Dollar is facing an intensified selloff in today’s Asian trading session, with the currency’s decline appearing to accelerate. The return of risk-on sentiment, signaled by overnight gains in major US stock indexes, has added additional weight on the greenback. Market watchers are eagerly anticipating the release of US CPI data today, as they seek further evidence to back their prediction that Fed’s anticipated rate hike later this month could be the last in the current cycle.

Elsewhere in the currency markets, New Zealand Dollar is posting marginal gains after RBNZ held its rates steady, while Australian Dollar is also up slightly. But these gains are largely overshadowed by the impressive rally of Yen, which is building further momentum in a bullish reversal. On the other hand, Canadian Dollar is showing weakness ahead of BoC’s anticipated rate hike today, despite it surpassing a near-term resistance against the US Dollar. Swiss Franc is exhibiting weakness for the time being too, whereas Euro and British Pound are experiencing a mixed trading session.

In Asia, at the time of writing, Nikkei is down -0.64%. Hong Kong HSI is up 1.08%. China Shanghai SSE is down -0.15%. Singapore Strait Times is up 0.52%. Japan 10-year JGB yield is up 0.018 at 0.474. Overnight, DOW rose 0.93%. S&P 500 rose 0.67%. NASDAQ rose 0.55%. 10-year yield dropped -0.026 to 3.980.

RBNZ holds OCR steady at 5.5%, expresses confidence in returning inflation to target range

In line with broad expectations, RBNZ keeps OCR unchanged at 5.5%, as tightening cycle has finally entered in to a pause phase.

RBNZ expressed its confidence in the current restrictive interest rate level, stating, “consumer price inflation will return to within its target range of 1 to 3% per annum, while supporting maximum sustainable employment.”

When discussing their Remit objectives, the Committee noted that it still expects inflation to fall within the target band by the second half of 2024. Risks surrounding the inflation projection as being “broadly balanced”. While employment remains above its maximum sustainable level, recent indicators suggest that “labour market conditions are easing.”

RBNZ also acknowledged the slight contraction in economic activity in Q1. It added that “growth is likely to remain weak in the near term.”

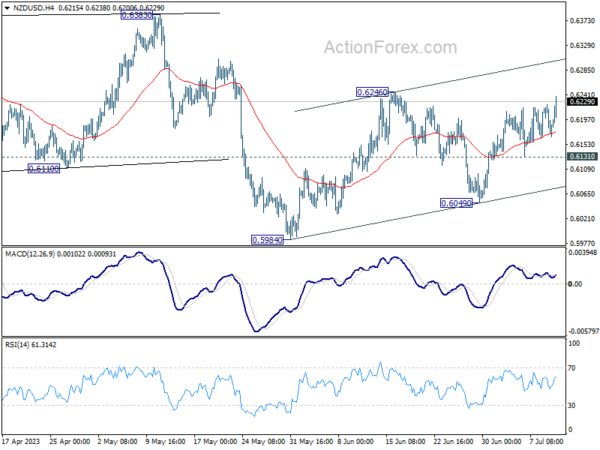

NZD/USD edges higher on Dollar weakness after RBNZ

NZD/USD inches higher today, following RBNZ decision to hold its interest rate steady at 5.50%. However, this uptick seems more driven by prevailing slight risk-on sentiment, and a weaker Dollar rather than the central bank’s decision itself.

From a technical perspective, while further short-term rally in NZD/USD seems probable, there isn’t yet a clear signal for bullish trend reversal. The pair remains capped below declining trend line, initiated from February’s high of 0.6537. Moreover, price action from 0.5894 do not exhibit a clear impulsive structure, suggesting it could be merely a corrective pattern within the broader decline from 0.6537.

On the downside, break of 0.6131 support will argue that the fall from 0.6537 is ready to resume through 0.5984 low.

RBA Lowe: Further tightening possible, look into new forecasts in Aug

RBA Governor Philip Lowe noted the current economic outlook is a “complex picture” with significant uncertainties”. He said in a speech today, “the Board decided that, having already increased rates substantially, it was appropriate to hold interest rates steady this month and re-examine the situation next month.”

Looking ahead, Lowe noted, “It is possible that some further tightening will be required to return inflation to target within a reasonable timeframe,” adding that requirement for further action will largely depend on evolution of the economy and inflation.

He highlighted that the Board will be provided with an updated set of economic forecasts, a revised risk assessment, and fresh data on inflation, the global economy, labour market, and household spending at the next meeting in August to inform its decision-making process.

He pointed to recent forecasts in May which saw inflation returning to top of target band in “mid-2025:. But he acknowledge, Data received since then had suggested that the inflation risks had shifted somewhat to the upside.”

DOW staying bullish with overnight bounce, US CPI on radar

US major stock indexes rallied overnight, breaking a three-session losing streak as investors eagerly await June US consumer inflation report, expected later today. Economists forecast a moderation in headline CPI from 4.0% to 3.1%, with core CPI also expected to decelerate from 5.3% to 5.0%.

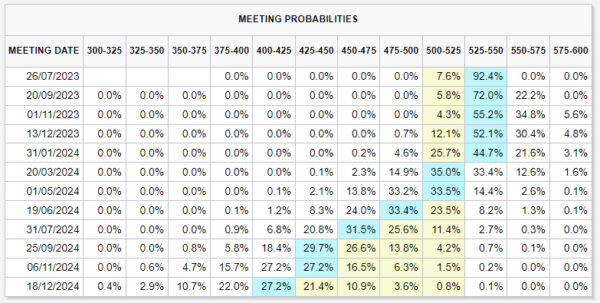

Market participants have already factored in a quarter-point hike at Fed’s July 25-26 meeting, with an over 90% likelihood priced in. As it stands, the probability of an additional rate hike for the remaining part of the year is below 50%. These odds could shift depending on whether today’s core CPI data undershoots, and by what margin.

As for DOW, the strong support from 55 D EMA (now at 33724.42) is clearly a near term bullish sign. Break of 34588.68 resistance will confirm resumption of recent rally. But the real test would lie in 61.8% projection of 28660.94 to 34712.28 from 31429.82 at 35169.54. Clear break of this projection level is needed to set the stage for further rally in the rest of H2. Meanwhile, a dip today or in the near term wouldn’t be disastrous as long as 32586.66 support stays intact.

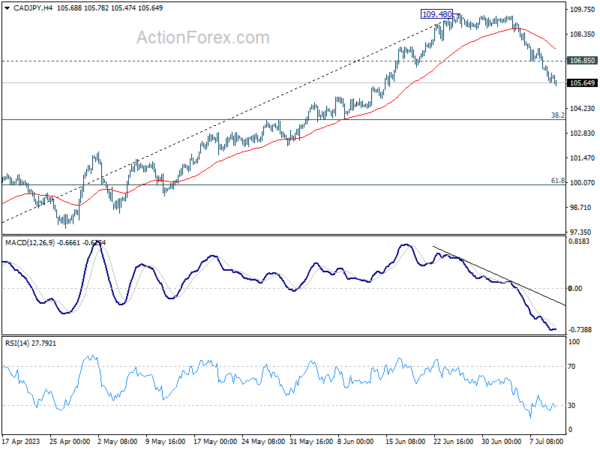

BoC to hike but what next? CAD/JPY extending near term fall

As BoC is widely expected to raise interest rates by another 25 bps to 5.00% today, the financial market awaits the answer on whether this move marks the end of the current tightening cycle. The hike today is expected after the bank restarted tightening last month, with many speculating that terminal rate could be reached with this adjustment.

However, the future pathway is fraught with uncertainties, and the key focus will be on how BoC chooses to communicate its stance. There are anticipations that Governor Tiff Macklem may maintain a hawkish tone, keeping options open and underscoring the bank’s determination to combat inflation that continues to overshoot target. Alternatively, the bank may more explicitly signal another “conditional pause”, like it did in January. Regardless of the approach, the new economic forecasts to be released today will be crucial in underpinning their message.

Some previews on BoC:

CAD/JPY is continuing the fall from 109.48 short term top today. The favored case is that this decline from 109.48 is the third leg of the pattern from 110.87 high. Sustained break of 55 D EMA (now at 104.86) would solidify this bearish case and target 38.2% retracement of 94.04 to 109.48 at 103.58 next. Break of 106.85 minor resistance will mix up the outlook and bring recovery first. But even in this case, risk will stay mildly on the downside as long as 109.48 resistance holds.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2880; (P) 1.2907; (R1) 1.2960; More…

GBP/USD’s rally continues today and hit as high as 1.2968 so far. Intraday bias remains on the upside for 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095. On the downside, below 1.2884 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, the strong support from 55 W EMA (now at 1.2341) is a medium term bullish sign. Outlook will stay bullish as long as 1.2306 support holds. Rise from 1.0351 medium term bottom (2022 low) is expected to extend further to retest 1.4248 key resistance (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | 4.10% | 4.50% | 5.10% | 5.20% |

| 23:50 | JPY | Machinery Orders M/M May | -7.60% | 1.20% | 5.50% | |

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 12:30 | USD | CPI M/M Jun | 0.30% | 0.10% | ||

| 12:30 | USD | CPI Y/Y Jun | 3.10% | 4.00% | ||

| 12:30 | USD | CPI Core M/M Jun | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Jun | 5.00% | 5.30% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 5.00% | 4.75% | ||

| 14:30 | USD | Crude Oil Inventories | -1.1M | -1.5M | ||

| 15:00 | CAD | BoC Press Conference | ||||

| 18:00 | USD | Fed’s Beige Book |