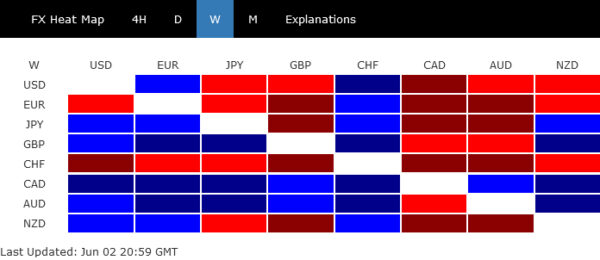

Global stock markets registered impressive gains last week, with the resolution of the US debt ceiling and robust American job data contributing to the bullish momentum. The ebbing expectation of a Federal Reserve rate hike in June also provided additional support. Canadian and Australian dollars emerged as the week’s top performers, reflecting the market’s increased anticipation of tighter monetary policy by BoC and RBA, even though these moves are not imminent. The British pound also showcased significant strength, gaining ground against other European majors.

Despite closing as the third weakest, the US dollar staged a notable rally towards the end of the week against Euro, Yen, and European majors. This surge was mirrored in stock markets and seems to indicate continuous decoupling from risk sentiment. This trend is expected to persist for some time. On the other end of the spectrum, Euro and Swiss Franc found themselves at the bottom of the performance chart. Lower than expected Eurozone headline and core inflation readings exerted significant pressure on these currencies, leading to their underperformance.

US stocks soar, retest of record high attainable in H2

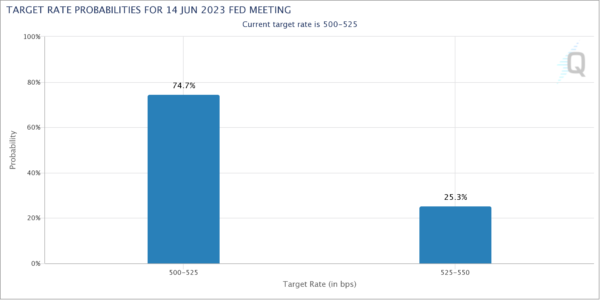

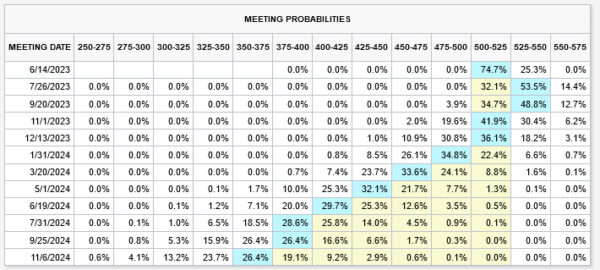

Last week saw a significant upswing in US stocks, primarily spurred by the resolution of the contentious debt ceiling issue and robust economic data. Market sentiment received a further boost from Friday’s impressive non-farm payroll report. Coupled with recent remarks by Fed officials hinting at a potential pause in interest rate hikes in June, market players are increasingly expecting a “skip” at the upcoming Fed meeting.

Fed funds futures now indicate a near 75% chance of a hold on June 14. They also predict a 67.9% probability of a further 25bp hike to a range of 5.25-5.50% on July 26, with a 61.5% chance of rates remaining unchanged post September 20 meeting. Expectations are currently at 63.4% for a rate cut to start in November.

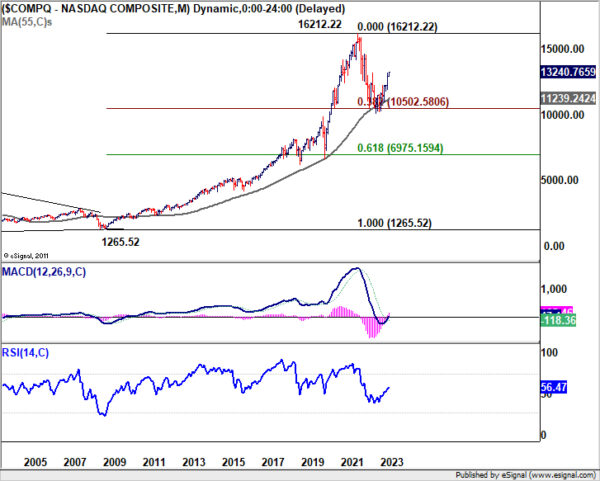

NASDAQ led the way in last week’s rally, closing at its highest level in over a year, bolstered by influential mega-cap companies including chipmakers Nvidia and AMD, and AI trailblazers Alphabet and Microsoft.

In technical terms, the close above the resistance level of 13181.08 appears to confirm that NASDAQ’s correction from 2021 high of 16212.22 ended at 10088.82. Such an outcome came after the support drawn from the 55 M EMA and 38.2% retracement of 1265.52 to 16212.22 at 10502.58.

Near term outlook will now stay bullish as long as 12756.22 support holds. Next target is 161.8% projection of 10088.82 to 12269.55 from 10982.80 at 14511.22.

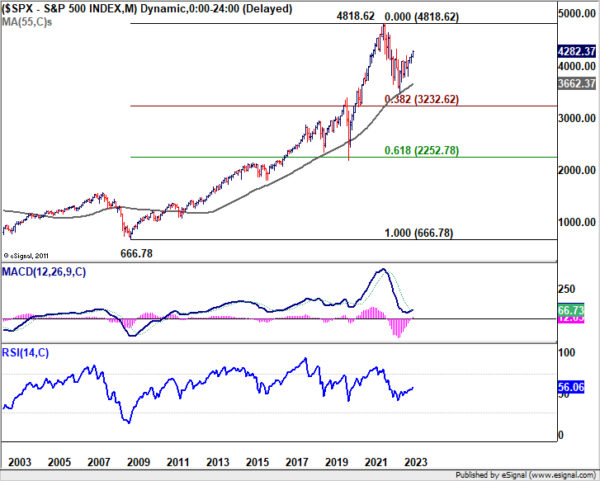

S&P 500 also enjoyed a vigorous rally last week, closing at 4282.37 and now setting its sights on 4325.28 structural resistance. Decisive break above this resistance will signal completion of the correction from the 2021 high of 4818.62, following support from the 55 M EMA.

In any case, near term outlook in SPX will now stay bullish as long as 4166.16 support holds. Next target is 100% projection of 3491.58 to 4100.51 from 3808.86 at 4417.79.

As it stands, it should be noted that while still a bit distant, retests of record highs in both NASDAQ and S&P 500 in the second half of the year now looking attainable.

Concurrently, US 10-year yield retreated significantly last week due to diminishing expectations of a June Fed rate hike. Despite this, TNX managed to draw support from 55 Day EMA now at 5.879) to recover and close at 3.691, thus maintaining some degree of near-term bullishness. Outlook remains unchanged, as the correction from 4.333 seems to have completed in three waves down to 3.253, with expectations of another rise towards 4.091 structural resistance.

Dollar in retreat, but further rally still expected for near term

Dollar’s correlation with overall risk sentiment appeared to continue to be unclear last week. Dollar index retreated after edging higher to 104.69. But DXY recovered notably on Friday (together with strong rally in stocks) to close at 104.01.

Further rally is expected in Dollar Index as long as 55 D EMA (now at 102.95) holds. Rise from 100.78 is seen as the third leg of the pattern from 100.82, and should target 105.88. Strong resistance could be seen from 38.2% retracement of 114.77 to 100.82 at 106.14 to limit upside, at least on first attempt.

EUR/CAD extended corrective fall, GBP/AUD risks topping

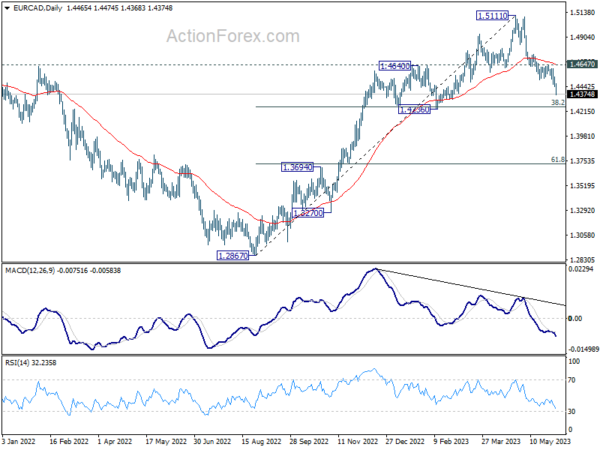

Euro ended as one of the worst performers in spite of persistent hawkish comments from ECB officials. Lower than expected headline and core inflation reading in May was a factor driving the weakness. Additionally, markets have increased expectation on extended tightening by some other major central banks, including BoC and RBA.

EUR/CAD resumed the corrective fall from 1.5111 last week to close at 1.4374. Near term outlook will stay bearish as long as 1.4647 resistance holds. Next target is 1.4256 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254). Strong support could be seen there to bring rebound, at least on first attempt. However, sustained trading below 1.4254/56 will bring even deeper decline to next cluster support at 1.3694 (61.8% retracement at 1.3724).

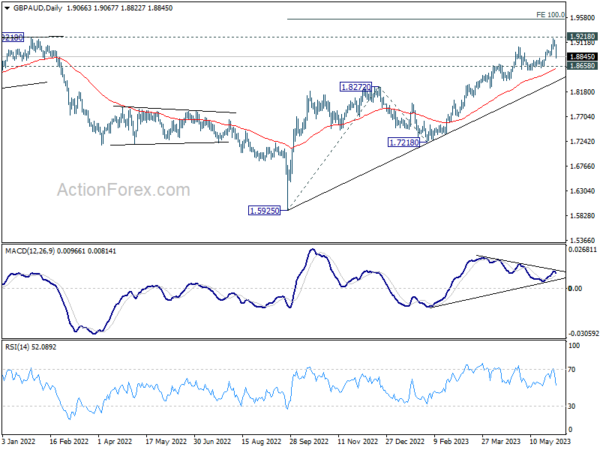

While GBP/AUD extended up trend to as high as 1.9180 risk of deeper pull back and extended correction is increasing. Considering bearish divergence condition in D MACD, firm break of 1.8658 support will indicate medium term topping, just a head of 1.9218 key resistance level. In this case, deeper decline could be seen to 1.8272 resistance support and possibly below, to correct whole up trend from 1.5925. However, firm break of 1.9218 will extend the up trend to 100% projection of 1.5925 to 1.8272 from 1.7218 at 1.9565 before topping.

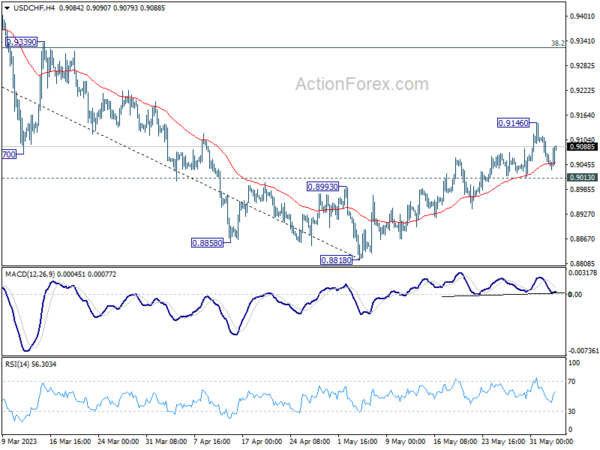

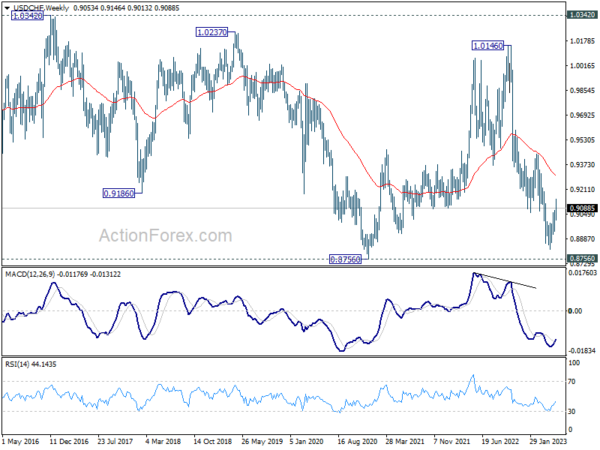

USD/CHF Weekly Outlook

USD/CHF rebounded to 0.9146 last week but retreated since then. Initial bias remains neutral this week for consolidations. But further rally is expected as long as 0.9013 minor support holds. Rise from 0.8818 short term bottom is seen as corrective whole down trend from 1.0146. Above 0.9146 will target 38.2% retracement of 1.0146 to 0.8818 at 0.9325. On the downside, however, break of 0.9013 will turn bias back to the downside for retesting 0.8818 low instead.

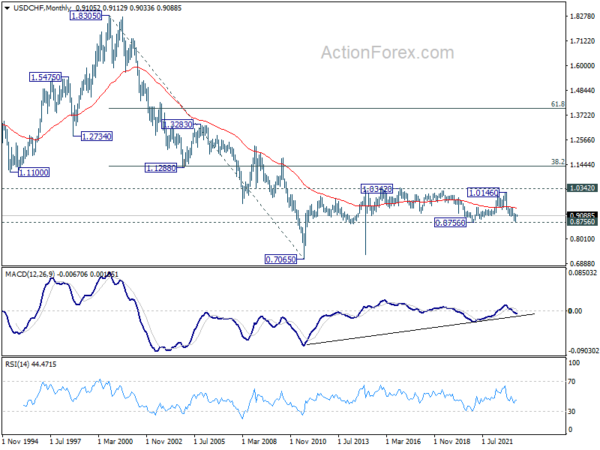

In the bigger picture, fall from 1.1046 (2022 high) is seen as a leg in the long term range pattern from 1.0342 (2016 high), which might have completed at 0.8818 already, just ahead of 0.8756 long term support. Sustained trading above 0.9058 support turned resistance should confirm medium term bottoming. Further break of 0.9439 resistance will confirm bullish trend reversal.

In the long term picture, long term sideway pattern from 1.0342 (2016 high) is expected to continue between 0.8756/1.0342. However, sustained break of 0.8756 will open up deeper fall back towards 0.7065 (2011 low).