Asian trading remains relatively subdued today, with the exception of Yen’s ongoing selloff. Meanwhile, Dollar attempts a weak recovery, while Euro and New Zealand Dollar are softer for now. The focus may shift away from the greenback this week, as significant data releases from other regions take center stage. Specifically, CPI data from the UK, Canada, New Zealand, and Japan will be in the spotlight, while PMIs from Australia, Japan, the Eurozone, and the UK will also be closely monitored. Additionally, China’s GDP data may have an impact on the markets.

AUD/CAD is an intriguing pair to watch this week, as both Canadian CPI data and Chinese economic figures could spark strong market reactions. Technically, the cross is losing downside momentum, as evidenced by bullish convergence condition in 4H MACD, while it approaches 61.8% projection of 0.9545 to 0.9043 from 0.9229 at 0.8919. Solid support at this level, followed by a break of 0.9065 resistance, would confirm short-term bottoming and serve as an early indication of trend reversal towards 0.9229 resistance. On the other hand, decisive break of 0.8919 could trigger reacceleration towards 100% projection at 0.8727.

In Asia, at the time of writing, Nikkei is up 0.07%. Hong Kong HSI is up 0.85%. China Shanghai SSE is up 1.11%. Singapore Strait Times is up 0.10%. Japan 10-year JBG yield is up 0.0196 at 0.481.

NZ BNZ Services dropped to 54.4, but keeps its head above water

New Zealand’s service sector growth slowed down in March, with the BusinessNZ Performance of Services Index (PSI) declining to 54.4 from 55.8 in February. However, the index stayed above the long-term average of 53.6.

BusinessNZ Chief Executive Kirk Hope highlighted the uptick in negative sentiment, with the proportion of negative comments surging from 51.9% in February to 58.6% in March. The main concerns expressed were a cooling economy, the impact of price increases, and overall uncertainty.

Despite these challenges, BNZ Senior Economist Craig Ebert remains cautiously optimistic. He noted that while the PSI held relatively steady in March, the Performance of Manufacturing Index (PMI) slipped into slightly negative territory. Nonetheless, Ebert believes that there is enough positive momentum to suggest an underlying tendency for growth in activity.

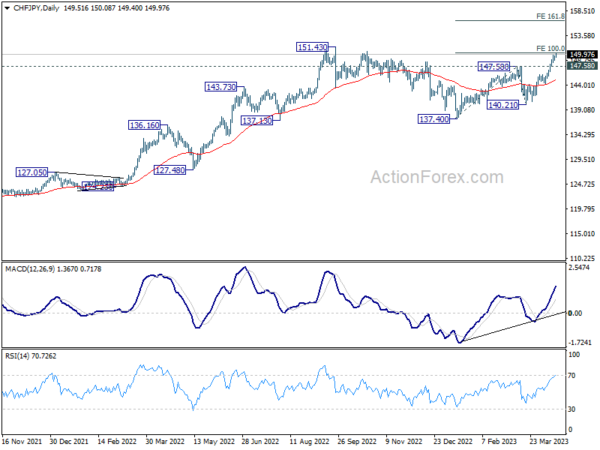

Yen’s downward spiral persists ahead of inflation data, CHF/JPY aiming new high

Japanese Yen continues its selloff in Asian session, remaining the worst performer in April thus far. The currency’s weakness is primarily driven by expectations of ongoing policy divergence between BoJ and other major central banks, as well as a rebound in major global benchmark yields.

New BoJ Governor Kazuo Ueda appears in no rush to modify the parameters of yield curve control or the framework itself, nor does he seem ready to alter the joint statement between the central bank and the government. Consequently, the BoJ’s exit from its ultra-loose monetary policy appears distant.

This stance is based on the assumption that Japan’s inflation will slow this year, while domestic wage growth momentum is insufficient to maintain a sustainable 2% inflation target. Markets are awaiting this week’s March CPI report to determine the validity of this view.

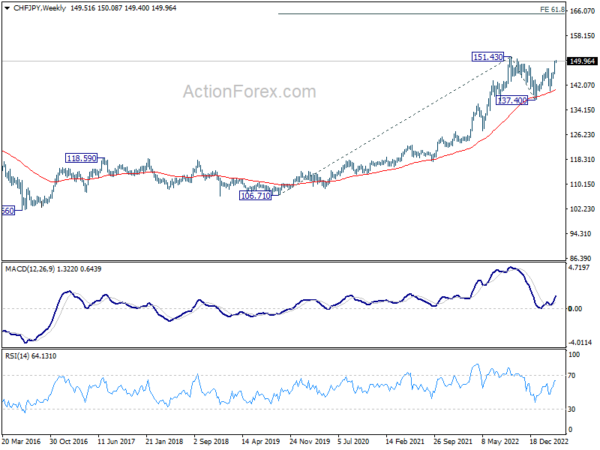

From a technical perspective, CHF/JPY is a key pair to watch, as it could be the first Yen pair to break through last year’s high and resume its long-term uptrend. The cross is currently rallying towards 151.43 high, with upside acceleration reflected in daily MACD. A firm break here would target 161.8% projection of 137.40 to 147.58 from 140.21 at 154.27. The outlook will remain bullish as long as 147.58 resistance-turned-support holds during any retreats.

While it may be too early to evaluate, a sustained break of 151.54 could also signal the resumption of the two-decade uptrend from the 58.83 (2000 low). The next medium-term target would the 61.8% projection of 106.71 to 151.43 from 137.40 at 165.30.

Inflation Takes the Limelight in a Busy Week Ahead

The upcoming week is packed with key inflation data. The leading acts are undoubtedly the UK and New Zealand’s CPI releases. These reports promise to not only grip our attention but also reaffirm BoE’s and RBNZ’s unwavering dedication to further monetary tightening. Canada and Japan’s CPI data, while not the stars of the show, play critical supporting roles in guiding BoC’s and BoJ’s future strategies.

An ensemble of PMI reports from Australia, Japan, Eurozone, the UK, and the US graces the stage, and offer further insight into current economic trends, including activity, employment, and prices.

PMIs from Australia, Japan, the Eurozone, the UK, and the US will offer further insight into current economic trends, including activity, employment, and prices.

Additional data to watch include UK employment and retail sales, Germany’s ZEW report, and a slew of Chinese data, including GDP. These acts have the potential to send ripples of volatility through the market sentiment.

In central bank activity, meeting minutes from the RBA and ECB will take the spotlight, while the Fed is set to release its Beige Book economic report.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index; Canada wholesales; US Empire state manufacturing index, NAHB housing index.

- Tuesday: RBA minutes; China GDP, industrial production, retail sales, fixed asset investment; UK employment; Germany ZEW; Eurozone trade balance; Canada CPI; US building permits and housing starts.

- Wednesday: UK CPI, PPI; Eurozone current account, CPI final; Canada housing starts, IPPI and RMPI; Fed’s Beige Book.

- Thursday: Japan trade balance, tertiary industrial index, tertiary industry index; New Zealand CPI; Australia NAB quarterly business confidence; Germany PPI; ECB meeting accounts; US jobless claims, Philly Fed survey, existing home sales.

- Friday: Australia PMIs; Japan CPI, PMI manufacturing; UK retail sales PMIs; Eurozone PMIs; Canada retail sales; US PMIs.

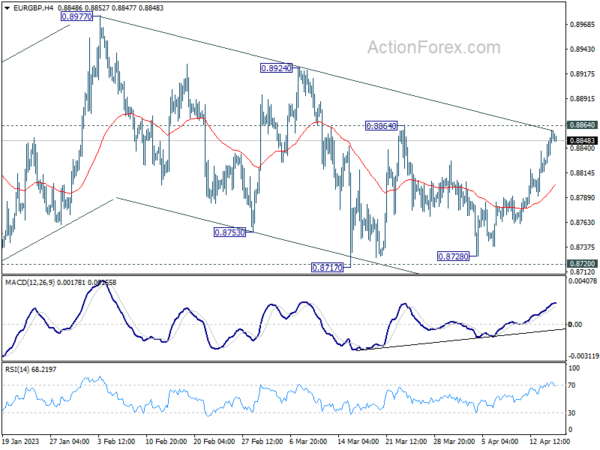

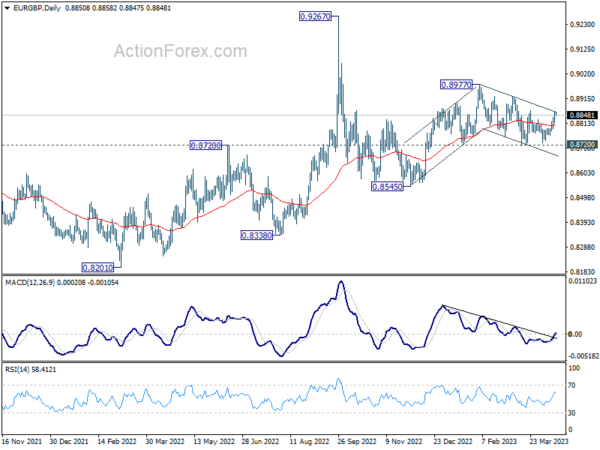

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8829; (P) 0.8844; (R1) 0.8871; More…

Intraday bias in EUR/GBP stays neutral first with focus on 0.8864 resistance. Firm break there will extend the rebound from 0.8717 to 0.8924 resistance. Further break there should confirm completion of the choppy decline form 0.8977, and should resume larger rise from 0.8545 through 0.8977 high. However, decisive break of 0.8717 support will resume the decline from 0.8977 instead.

In the bigger picture, outlook remains rather mixed for now, except that price actions from 0.9267 (2022 high) are part of the long term range pattern from 0.9499 (2020 high). With 0.8720 support intact, rise from 0.8545 is in favor to continue through 0.8977. However, firm break of 0.8720 will argue that such rebound has completed, and open up deeper fall through this support level.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Mar | 54.4 | 55.8 | ||

| 12:30 | CAD | Wholesale Sales M/M Feb | -1.60% | 2.40% | ||

| 12:30 | CAD | Foreign Securities Purchases (CAD) Feb | 6.28B | 4.21B | ||

| 12:30 | USD | Empire State Manufacturing Index Apr | -18.2 | -24.6 | ||

| 14:00 | USD | NAHB Housing Market Index Apr | 44 | 44 |