Dollar falls significantly in early US session, reacting to reports that both headline and core CPI decelerated in May. This development boosts confidence to Fed policymakers to skip tightening at tomorrow’s decision. Meanwhile, Canadian Dollar and Yen are following as the next weakest for now.

Contrarily, Sterling is witnessing a surge, rebounding from its initial dip. Solid job figures, especially strong wage growth, are strengthening the argument for another rate hike by BoE next week. Euro, however, is falling behind following disappointing Germany ZEW data. Australian and New Zealand Dollar are mixed for now, but stay as some of the best performers for the week.

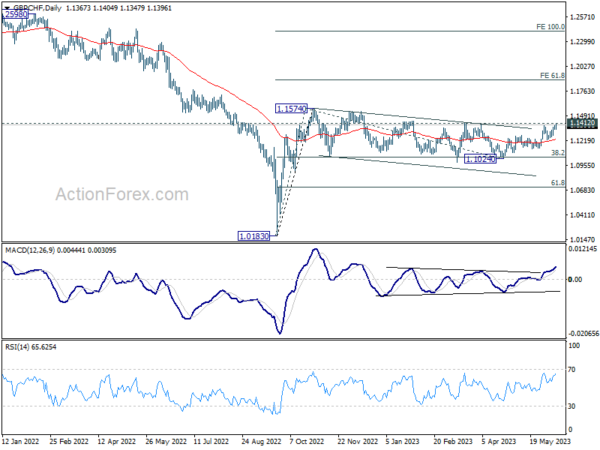

Technically, GBP/CHF is worth some attention this week, in particular with UK GDP data featured tomorrow. It’s now pressing 1.1412 resistance. Firm break there will add to case that whole corrective pattern from 1.1574 has completed. More importantly, the up trend from 1.0183 might be ready to resume through 1.1574 high. Let’s see how it goes.

In Europe, at the time of writing, FTSE is flat. DAX is up 0.29%. CAC is up 0.28%. Germany 10-year yield is down -0.028 at 2.363. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 0.60%. China Shanghai SSE rose 0.15%. Singapore Strait Times dropped -0.21%. Japan 10-year JGB yield dropped -0.0078 to 0.421.

In Europe, at the time of writing, FTSE is flat. DAX is up 0.29%. CAC is up 0.28%. Germany 10-year yield is down -0.028 at 2.363. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 0.60%. China Shanghai SSE rose 0.15%. Singapore Strait Times dropped -0.21%. Japan 10-year JGB yield dropped -0.0078 to 0.421.

US CPI slowed to 4.0% yoy in May, core CPI down to 5.3% yoy

US CPI rose 0.1% mom in May, below expectation of 0.3% mom. CPI core, all items less food and energy, rose 0.4% mom, matched expectations. Food index rose 0.2% while energy index declined -0.3% mom.

For the 12 months, CPI slowed from 4.9% yoy to 4.0% yoy, below expectation of 4.2% yoy. That’s also the lowest reading since March 2021. CPI core slowed from 5.5% yoy to 5.3% yoy, matched expectations. Energy index dropped -11.7% yoy while food index rose 6.7% yoy.

Germany ZEW economic sentiment rose to -8.5, but current situation tumbles very sharply

Germany ZEW Economic Sentiment rose slightly from -10.7 to -8.5 in May, above expectation of -14.7. Current Situation index, however, fell “very sharply” from -34.8 to -56.5, much worse than expectation of -40.

“The ZEW Indicator of Economic Sentiment shows a slight improvement, but it remains in negative territory. This means that experts do not anticipate an improvement in the economic situation during the second half of the year. Particularly, sectors focused on exports are likely to perform poorly due to a weak global economy. However, the current recession is generally not considered particularly alarming,” comments ZEW President Achim Wambach.

Eurozone ZEW Economic Sentiment dropped from -9.4 to -10.0, above expectation of -13.1. Current Situation index dropped from -14.4 to -41.9.

Eurozone balance for short-term interest rates stands at 72.3, indicating anticipated rate hikes. On the other hand, balance for short-term interest rates for the US stands at 16.6, indicating no change in interest rates.

UK payrolled employees rose 23k in May, unemployment rate down to 3.8% in Apr

In May, UK payrolled employees rose 0.1% mom or 23k. Comparing with the same month a year ago, payrolled employees rose 1.6% yoy or 460k. Median monthly pay rose 7.0% yoy, highest in the other service activities sector, with an increase of 10.1% yoy, and lowest in the arts, entertainment and recreation sector, with an an increase of 5.4% yoy. Claimant count dropped -13.6k versus expectation of 21.4k.

In the three months to April, unemployment rate dropped to 3.8%, versus expectation of 4.0%. Average earnings excluding bonus accelerated from 6.8% to 7.2%, above expectation of 6.9%. Average earnings including bonus accelerated from 6.1% to 6.5%, above expectation of 6.1%.

Australia Westpac consumer sentiment up 0.2%, dived after RBA hike

Australia Westpac Consumer Sentiment Index rose marginally by 0.2% to 79.2 in June. Nevertheless, the index continues to hover around “recession lows” over the past year, similar to figures recorded during the “deep recessions” of late 1980s/early 1990s.

Significantly, responses gathered within the survey period (June 5-9) reflected the considerable impact of RBA’s unexpected rate hike on June 6. Confidence had seen a substantial surge from 79.0 in May to 89.0 prior to the rate hike announcement. However, it experienced a sharp decline post-announcement, plummeting to a severely low level of 72.6.

Westpac pointed out that inflation continues to be the “dominant drag” on consumer confidence, overshadowing even the effects of higher interest rate Nevertheless,confidence in labor market turned as one consistent positive.

In light of the upcoming RBA meeting on July 4, Westpac forecasts another 25 basis point rate hike, taking the rate to 4.35%. It noted, “Given that little further information will be available on expectations and unit labour costs in the near term it seems logical that delaying the tightening for another month, to assess more data, seems unnecessary”.

Australia NAB business confidence fell to -4, conditions down to -8

Australia’s NAB Business Confidence Index reported a decline in May, dropping from 0 to -4. Furthermore, Business Conditions witnessed a significant drop from 15 to 8. Looking at some details, trading conditions fell from 22 to 14, profitability conditions went down from 12 to 7, and employment conditions also experienced a drop, going from 11 to 4.

“Business conditions recorded a solid decline in May, and it appears the gradual easing we have seen through early 2023 appears to be strengthening,” said NAB Chief Economist Alan Oster. “That said, conditions remain above average reflecting just how strong the economy was through 2022.”

Oster highlighted that “all three sub-components eased in the month, suggesting that demand growth is now moderating, and trading conditions, profitability and employment are beginning to reflect this.”

Business confidence fell back into the negative zone, oscillating within the 0 to -4 index point range in recent months. “Our bigger worry is the sharp decline in forward orders in the month,” Oster noted.

Meanwhile, price measures inched upwards again, yet they remain notably below their mid-2022 peaks. “The trend over the coming months will be important as the RBA tries to assess whether it has done enough and if underlying inflation pressures are easing in a timely way,” Oster noted.

China cuts key short-term policy rate

China’s central bank PBOC cut a key short-term policy rate, the seven-day reverse repurchase rate, by -10bps from 2% to 1.9%. The policy change is anticipated to infuse an additional CNY 2B of liquidity into the economy through its seven-day repos.

This marks the first move in the past 10 months, dating back to last August. It follows hot on the heels of the country’s major banks slashing deposit rates last week, which included a decrease in interest rate for five-year time deposits from 2.65% to 2.5%.

The timing of this decision is particularly notable, as it precedes PBoC’s medium-lending facility interest rate announcement, which is set to be unveiled this Thursday. Moreover, the bank’s loan prime rate is scheduled for release on June 20.

Adding to this week’s financial developments, China is expected to publish its May credit lending data along with several key activity indicators such as retail sales and industrial production.

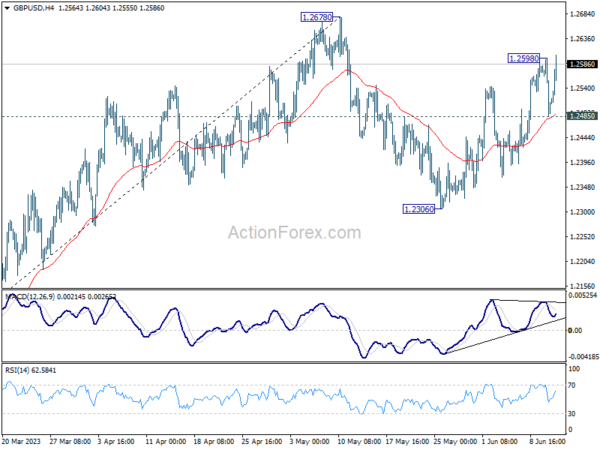

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2466; (P) 1.2533; (R1) 1.2578; More…

Intraday bias in GBP/USD is back on the upside as rebound from 1.2306 resumed after brief retreat. Further rally should be seen to retest 1.2678 high. Based on current momentum, upside could be limited there, to bring another fall to extend the corrective pattern from 1.2678. On the downside, break of 1.2485 support will turn bias back to the downside for 1.2306 support instead.

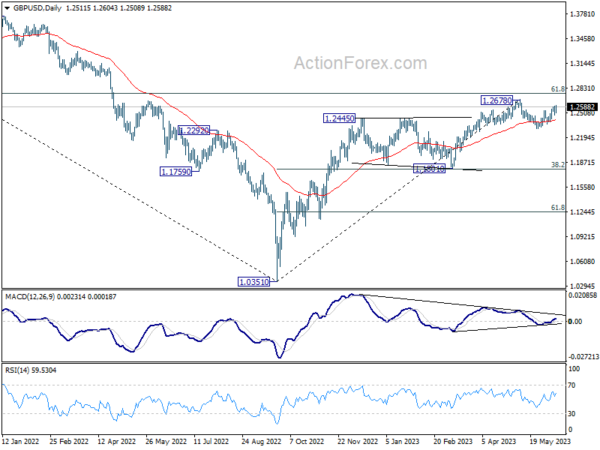

In the bigger picture, as long as 1.1801 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. However, firm break of 1.1801 will indicate rejection by 1.2759, and bring deeper decline, even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Index Q2 | -0.4 | -10.5 | ||

| 00:30 | AUD | Westpac Consumer Confidence Jun | 0.20% | -7.90% | ||

| 01:30 | AUD | NAB Business Conditions May | 8 | 14 | ||

| 01:30 | AUD | NAB Business Confidence May | -4 | 0 | ||

| 06:00 | GBP | Claimant Count Change May | -13.6K | 21.4K | 23.4K | |

| 06:00 | GBP | ILO Unemployment Rate (3M) Apr | 3.80% | 4.00% | 3.90% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Apr | 7.20% | 6.90% | 6.70% | 6.80% |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Apr | 6.50% | 6.10% | 5.80% | 6.10% |

| 06:00 | EUR | Germany CPI M/M May F | -0.10% | -0.10% | -0.10% | |

| 06:00 | EUR | Germany CPI Y/Y May F | 6.10% | 6.10% | 6.10% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jun | -8.5 | -14.7 | -10.7 | |

| 09:00 | EUR | Germany ZEW Current Situation Jun | -56.5 | -40 | -34.8 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | -10 | -13.1 | -9.4 | |

| 10:00 | USD | NFIB Business Optimism Index May | 89.4 | 88.8 | 89 | |

| 12:30 | USD | CPI M/M May | 0.10% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Y/Y May | 4.00% | 4.20% | 4.90% | |

| 12:30 | USD | CPI Core M/M May | 0.40% | 0.40% | 0.40% | |

| 12:30 | USD | CPI Core Y/Y May | 5.30% | 5.30% | 5.50% |