Australian Dollar surges broadly after surprised RBA rate hike. Tightening bias is also maintained, so more hike(s) could still be in the pipeline. The move in Aussie is taking other commodity currencies higher. Now, a focus will be on whether BoC would follow and surprises the markets too. At the other end of the spectrum, Dollar is sold off broadly today. Yen is following as the second worst and then Euro. Swiss Franc and Sterling are mixed.

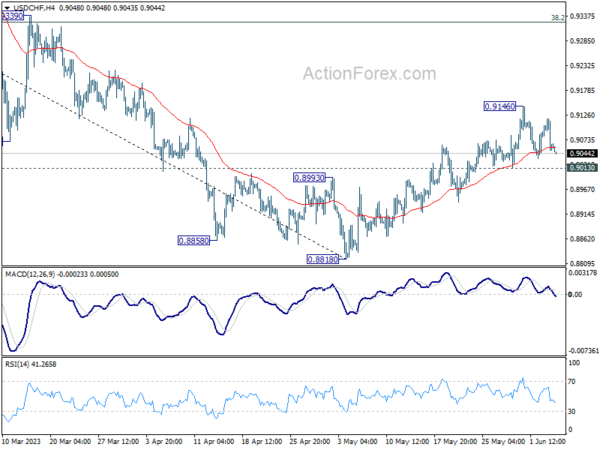

Technically, some attention will also be on Dollar in the early part of the week. Near term price actions in EUR/USD, USD/CHF, USD/JPY and even GBP/USD are displaying corrective structures. That is, the greenback’s rally against European majors and Yen shouldn’t be over yet. Break of any of 1.0634 support in EUR/USD, 1.2306 support in GBP/USD, 0.9146 resistance in USD/CHF and 140.90 resistance in USD/JPY could be the early signal of resumption in Dollar’s rise.

In Asia, at the time of writing, Nikkei is up 0.69%. Hong Kong HSI is up 0.51%. China Shanghai SSE is up 0.05%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.0040 at 0.430. Overnight, DOW dropped -0.59%. S&P 500 dropped -0.20%. NASDAQ dropped -0.09%. 10-year yield rose 0.0002 to 3.693.

RBA surprises with 25bps hike, to give itself greater confidence

RBA surprises the market by raising the cash rate target rate, by 25bps to 4.10. Tightening bias is maintained as “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”.

The central bank noted that while inflation is “still too high” even though it has “passed its peak.” Also, it will be “some time yet” before inflation falls back to target range. It explained, “this further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe”.

Growth “has slowed” and labor market conditions “remain very tight” even though eased. Wages growth “has picked up” but is “still consistent with the inflation target”. The path to soft landing “remains a narrow one” and a “significant source” of uncertainty continues to be household consumption.

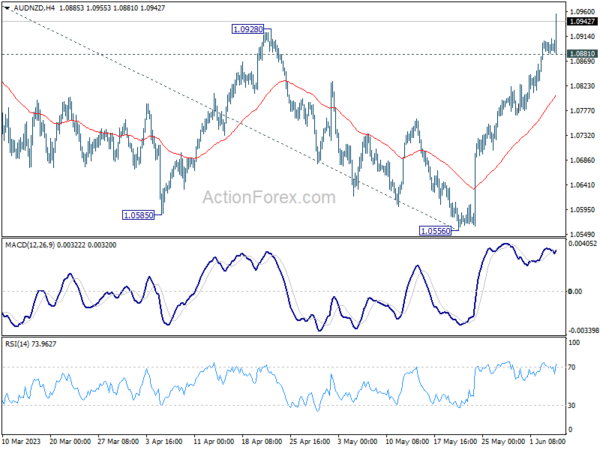

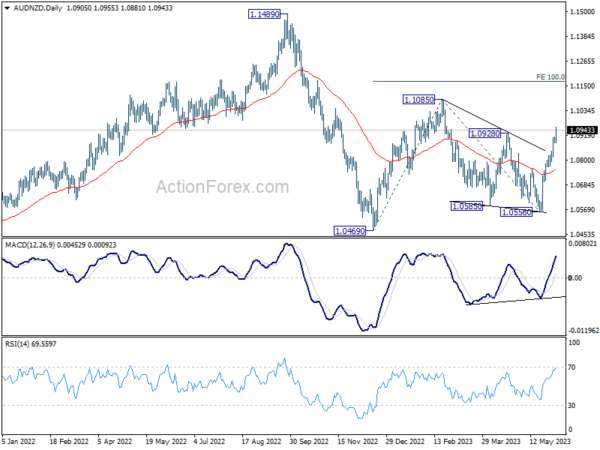

AUD/NZD breaks structural resistance after RBA hike

AUD/NZD surges after RBA’s surprised rate hike and breaks through 1.0928 structural resistance. The development should confirm that corrective fall from 1.1085 has completed with three waves down to 1.0556.

Intraday bias is now on the upside as long as 1.0881 minor support holds. Sustained trading above 1.0928 could prompt upside acceleration 1.1085 resistance. Break there will resume whole rally from 1.0469 (2022 low) to 100% projection of 1.0469 to 1.1085 from 1.0556 at 1.1172.

Looking ahead

Germany factor orders, UK PMI construction, Eurozone retail sales will be released in European session. Later in the day, Canada will publish building permits and Ivey PMI.

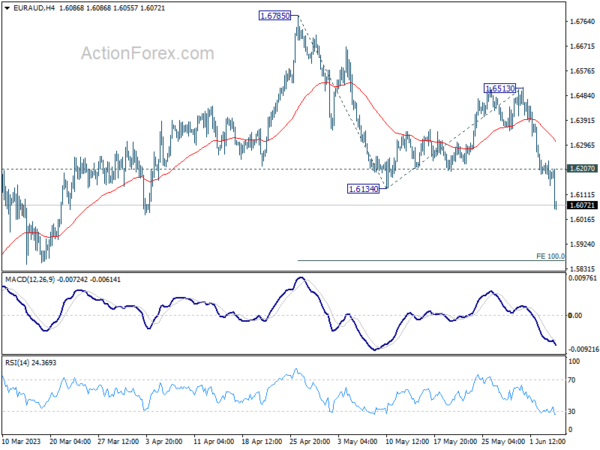

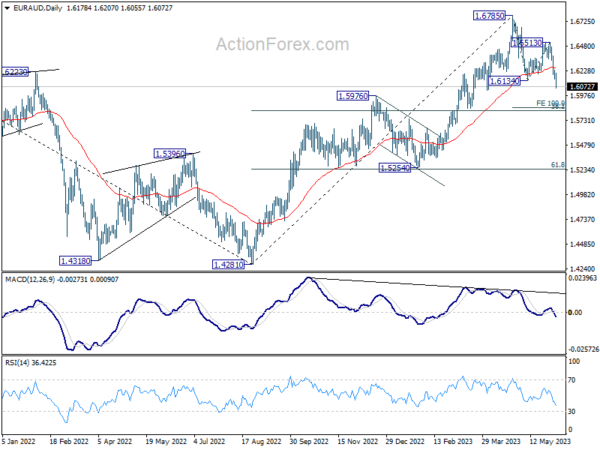

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6143; (P) 1.6191; (R1) 1.6237; More…

EUR/AUD’s decline continues today and break of 1.6134 support confirms resumption of whole fall from 1.6785. Intraday bias stays on the downside for 100% projection of 1.6785 to 1.6134 from 1.6513 at 1.5862. On the upside, above 1.6207 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.6513 resistance holds, in case of recovery.

In the bigger picture, a medium term top is possibly in place at 1.6785 already, on bearish divergence condition in D MACD. Fall from there is seen as correcting whole up trend from 1.4281 (2022 low). Deeper decline is expected as long as 1.6513 resistance holds, to 38.2% retracement of 1.4281 to 1.6785 at 1.5828. Strong support could be seen there to complete the first leg of the corrective pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y May | 3.70% | 5.20% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 1.00% | 1.90% | 0.80% | 1.30% |

| 23:30 | JPY | Overall Household Spending Y/Y Apr | -4.40% | -2.30% | -1.90% | |

| 01:30 | AUD | Current Account (AUD) Q1 | 12.3B | 15.0B | 14.1B | 11.7B |

| 04:30 | AUD | RBA Interest Rate Decision | 4.10% | 3.85% | 3.85% | |

| 06:00 | EUR | Germany Factory Orders M/M Apr | 3.80% | -10.70% | ||

| 08:30 | GBP | Construction PMI May | 50.9 | 51.1 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | 0.20% | -1.20% | ||

| 12:30 | CAD | Building Permits M/M Apr | 0.20% | 11.30% | ||

| 14:00 | CAD | Ivey PMI May | 57.2 | 56.8 |