The USDJPY is extending the declines with the pair now trading to the lowest level since June 22. The move today has now seen a high-to-low trading range of 210 pips. That is well above the 109 average over the last 22 trading days. So there may be some oversold component, but technicals will play a role.

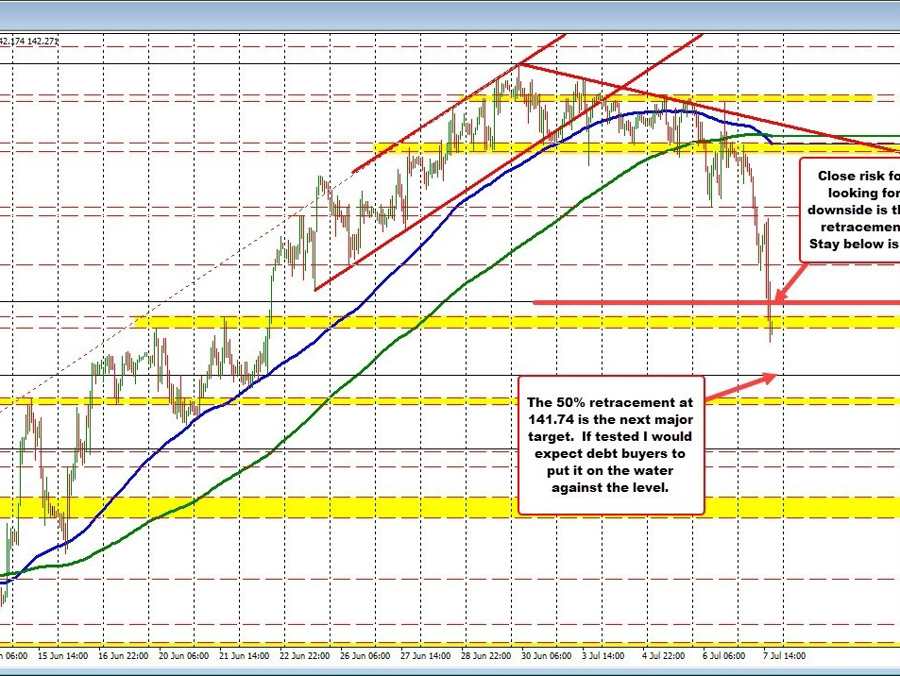

The move to the downside (see hourly chart) has broken below the 38.2% retracement of the move up from the June 1 low. That retracement level comes in at 142.528 and represents a close risk level now for sellers looking for more downside momentum. If the price can stay below that level, the sellers remain in control.

The price also fell below a swing area between 142.247 and 142.370.

On the downside, the next major target comes against the 50% retracement of the move up from the June low. That level comes in at 141.743. If the selling continues and the price moves/approaches that level, I would expect buyers to stick a toe in the water – with stopped on a break below..

So sellers are making a play and trending the pair lower today. The 38.2% retracement is now close risk at 142.528. Stay below and we could see a further run toward the 50% midpoint, but be aware that the range today is already extended.

USDJPY breaks below 38.2% retracement