Dollar fell to its lowest level of the year and breached a critical support, after being under pressure for most of the week. Yet, it staged a recovery towards the end, closing mixed only. Decelerating US inflation data was welcomed by risk market investors, but a lower terminal rate may not necessarily lead to an earlier rate cut. While risk-on sentiment received a boost, the markets seem somewhat uncertain. Whether the greenback can find a bottom at current levels may depend on overall developments in other markets like stocks and bonds.

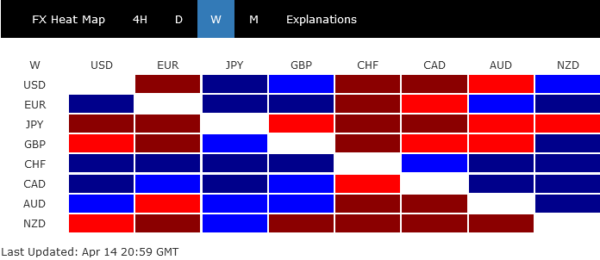

Staying in the currency markets, Yen emerged as the week’s worst performer, following new BoJ Governor Kazuo Ueda’s persistent commitment to ultra-loose monetary policy. New Zealand Dollar came in as the second worst, largely due to a reversal in its cross against Australian Dollar. Swiss Franc ended as the strongest currency, followed by Canadian Dollar and Euro.

US Disinflation Continues, Fed Opinions Diverge on Rate Hikes

One of the major themes last week was that disinflation continued in the US as reflected by latest CPI and PPI data. Meanwhile, retail sales contracted for another month in March, indicating that inflation and higher interest rates were starting to bite into people’s pockets. Jobless claims had also returned to a more “normal” level above 200k, suggesting that the economy has already be cooling.

However, opinions among Fed officials remain divided. Hawks, such as Fed Governor Christopher Waller, bemoaned the lack of “much progress” on core inflation. In contrast, doves like Chicago Fed President Austan Goolsbee urged caution, calling for restraint in tightening. Additionally, a dampener was put on inflation optimism as the University of Michigan’s consumer inflation expectation for the year ahead spiked from 3.6% to 4.6%.

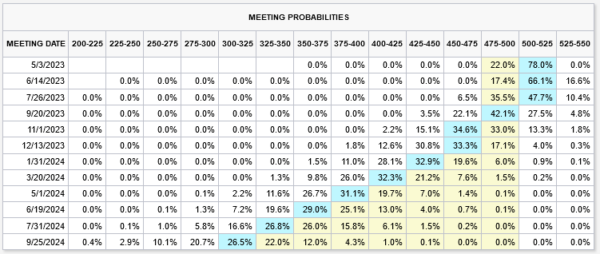

Regardless, Fed is undoubtedly nearing a pause in rate hikes, even if it remains uncertain whether it will be a “one and done” in May. Diverging opinions from Fed officials are expected during this stage of the cycle. What is more critical is when Fed will start reversing the rate hikes. Fed funds futures are pricing in a near 58% chance of rates staying at 5.00-5.25% in July (after one more hike in May) and a 68% chance of a cut in September. Excluding a resurgence and intensification of the banking crisis, these pricings are overly aggressive, considering that Fed officials and projections have essentially ruled out a cut this year. However, the situation is evolving week by week.

Dollar Index Testing Key Support Support, Yet Uncertainty Remains

Last week, Dollar Index dipped to a new 2023 low at 100.78 but found substantial support at 100.82, ultimately recovering to close at 101.55. From a technical perspective, the base case suggests that price movements from 100.82 are unfolding into a three-wave corrective pattern. As such, sustained break below 100.82 is not anticipated for now, and a rebound is due.

On the upside, a break through 102.51 resistance level would confirm short-term bottoming and trigger stronger rally towards 105.88 resistance, passing through 55 D EMA (now at 103.16).

Conversely, a decisive break below 100.82 would nullify this outlook and lead to a resumption of the overall downtrend from 114.77. In this scenario, Dollar Index may only find enough support for a bounce at 55 W EMA (now at 97.76), which is near to 38.2% retracement of 70.69 to 114.77 at 97.93.

Dollar’s Fate Hangs in the Balance: Risk Appetite and Yields

Whether Dollar could rebound from the current level would very much also depend on the interaction with other markets. The extended rally in stocks and improvement in risk appetite is negative for the greenback. But at the same time, rebound in treasury yields should be supportive. It remains to be seen which factor would persist further and exert a larger influence on Dollar.

Recent development suggests that DOW’s corrective pattern from 34712.28 has completed with three waves down to 31429.82 already. Further rise is expected as long as 55 D EMA (now at 33106.92) holds. Break of 34712.28 resistance is likely as the rally extends. The main level to watch is 61.8% projection of 28660.94 to 34712.28 from 31429.82 at 35169.54. If realized, the development would at least cap any rebound momentum of Dollar, with prospect of trigger deeper selloff.

10-year yield’s strong close last week raises the chance of short term bottoming at 3.351. More importantly, the whole corrective pattern from 4.333 might have completed with three waves down to there too. Near term focus is shifted to 3.610 resistance. Firm break there will add to this bullish case and bring stronger rise back to 4% handle, or to 4.091 resistance. This development, if realized will help limit downside momentum in Dollar. However, rejection by 3.610 and 55 D EMA (now at 3.583) should extend the decline from 4.333 through 3.351 later.

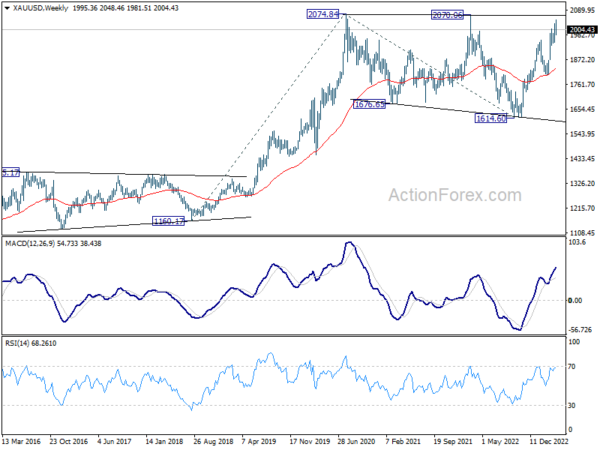

Gold, though more influenced by the Dollar than vice versa, is still worth monitoring to confirm the greenback’s underlying direction. While Gold rose further to 2048.26, it’s starting to feel heavy ahead of 2070.06/2074.84 long term resistance zone. Bearish divergence in 4H MACD suggests that a short term top is possibly in place already. Deeper pull back is likely for 38.2% retracement of 1804.48 to 2048.26 at 1955.13, which is close to 1949.55. Strong support could be seen there to contain downside to bring rebound. But sustained break of this fibonacci level will bring deeper pull back to 61.8% retracement at 1897.60.

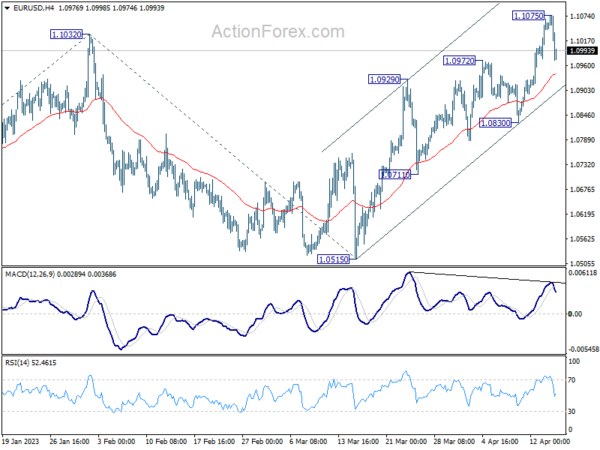

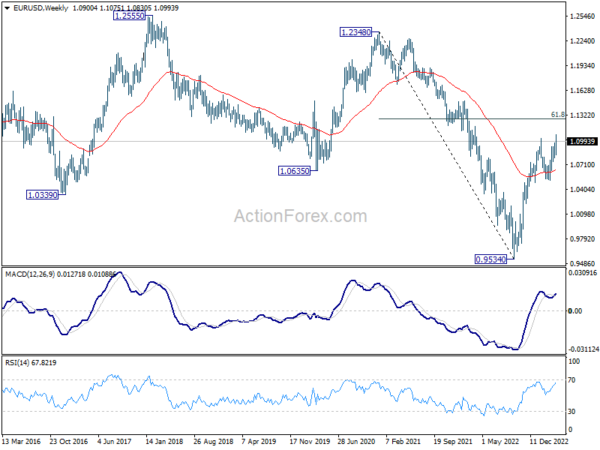

EUR/USD Weekly Outlook

EUR/USD’s up trend resumed last week by breaking through 1.1032 resistance. However, a temporary top was formed after hitting 1.1075. Initial bias is neutral this week for consolidations first. Outlook will stay bullish as long as 1.0830 support holds. Above 1.1075 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441.

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

In the long term picture, while it’s still early to call for long term trend reversal at this point, the strong break of 1.0635 support turned resistance (2020 low) should at least turn outlook neutral. Focus will turn to 55 M EMA (now at 1.1166). Rejection by this EMA will revive long term bearishness.