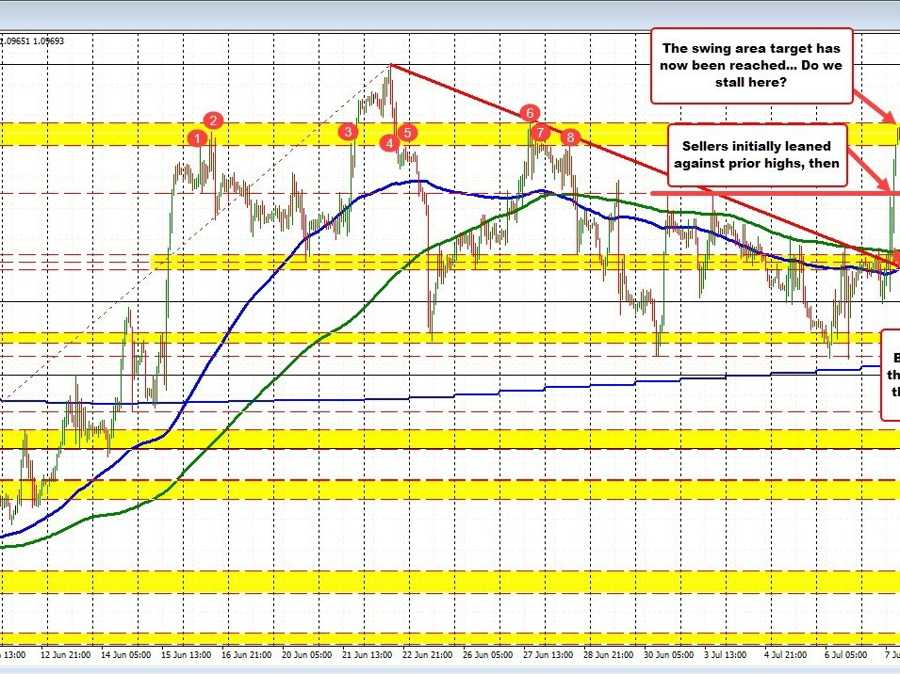

EURUSD targets the swing area

The EURUSD continued its run to the upside and in the process has now reached the next key swing area between 1.09618 and 1.09759. The high price reached 1.09725. The current price trades at 1.0966.

The move to the upside took the steps outlined in the pre-employment video. IN that video (see video at the bottom of this post) I spoke of the need to break above the 200-hour MA at 1.08978, then a break of the highs from last Monday and the previous Friday at 1.09329, and if that is broken, getting to the swing area between 1.09618 to 1.09859.

So what happened?

The price moved higher after the employment statistics were released. The price moved up to just below the 1.09329 level and then corrected back down toward the 200-hour moving average at 1.08978. Support buyers came in against that level (the low reach 1.0895) and rotated back to the upside.

The high from Friday Monday at 1.09329 was then broken and that momentum has continued to the top side swing area between 1.09618 and 1.09859.

As mentioned the high price reached 1.09725.

The trades “A-B-C’s” have been reached.

The potential exists for continued momentum that would next target the 1.1000 natural resistance level and the swing high from June 22 at 1.10112. The one caveat that might give traders some cause for pause is that the range for the day is 106 pips. The average of the last 22 days is 73 pips. So the range is 146% of what has been normal over the last month of trading in the pair.

That may not mean that the high is in place but it could give some stall to the price action into the weekend, and then the market can see what happens next week (i.e what happens with the CPI).

Of course if the price should break 1.09789 the buyers are still in firm control and we would start to target those higher levels.