- EUR/USD bulls eye higher highs but a correction could be on the cards.

- Bears eye a correction to test trendline support.

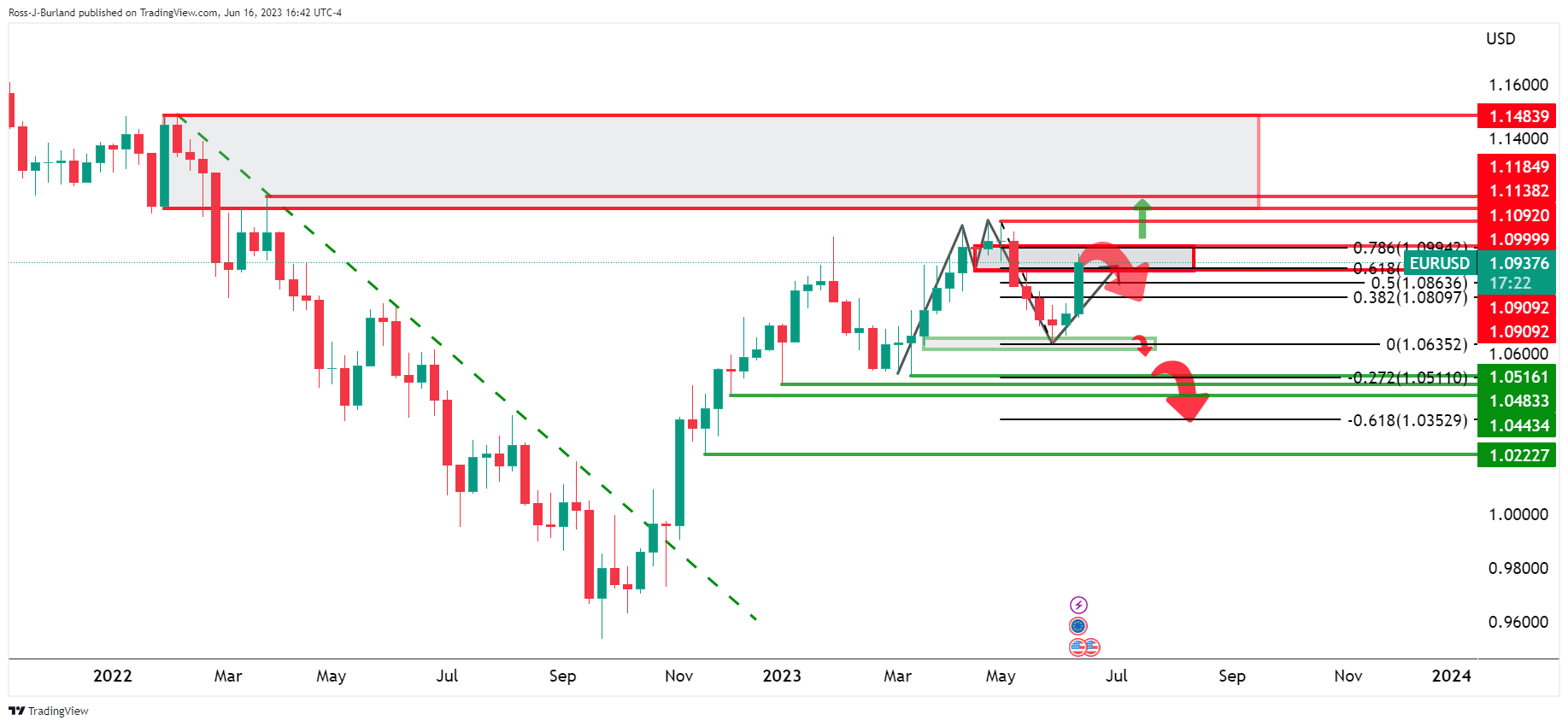

The euro surged into the 1.0970 mark vs. the US Dollar on Friday, reaching its strongest level since May, following the European Central Bank’s decision to raise interest rates for the eighth consecutive time earlier in the week. There was also a signal that future rate hikes were on the table, leaving scope for higher highs in the pair:

EUR/USD weekly chart

The market has run into the weekly neckline of the M-formation. This leaves prospects of a correction but it has been a solid drive higher, so there is momentum in this bullish impulse and we could be headed for higher highs still.

EUR/USD daily chart

We have possible stops above the swing highs that have been left intact, so far. Before a move higher into them, a drive to the downside could be in order first. This brings the 38.2% Fibonacci of the bullish impulse on the daily chart into focus and trendline support.