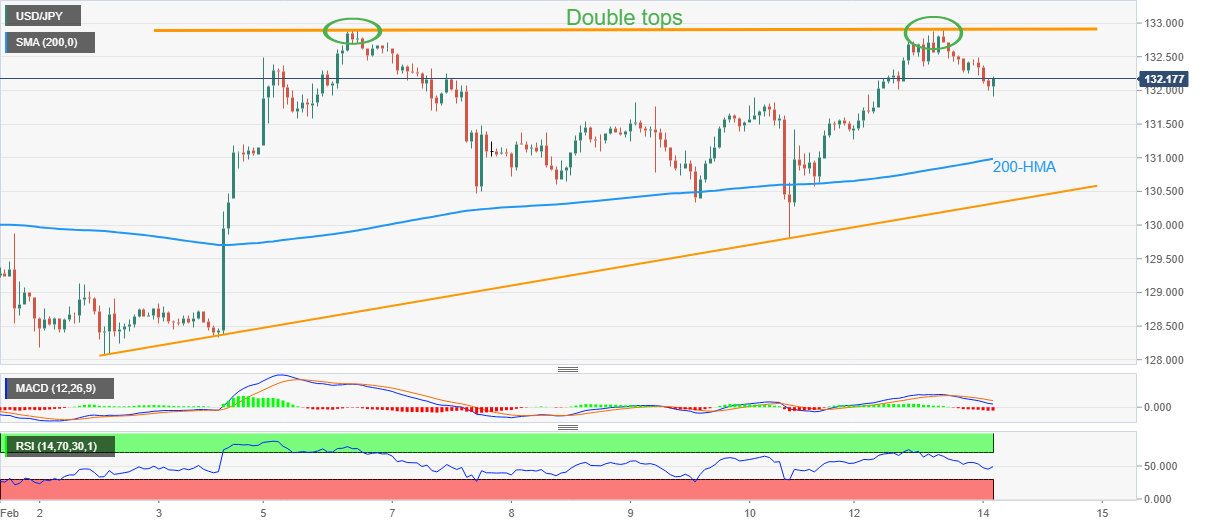

- USD/JPY bounces off intraday low, keeps extends pullback from five-week high.

- RSI’s retreat from overbought conditions joins double top bearish formation to favor sellers.

- 200-HMA, triangle’s support line probe bears even as MACD signals hint at further downside.

USD/JPY prints mild losses around the intraday low of 131.90 as the Japanese government officially nominates Kazuo Ueda to become the next Bank of Japan (BoJ) Governor on early Tuesday.

In doing so, the Yen pair extends the early-day pullback from the previous weekly to surrounding 132.90 and forms “Double tops”, a bearish chart pattern. Also justifying the USD/JPY pair’s latest weakness is the RSI (14) line that took a U-turn from the overbought conditions, not to forget the bearish MACD signals.

With this, the quote is likely to decline toward the 200-Hour Moving Average (HMA) level surrounding 131.00. However, an upward-sloping support line from February 02, forming part of the short-term triangle, could challenge the pair sellers around 130.30 afterward.

In a case where the USD/JPY drops below 130.30, the 130.00 round figure may act as a validation point for the quote’s further downside.

Alternatively, recovery moves remain elusive unless trading below the double tops surrounding 132.90. Also acting as the upside filter is the 133.00 round figure.

Following that, a run-up towards the previous monthly peak surrounding 134.80 can’t be ruled out.

USD/JPY: Hourly chart

Trend: Further downside expected