The forex markets are relatively mixed with a near empty economic calendar today. Australian Dollar is extending last week’s rally, while Euro and Yen are following as next strongest. On the other hand, Swiss Franc and Sterling are trading as the worst performers. Dollar is currently mixed in the middle, displaying no definitive directional trajectory.

Two monumental events this week will significantly sway the markets – Fed and ECB interest rate decisions. Simultaneously, BoJ will also meet, and the UK is set to release a slew of crucial economic data that could cause ripples in the market waters.

Notably, the softening of both oil and copper prices is also a crucial element in the global financial scene, deserving a significant mention. Specifically, for Australian Dollar, market sentiment and metal prices could be influenced heavily by China’s economic data. Any disheartening figures from China have the potential to truncate Aussie’s short-term rally.

In Europe, at the time of writing, FTSE is up 0.19%. DAX is up 0.78%. CAC is up 0.68%. Germany 10-year yield is down -0.0272 at 2.351. Earlier in Asia, Nikkei rose 0.52%. Hong Kong HSI rose 0.07%. China Shanghai SSE dropped -0.08%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0059 to 0.429.

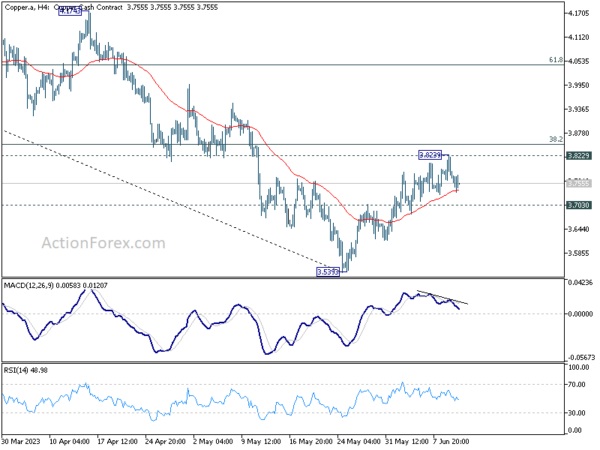

Copper dips after hitting strong cluster resistance

Copper prices dip notably today as metal traders appeared to be turning cautious ahead of FOMC rate decision. In addition, the market needs to seek direction from Chinese data including investment and production to gauge the outlook of demand.

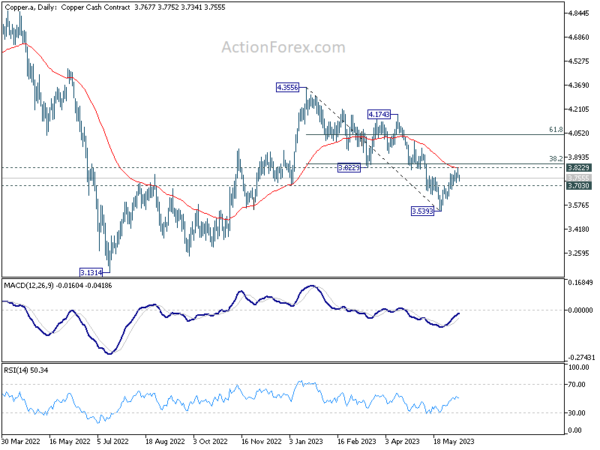

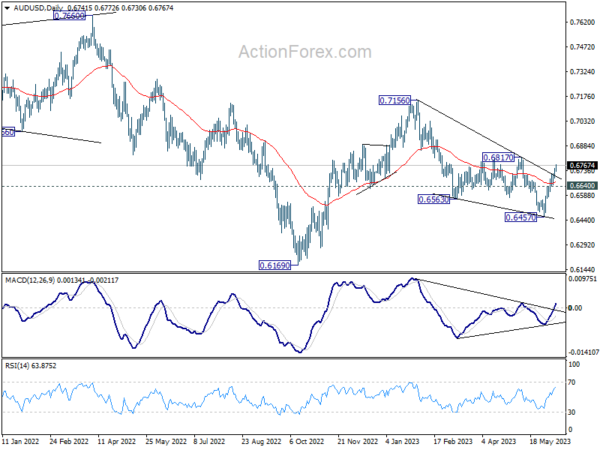

Technically, Copper is facing a key cluster resistance zone at around 3.8229 support turned resistance, 55 D EMA (now at 3.8200), as well as 38.2% retracement of 4.3556 to 3.5393 at 3.8511. Rejection by this resistance zone, followed by 3.703 near term support will bring deeper fall back to 3.5393 low, with prospect of resuming the whole down trend from 4.3556. Given the correction between Australian Dollar and Copper, this bearish scenario could push AUD/USD back towards 0.6457 low.

On the other hand, sustained break of 3.8229/8511 will argue that whole fall from 4.3556 has completed with three waves down, and turn outlook bullish for 61.8% retracement at 4.0438 and above. This bullish development could help push AUD/USD through structural resistance at 0.6817 decisively.

WTI crude oil eyes 67 support as selling intensifies

Oil prices trade deeply lower today as the impact of Russian supply recovery was more than enough to offset Saudi Arabia production cut. Indeed, Goldman Sachs has lowered its WTI forecast for December from 89 to 81 (above current level at around 68 though).

Technically speaking, WTI crude oil was clearly rejected by falling 55 D EMA repeatedly, keeping outlook bearish. Immediate focus is now on 67.05 support. Firm break there could prompt downside acceleration through 63.67 low to 61.8% projection of 83.46 to 63.67 from 74.38 at 62.14. Also,l outlook will stay bearish as long as 74.38 resistance holds, in case of another recovery.

BoE’s Haskel: Important to lean against risks of inflation momentum

In an article penned for The Scotsman newspaper, BoE Monetary Policy Committee member Jonathan Haskel signaled the potential for further increases in interest rates, citing persistent inflation concerns.

Haskel highlighted an improvement in UK’s inflation outlook, observing, “Things look better than a few months ago. Since October last year, inflation has fallen from 11.1 per cent to 8.7 per cent, and we expect it to be around 5 per cent by the end of this year.”

However, he expressed concern that “inflation remains much too high,” reaffirming the MPC’s commitment to achieving its 2% target. “Our tool for doing this is interest rates,” he added.

“My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out,” he said.

Haskel addressed the often-asked question of how increasing interest rates can help when inflation is driven by the prices of essential goods like energy and food, largely determined at a global level.

He clarified, “The aim of higher interest rates is not to affect the prices of these goods directly. Instead, it is to ensure the resulting inflation does not become embedded in the economy and prices do not continue to increase at the rates we’ve seen recently.”

Markets brace for Fed, ECB and BoJ, as well as UK data

As June unfolds, global financial markets brace for a cavalcade of central bank decisions following last week’s unexpected moves by RBA and BoC. Both banks sent shockwaves through the market with their surprise rate hikes. As we gear up for a busy week ahead, market participants will have a keen eye on Fed, ECB and BoJ, anticipating their monetary policy decisions amid an intricate economic landscape.

As market forecasts a 70% chance of maintaining status quo, Fed is likely to hold the line on tightening during this week’s FOMC meeting, leaving interest rates untouched at 5.00-5.25%. However, in the wake of last week’s unexpected moves by RBA and BoC, nothing can be definitively ruled out. Regardless of the decision, the focus will be on Fed’s new economic projections and dot plot, revealing policymakers’ terminal rate expectations and potential timing for rate cuts. The release of key economic data including CPI, PPI, retail sales, and U of Michigan consumer sentiment will also potentially stir the markets.

Meanwhile, ECB is anticipated to raise the main refinancing rate by 25bps to 4.00%. While continued tightening bias is expected, ECB President Christine Lagarde will likely emphasize the data-dependency and meeting-by-meeting approach of future decisions. Given recent unexpected dips in inflation data, inflation outlook detailed in the new economic projections will be crucial. Other noteworthy data from Eurozone include German ZEW economic sentiment.

In contrast, BoJ is expected to keep monetary policy unchanged, holding the short-term interest rate at -0.10% and capping 10-year JGB yield at 0.50%. Governor Kazuo Ueda is likely to reiterate that expected slowing in inflation rate in the second half of the year necessitates continuation the current ultra-loose monetary policy. Lack of violent fluctuations in 10-year JGB yields recently suggest that market participants not speculating on any changes. A clearer picture of BoJ’s next steps might not emerge until release of July’s updated Outlook for Economic Activity and Prices.

In the UK, employment and wage growth data, along with GDP and production figures, will play a crucial role in solidifying another rate hike by BoE next week. Other significant data releases to monitor include China’s industrial production, retail sales, and fixed asset investment, as well as Australia’s employment figures.

Here are some highlights for the week:

- Tuesday: Japan BSI manufacturing; Australia Westpac consumer sentiment, NAB business confidence; UK employment; Germany CPI final, ZEW economic sentiment; US CPI.

- Wednesday: New Zealand current account; UK GDP, production, trade balance; US PPI, FOMC rate decision.

- Thursday: New Zealand GDP; Australia employment; Japan machine orders, trade balance, tertiary industry activity; China industrial production, retail sales, fixed asset investment; Swiss PPI, SECO economic forecasts; Eurozone trade balance, ECB rate decision.; Canada manufacturing sales; US retail sales, Empire state manufacturing, Philly Fed survey, jobless claims, import prices, industrial production, business inventories.

- Friday: New Zealand BusinessNZ manufacturing; BoJ rate decision; Eurozone CPI final; wholesale sales; US U of Michigan sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6708; (P) 0.6729; (R1) 0.6766; More…

Intraday bias in AUD/USD remains on the upside for 0.6817 structural resistance. Decisive break there will carry larger bullish implications. On the downside, however, break of 0.6640 minor support will turn bias back to the downside for retesting 0.6457 low again.

In the bigger picture, fall from 0.7156 is still in favor to continue as long as 0.6817 resistance holds. Prior rejection by 55 W EMA (now at 0.6801) keeps medium term outlook bearish. Break of 0.6457 will target 0.6169 key support (2022 low). Nevertheless, firm break of 0.6817 will indicate that fall from 0.7156 has completed in a three-wave corrective structure. Rise from 0.6169 would then be ready to resume through 0.7156.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y May | 5.10% | 5.50% | 5.80% | 5.90% |

| 06:00 | JPY | Machine Tool Orders Y/Y May F | -22.20% | -14.40% |