Virgin Galactic said on Tuesday it remains on track to resume spaceflights in the coming months after completing upgrades to its carrier aircraft and spacecraft.

The update came alongside the company’s fourth-quarter results, which showed losses roughly in line with its previous quarter.

“Our near-term objective for commercial spaceline operations is to safely deliver recurring flights with our current ships while providing an unrivaled experience for private astronauts and researchers,” Virgin Galactic CEO Michael Colglazier said in a statement.

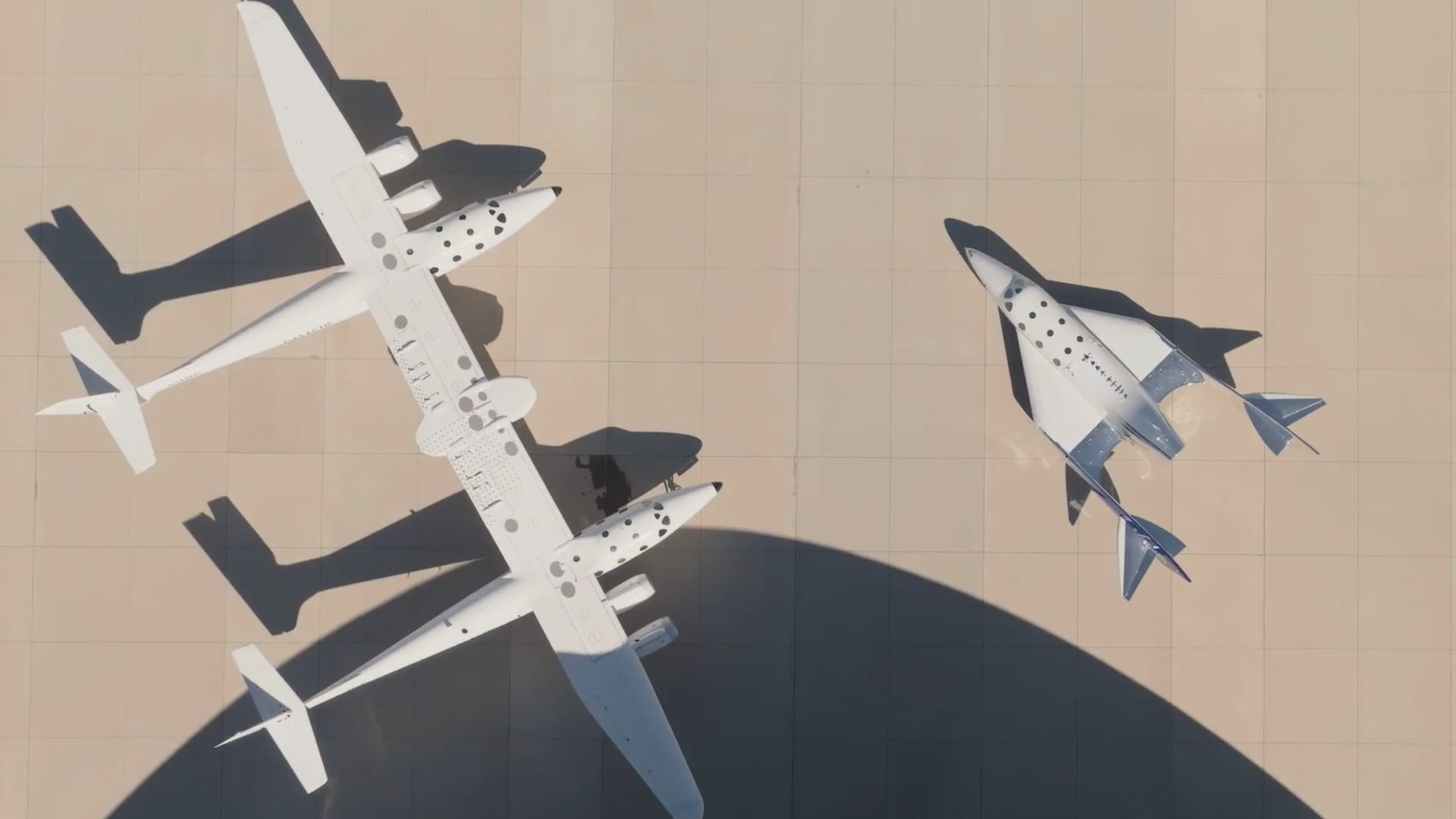

The space tourism company stuck to its goal of conducting its next spaceflights in the second quarter of this year, after a lengthy hiatus dating back to summer 2021. During that period Virgin Galactic conducted a variety of repairs and enhancements to its jet-powered mothership, called VMS Eve.

Earlier this month, the company flew two validation flight tests with VMS Eve and relocated it, from its manufacturing facility in California’s Mojave to Spaceport America in New Mexico.

Next up are a series of tests, starting with attaching the spacecraft VSS Unity to the carrier aircraft while on the ground, to demonstrate work done to reinforce the pylon in the center of VMS Eve’s wing was successful. Then Virgin Galactic will conduct glide tests, where VMS Eve carries the spacecraft and releases it, before a test spaceflight with a full company crew onboard.

After that, the company’s first commercial flight is expected to carry members of the Italian Air Force, before moving on to flights from its backlog of private-paying customers.

For the fourth quarter, the company reported an adjusted EBITDA loss of $133 million, compared with a loss of $65 million a year ago, with negligible revenue. The company has about $980 million in cash on hand.

Shares of Virgin Galactic are up about 65% this year as of Tuesday’s close of $5.74 per share.