The dollar is sitting lower on the day as markets are adopting a calmer mood ahead of European morning trade. US futures may not exactly show it but the good news is that there is no further bad news since overnight trading at least.

EUR/USD is up 0.4% to 1.0650 and is looking to build on a bounce off its 100-day moving average, with the ECB sticking to the script in delivering a 50 bps rate hike yesterday. The bond market remains a key spot to watch but overall sentiment will continue to look towards banking stocks before the weekend.

In particular, US trading later will be of keen interest to see how Wall Street takes to the “bailout” of FRB from the big boys.

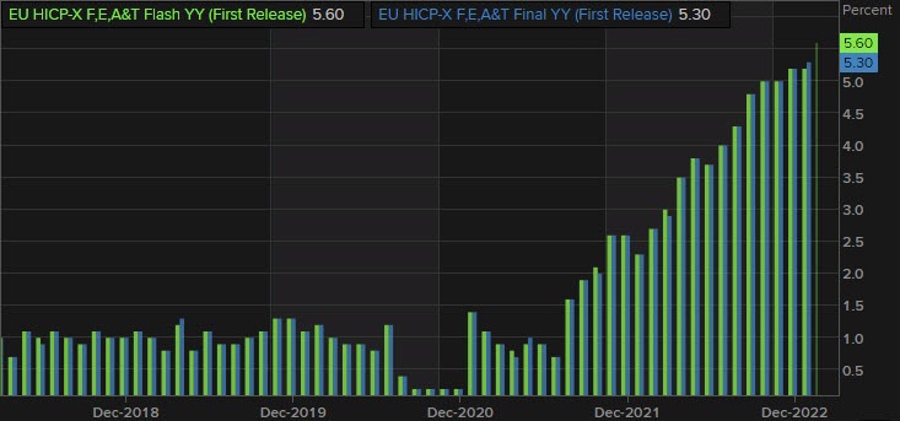

Eurozone final consumer inflation figures for February will be the only notable economic release in the session ahead but that is not likely to be of much impact, as it should just reaffirm that core inflation is still running hot in the euro area.

1000 GMT – Eurozone February final CPI figures

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.