Dollar is fighting back today as jobless claims data continue to show tightness in the labor market. Following the greenback, Canadian dollar is the second strongest currency, surging in crosses. Meanwhile, Euro has failed to show a bullish reaction to stronger-than-expected consumer inflation data, disappointing traders. The common currency is even retreating notably against Swiss Franc. Sterling is also soft, along with the Australian and New Zealand dollars.

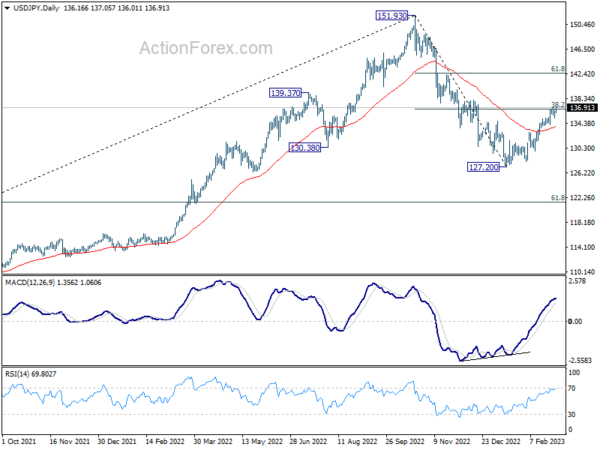

From a technical perspective, USD/JPY is attempting to resume the rise from 127.20, but it has yet to overcome the 38.2% retracement of 151.93 to 127.20 at 136.64 cleanly. A sustained break above this level would be a strong sign of a bullish reversal, with the next target at 61.8% retracement at 142.48. If this were to happen, it could lead to a rise in Dollar and a Selloff in Yen elsewhere at the same time, considering near-term bullishness in US treasury yields.

In Europe, at the time of writing, FTSE is down -0.15%. DAX is down -0.52%. CAC is down -0.13%. Germany 10-year yield is up 0.018 at 2.731. Earlier in Asia, Nikkei dropped -0.06%. Hong Kong HSI dropped -0.92%. China Shanghai SSE dropped -0.05%. Singapore Strait Times dropped -0.62%. Japan 10-year JGB yield dropped -0.0109 to 0.497.

US initial claims dropped to 190k vs exp. 196k

US initial jobless claims dropped -2k to 190k in the week ending February 25, below expectation of 196k. The reading was also below 200k handle for the seventh straight months. Four-week moving average of initial claims rose 1750 to 193k.

Continuing claims dropped -5k to 1655k in the week ending February 18. Four-week moving average of continuing claims rose 1250 to 1672k.

ECB accounts: Concerns of overtightening premature

The accounts of ECB’s February 1-2 meeting noted, “it was generally felt that concerns of ‘overtightening’ were premature at the present high levels of inflation and in view of the likely persistence of underlying price pressures”.

The view was expressed that, “given the still substantial distance to the prospective terminal rate, there continued to be value – from a risk management perspective – in frontloading rate hikes at the present stage.”

The communication regarding March meeting, “conveyed the view that, in the absence of abrupt changes in circumstances, a further 50 basis point interest rate hike at the March meeting was consistent with a very wide range of possible scenarios for the way inflation would develop.”

Eurozone CPI ticked down to 8.5% yoy in Feb, core CPI rose to 5.6% yoy

Eurozone CPI slowed from 8.6% yoy to 8.5% yoy in February, above expectation of 8.2% yoy. CPI core all items ex energy, food, alcohol and tobacco) rose from 5.3% yoy to 5.6% yoy, above expectation of 5.3% yoy.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in February (15.0%, compared with 14.1% in January), followed by energy (13.7%, compared with 18.9% in January), non-energy industrial goods (6.8%, compared with 6.7% in January) and services (4.8%, compared with 4.4% in January).

ECB Lagarde: It’s possible to continue on tightening path after march

ECB President Christine Lagarde told Spain TV channel Antena 3, “at this point in time, it’s possible that we continue on that path (of tightening after March)… By which amount in each and every meeting is impossible to say at this point.”

Regarding the terminal rate, Lagarde said, “the real honest answer is that it will determined by data.”

“What’s very certain is that we’ll do whatever’s needed in order to bring inflation back to 2%,” Lagarde said.

BoJ Takata: We need to patiently maintain monetary easing

BoJ board member Hajime Takata said said in a speech today, “now is the time where the BOJ must scrutinise whether the economy and prices can achieve a sustained, positive cycle.”

“While we need to be mindful of the impact of our massive stimulus program on market function, we’re at a stage where we need to patiently maintain monetary easing,” he said.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0593; (P) 1.0642; (R1) 1.0719; More…

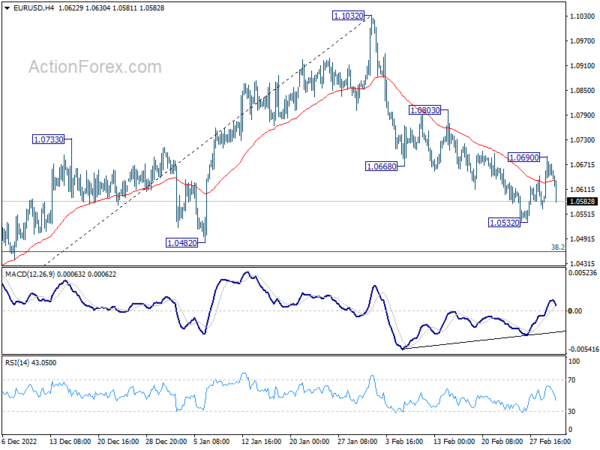

Intraday bias in EUR/USD is turned neutral again as it retreated sharply after hitting 1.0690, and failed to sustain above 4 hour 55 EMA. Fall from 1.1032 could still extend lower. But strong support is expected from 38.2% retracement of 0.9534 to 1.1032 at 1.0463 to bring rebound. Break of 1.0690 will turn bias back to the upside for 1.0803 resistance first. However, sustained break of 1.0463 will carry larger bearish implication and bring deeper decline.

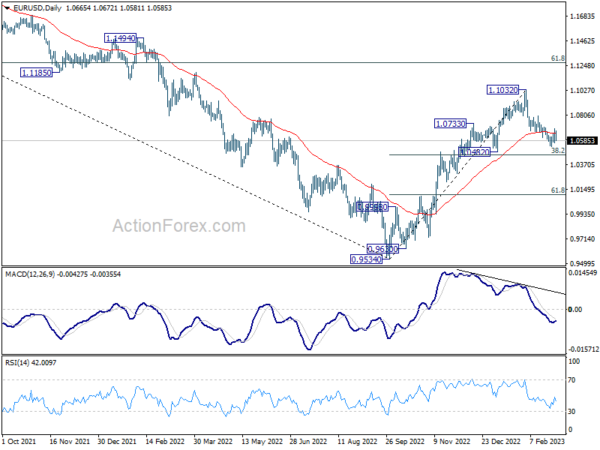

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, even as a corrective pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q4 | 1.80% | -1.70% | -3.40% | -3.90% |

| 23:50 | JPY | Capital Spending Q4 | 7.70% | 6.90% | 9.80% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | -1.60% | -3.20% | -3.80% | |

| 00:30 | AUD | Building Permits M/M Jan | -27.60% | -7.60% | 18.50% | |

| 05:00 | JPY | Consumer Confidence Feb | 31.1 | 32 | 31 | |

| 09:00 | EUR | Italy Unemployment Jan | 7.90% | 7.80% | 7.80% | |

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 6.70% | 6.60% | 6.60% | 6.70% |

| 10:00 | EUR | Eurozone CPI Y/Y Feb P | 8.50% | 8.20% | 8.60% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb P | 5.60% | 5.30% | 5.30% | |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (Feb 24) | 190K | 196K | 192K | |

| 13:30 | USD | Nonfarm Productivity Q4 | 1.70% | 2.50% | 3.00% | |

| 13:30 | USD | Unit Labor Costs Q4 | 3.20% | 1.40% | 1.10% | |

| 15:30 | USD | Natural Gas Storage | -72B | -71B |