to 114.77 at 98.96. 55 M EMA currently sits around 98.06. Even if DXY is correcting the up trend from 70.69 (2008 low), there is 38.2% retracement of 70.69 to 114.77 at 97.93. However, that would very much depends on the case that risk markets are only in a “bear market rally” for now.

S&P 500 extended rally, but pay attention to loss of momentum

Taking about risk markets, S&P 500 extended recent rally to close at 4505.42 last week. Near term outlook will remain bullish as long as 4328.08 support holds. Next target is 138.2% projection of 3491.58 to 4100.51 from 3808.86 at 4650.40.

Nevertheless, for now, the rise from 3491.58 (2022 low) is only seen as the second leg of the long term corrective pattern from 4818.62 (2022 high), i.e. a bear-market rally. Hence, SPX should target to lose upside momentum ahead, with prospect of topping between 4650.40 and 4818.62. This development, if realized, would likely be in tandem with bottoming in Dollar index after next fall to 98 as mentioned above.

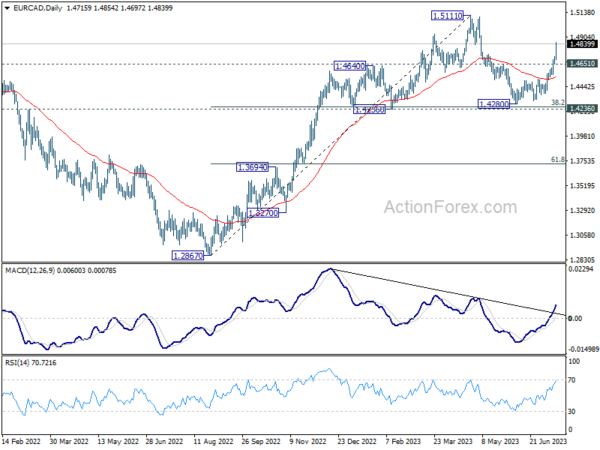

EUR/CAD rally extends, but should face resistance at 1.5111

Looking at other currencies, Canadian Dollar was the second worst despite BoC’s rate hike last week. While markets are pricing in roughly 50% chance of one more hike by the end of the year, some economists believe that the peak rate was already reached. Even not, BoC would now be outpaced by other major central banks, BoE for sure, and probably ECB too.

EUR/CAD’s strong accelerated higher last week as the rally from 1.4280 extended. Further rise is expected as long as 1.4651 support holds, to retest 1.5111. For now, the rebound from 1.4280 is seen as the second leg of the corrective pattern from 1.5111 high only. Hence, upside should be limited by 1.5111 to bring reversal, as the third leg of the pattern. Hence, attention will be paid on sign of loss of momentum ahead.

AUD/NZD extending near term fall

The fortune of Aussie and Kiwi diverged again last week, with the latter ending as the second best, while Aussie was just mixed. The appointment of current Depute RBA Governor Michelle Bullock as the next head of the central bank isn’t expected to bring much difference or any discontinuity of current policy path. Meanwhile, other changes in the central bank are mostly nothing more than political gestures.

After outgoing Governor Philip Lowe was criticized for raising interest a historic “12 times in 15 months”, the central bank will now cut the number of meetings from 11 times to 8 times a year. The post-meeting statement will be issued by the Board, rather than the Governor alone. The Board, rather than just the Governor, will be the signatory to the Statement on the Conduct of Monetary Policy.

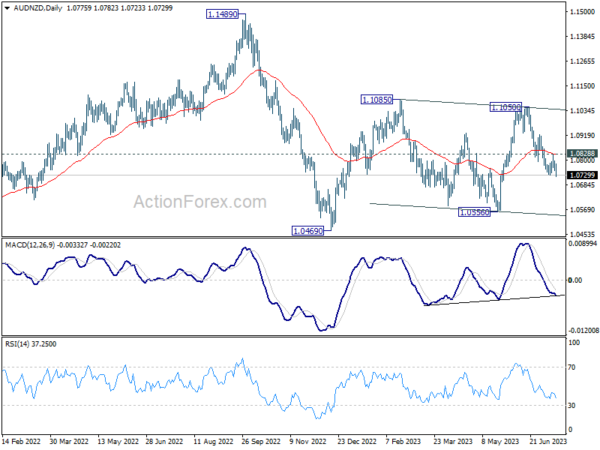

Anyway, AUD/NZD’s decline from 1.1050 resumed last week by breaking 1.0730 support. Rejection by 55 D EMA (now at 1.0825) is a near term bearish sign. Further fall is expected as long as 1.0828 resistance holds. Nevertheless, current decline is seen as either a correction to rise from 1.0556, or worse the third leg of the corrective pattern from 1.1085. Hence, while break of 1.0556 support cannot be totally ruled out, strong support should emerge above 1.0469 (2022 low). Break of 1.0828 resistance will be an early sign of near term bullish reversal.

USD/CHF Weekly Outlook

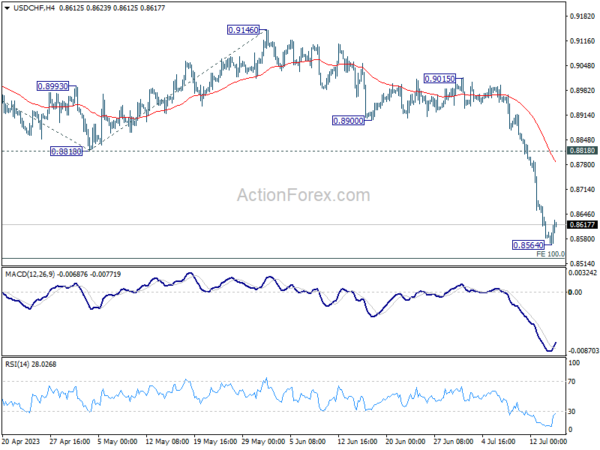

USD/CHF’s decline from 1.0146 resumed last week and broke 0.8756 long term support decisively. But as a temporary low was formed at 0.8564 with subsequent recovery, initial bias is neutral this week for some consolidations first. Upside of recovery should be limited below 0.8818 support turned resistance to bring another fall. Break of 0.8564 will target 100% projection of 0.9439 to 0.8818 from 0.9146 at 0.8525 next.

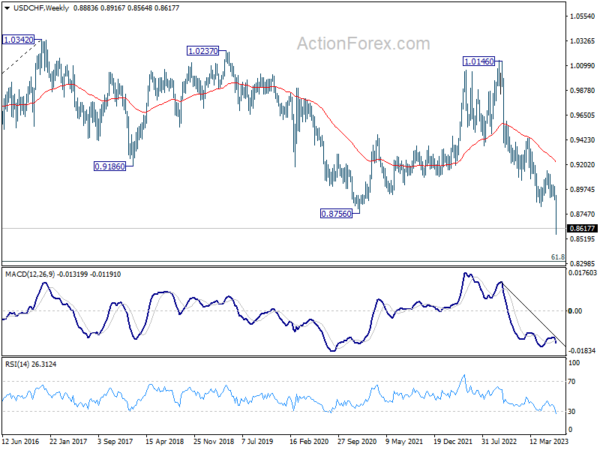

In the bigger picture, the break of 0.8756 (2021 low) indicates break out from the long term range pattern. For now, medium term outlook will stay bearish as long as 0.9146 resistance holds. Further fall would be seen to 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 next.

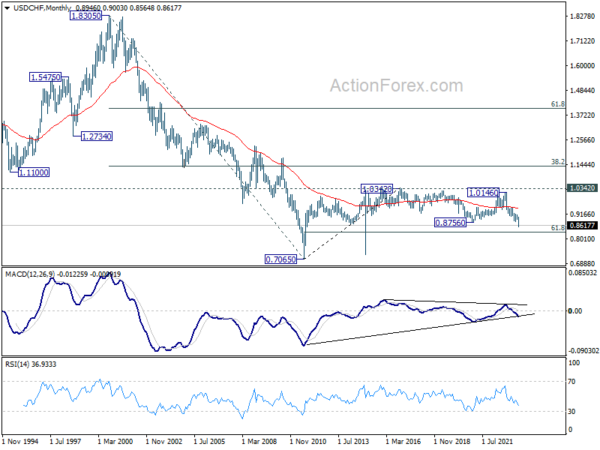

In the long term picture, there is no clear sign that down trend from 1.8305 (2000 high) has completed. With 38.2% retracement of 1.8305 to 0.7065 at 1.1359 intact, outlook is neutral at best. Sustained break of 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317 will bring retest of 0.7065 low.