Asian stocks took a beating today as disappointing economic data from China put a damper on the region’s markets. The bearish mood led to widespread selling of commodity currencies. Despite higher-than-expected CPI figures, Australian Dollar found little support, while an uptick in New Zealand business confidence did little to boost Kiwi.

As investors sought safe haven assets, Japanese Yen led the pack in a strong rebound, while Dollar also saw broad gains riding on the current risk-off sentiment. European majors displayed mixed performance with Sterling outperforming, extending its weekly rally against Euro and Swiss Franc.

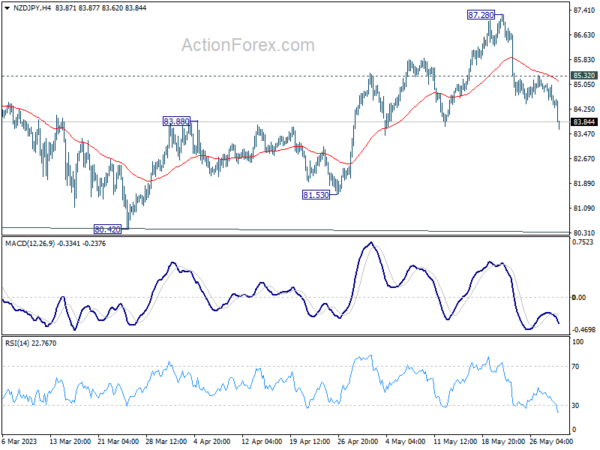

From a technical perspective, NZD/JPY’s drop from 87.28 continued today, with sign of downside re-acceleration. This decline is viewed as a falling leg within the medium-term range pattern. Deeper fall is expected as long as 85.32 minor resistance level holds, aiming towards 81.53 support level and possibly further, to extend range trading.

In Asia, Nikkei closed down -1.41%. Hong Kong HSI is down -2.76%. China Shanghai SSE is down -0.86%. Singapore Strait Times is down -0.81%. Japan 10-year JGB yield is down -0.0031 at 0.433. Overnight, DOW dropped -0.15%. S&P 500 rose 0.00%. NASDAQ rose 0.32%. 10-year yield dropped -0.110 to 3.700.

China’s manufacturing PMI slides to five-month low as economic recovery stumbles

China NBS PMI Manufacturing dropped from 49.2 to 48.8 in May, below expectation of 49.4. That’s the lowest level in five months. New orders sub-index followed suit, slipping from 48.8 in April to 48.3 in May, while the new export orders sub-index descended from 47.6 to 47.2.

PMI Non-Manufacturing dropped from 56.4 to 54.5, below expectation of 54.9, lowest growth in four months. The official composite PMI, encapsulating both manufacturing and services activity, fell from 54.4 in April to 52.9 in May.

“China’s economic-prosperity level has receded, and the foundation for recovery and development still needs to be consolidated,” said NBS senior statistician Zhao Qinghe.

Japan industrial production down -0.4% mom in Apr, retail sales disappoint

Japan’s industrial production experienced a contraction of -0.4% mom in April, a significantly worse result than expectation of 1.4% mom growth.

According to survey by the Ministry of Economy, Trade and Industry, manufacturers are forecasting an output increase of 1.9% in May and 1.2% in June. This rise is expected to be driven by an easing in parts shortages, which should lift production in transportation and production machinery.

Despite these projections, a METI official struck a more cautious note, stating, “The current production sentiment is still bearish due to ongoing concerns about the downturn in overseas economies.”

Meanwhile, the country’s retail sales also delivered disappointing results. They rose 5.0% yoy, falling short of the anticipated 7.1% yoy increase. On a month-on-month basis, retail sales contracted by -1.2% in April, reversing the 0.3% gain recorded in March.

Australia CPI jumped back to 6.8% yoy in Apr, ex-volatile items down to 6.5% yoy

Australia monthly CPI jumped from 6.3% yoy to 6.8% yoy in April, well above expectation of 6.4% yoy. Excluding volatile items of automotive fuel, fruit and vegetables and holiday travel, CPI slowed from 6.9% yoy to 6.5% yoy.

Michelle Marquardt, ABS head of prices statistics, said: “It’s important to note that a significant contributor to the increase in the annual movement in April was automotive fuel. The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023.”

New Zealand ANZ business confidence rose to -31.1, RBNZ back at hike by year-end

New Zealand’s ANZ Business Confidence Index climbed from -43.8 to -31.1 in May, offering some positive news for the economy. Own Activity outlook also edged higher, moving from -7.6 to -4.5.

A more granular look at the data reveals that export intentions went up from -1.5 to 2.0, while investment intentions remained steady at -6.8. However, employment intentions slid from -2.4 to -5.7.

Pricing intentions dipped slightly from 53.7 to 52.4, while cost expectations barely shifted, coming down from 84.2 to 84.1. Profit expectations saw a significant uplift, rising from -37.7 to -27.4. Inflation expectations also moderated, falling from 5.70% to 5.47%.

ANZ commented on the findings, noting that while RBNZ may view the economy as broadly sluggish, the picture isn’t entirely clear. In their words, “Things are patchy, certainly, but most activity indicators are well off their lows and rising, while cost and price indicators are inching lower, rather than plunging.”

In light of these developments, ANZ continues to predict that RBNZ will resume rate hikes by the end of the year, potentially countering the additional stimulus from robust net migration and higher fiscal spending than anticipated. “We continue to expect that the RBNZ will be back at the hiking table by the end of the year.”

Looking ahead

Swiss retail sales, France GDP, Germany unemployment and CPI flash will be featured in European session. Later in the data, Canada GDP will take center stage. Fed will publish Beige Book economic report.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6494; (P) 0.6526; (R1) 0.6550; More…

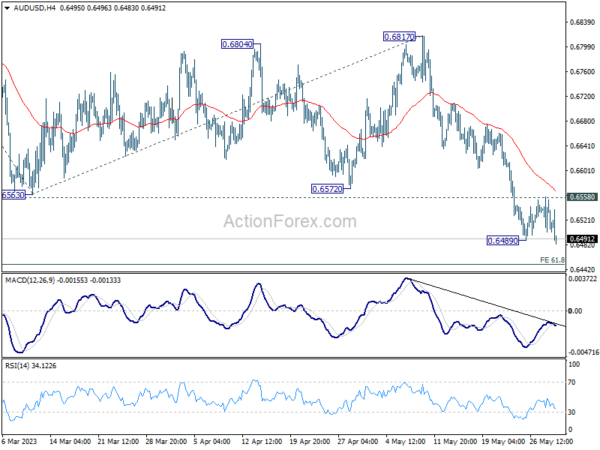

Intraday bias in AUD/USD is back on the downside with breach of 0.6489 temporary low. Current down trend from 0.7156 should target 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451. Firm break there will target 100% projection at 0.6224. On the upside, however, break of 0.6558 resistance will now indicate short term bottoming, and turn bias back to the upside for stronger rebound.

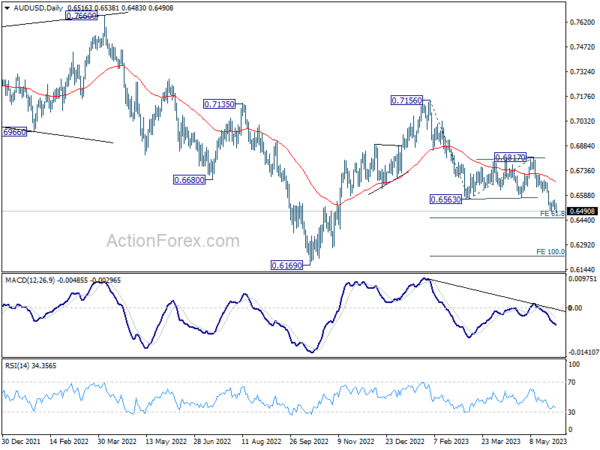

In the bigger picture, rejection by 55 W EMA (now at 0.6822) keeps medium term outlook bearish. Current development suggests that down trend from 0.8006 (2021 high) is possibly still in progress. Retest of 0.6169 (2022 low) should be seen next. Firm break there will confirm down trend resumption. For now, this will remain the favored case as long as 0.6817 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Apr P | -0.40% | 1.40% | 1.10% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | 5.00% | 7.10% | 7.20% | 6.90% |

| 01:00 | NZD | ANZ Business Confidence May | -31.1 | -43.8 | ||

| 01:30 | AUD | Monthly CPI Y/Y Apr | 6.80% | 6.40% | 6.30% | |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.60% | 0.30% | 0.30% | 0.20% |

| 01:30 | AUD | Construction Work Done Q1 | 1.80% | 0.60% | -0.40% | 1.00% |

| 01:30 | CNY | NBS Manufacturing PMI May | 48.8 | 49.4 | 49.2 | |

| 01:30 | CNY | Non-Manufacturing PMI May | 54.5 | 54.9 | 56.4 | |

| 05:00 | JPY | Housing Starts Y/Y Apr | -11.90% | -0.90% | -3.20% | |

| 05:00 | JPY | Consumer Confidence Index May | 36 | 36.1 | 35.4 | |

| 06:00 | EUR | Germany Import Price Index M/M Apr | -1.70% | -0.60% | -1.10% | |

| 06:30 | CHF | Real Retail Sales Y/Y Apr | -1.40% | -1.90% | ||

| 06:45 | EUR | France Consumer Spending M/M Apr | 0.30% | -1.30% | ||

| 06:45 | EUR | France GDP Q/Q Q1 | 0.20% | 0.20% | ||

| 07:55 | EUR | Germany Unemployment Change Apr | 15K | 24K | ||

| 07:55 | EUR | Germany Unemployment Rate Apr | 5.60% | 5.60% | ||

| 08:00 | CHF | Credit Suisse Economic Expectations May | -33.3 | |||

| 12:00 | EUR | Germany CPI M/M May P | 0.30% | 0.40% | ||

| 12:00 | EUR | Germany CPI Y/Y May P | 6.50% | 7.20% | ||

| 12:30 | CAD | GDP M/M Mar | -0.10% | 0.10% | ||

| 13:45 | USD | Chicago PMI May | 47.1 | 48.6 | ||

| 18:00 | USD | Fed’s Beige Book |