Today, the US Dollar rallied, stimulated by rising preliminary inflation expectations from the University of Michigan’s monthly consumer survey and overall stronger data. The bond yields also recorded a sharp incline.

The inflation reading depicted a minor increment, moving from 3.3% to 3.4%. Given a market that has reacted positively to the favorable CPI and PPI data this week, even the slightest gains in inflation have somewhat deflated the narrative of receding inflation.

Further, consumer sentiment indices also demonstrated a significant uplift:

- Consumer sentiment surged to 72.6 from 64.4 last month

- Current conditions ascended to 77.5 from 69.0 in the previous month

- Expectations climbed to 69.4 from 61.5 last month

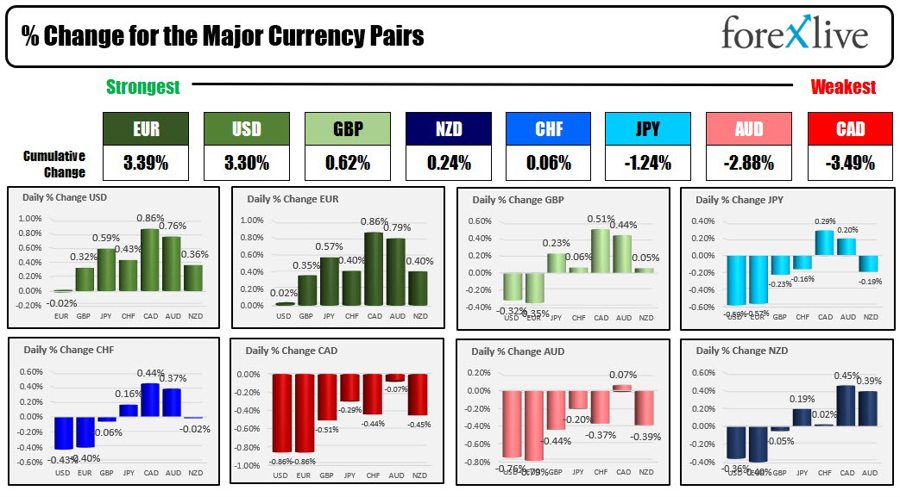

In currency performances, the Euro marginally edged out the USD as the strongest among the major currencies, with the USD depreciating by 0.02% against the Euro. However, the dollar posted substantial gains against other currencies, most notably against the Canadian Dollar (+0.86%) and the Australian Dollar (+0.76%). Furthermore, the USD/JPY pair also saw an increase of 0.59%.

The strongest to weakest of the major currencies

Although higher today, the US dollar is ending the trading week with declines vs all the major currencies. Below are the changes vs the majors:

- EUR, -2.34%

- GBP, -1.98%

- JPY, -2.38%

- CHF, -3.06%

- CAD, -0.46%

- AUD, -2.15%

- NZD, -2.60%

This week’s lower inflation readings from the Consumer Price Index (CPI) and Producer Price Index (PPI) have spurred hopes among traders that the Federal Reserve may opt for just one more rate hike in 2023. This expectation persists despite indications from several Fed officials, including Fed’s Daly and Waller, that two hikes still remain the most likely scenario.

Fed’s Waller highlighted that the September meeting still holds possibilities (although most anticipate the Fed would bypass that meeting) and maintained that he foresees “two more 25-basis-point hikes in the target range over the four remaining meetings this year as necessary to keep inflation moving toward our target.”

Earlier in the week, prior to the release of inflation data, Fed’s Daly suggested that two hikes were still probable. However, she slightly backtracked yesterday, clarifying that her comments were intended to keep open the possibility of an additional hike this year.

The Federal Reserve will announce its next rate decision on July 26. The subsequent meetings are slated for September 20 and November 1, offering an opportunity for two more sets of unemployment and inflation data before the September meeting, and three more before the November meeting. This will provide ample data to ascertain whether the decline in inflation has run its course and is reverting to an upward trajectory, or if it continues to decelerate.

This week the market was full of optimism for a Goldilocks economy with growth remaining but inflation moving lower.

In the US debt market today, yields corrected higher after falling lower earlier this week. For the day:

- 2-year yield 4.767% +15.7 basis points

- 5-year yield 4.045%, +11.0 basis points

- 10-year yield 3.830% +7.1 basis points

- 30-year yield 3.925% +3.1 basis points

For the trading week yields were still lower:

- 2-year yield fell -17.8 basis points

- 5-year yield fell -31 basis points

- 10-year yield fell -23 basis points

- 30-year yield fell -11.7 basis points

The lower yields and lower dollar – along with the Goldilocks scenario – helped to boost stocks this week:

- Dow industrial average added 774 points or 2.29%

- S&P index added 106.45 points or 2.42%

- NASDAQ index added 452.98 points or 3.32%

The NASDAQ gain was the largest since the week of March 27, 2023.

In Europe, the major indices were mostly lower today, but like US indices, they had strong gains for the week:

- German DAX, +3.22%

- Frances CAC, +3.69%

- UK’s FTSE 100, +2.45%

- Spain Ibex, +2.05%

- Italy’s FTSE MIB, +3.19%

In the Asian Pacific market:

- Japan’s Nikkei 225 rose 2.42%

- Hong Kong’s Hang Seng index increased 5.71%

- China’s Shanghai composite index rose 1.28%

- Australia’s S&P/ASX index rose 3.7%

European benchmark 10 year yields fell sharply:

- Germany, -15.9 basis points

- France, -15.2 basis points

- UK, -27.3 basis points

- Spain -15.7 basis points

- Italy -18.6 basis points

Canada’s 10-year yield fell by -20.7 basis points this week.

Next week, the US earning season will continue with more large financials including:

- Bank of America

- Morgan Stanley

- Charles Schwab

- PNC financial

- Bank of New York

- Goldman Sachs

- American Express

A significant number of regional banks, believed to be more susceptible to earnings fluctuations, are set to release their earnings announcements next week. Among the top 15 stocks in the KRE ETF (exchange-traded fund) designated for regional banks, 12 will be delivering reports. These 12 institutions represent roughly 25% of the index’s composition. According to sources, 60% of the KRE holdings will be announcing.

Other big names announcing next week include:

- Tesla, Netflix and IBM on Wednesday

- Johnson & Johnson, American Airlines, United Airlines and Travelers will announce earnings on Thursday

Looking ahead the week of July 24 will be the “big” week for the large cap leaders:

- Alphabet is scheduled on Monday, July 24

- Microsoft is scheduled on Tuesday, July 25

- Amazon, Meta and Boeing are scheduled on Wednesday, July 26

- Bristol Myers Squibb, Intel, McDonald’s and Northrop Grumman are scheduled on Thursday, July 27

Nvidia is not scheduled to announce until toward the end of August.

Below is a summary of some of the major economic releases scheduled for release next week (times are ET)

Sunday, July 16

- 10:00 PM: China’s GDP for Q2 (Forecast: 7.1%, Previous: 4.5%)

- 10:00 PM: China’s Industrial Production YoY (Forecast: 2.5%, Previous: 3.5%)

Monday, July 17

- 8:30 AM: U.S. Empire State Manufacturing Index (Forecast: -3.5, Previous: 6.6)

- 9:30 PM: Australia’s Monetary Policy Meeting Minutes

Tuesday, July 18

- 8:30 AM: Canada’s CPI MoM (Forecast: 0.3%, Previous: 0.4%)

- 8:30 AM: Canada’s Median CPI YoY (Forecast: 3.7%, Previous: 3.9%)

- 8:30 AM: Canada’s Trimmed CPI YoY (Forecast: 3.6%, Previous: 3.8%)

- 8:30 AM: U.S. Core Retail Sales MoM (Forecast: 0.4%, Previous: 0.1%)

- 8:30 AM: U.S. Retail Sales MoM (Forecast: 0.5%, Previous: 0.3%)

- 6:45 PM: New Zealand’s CPI QoQ (Forecast: 0.9%, Previous: 1.2%)

Wednesday, July 19

- 2:00 AM: UK’s CPI YoY (Forecast: 8.2%, Previous: 8.7%)

- 9:30 PM: Australia’s Employment Change (Forecast: 16.5K, Previous: 75.9K)

- 9:30 PM: Australia’s Unemployment Rate (Forecast: 3.6%, Previous: 3.6%)

Thursday, July 20

- 8:30 AM: U.S. Unemployment Claims (Forecast: 242K, Previous: 237K)

Hope you have a great weekend.