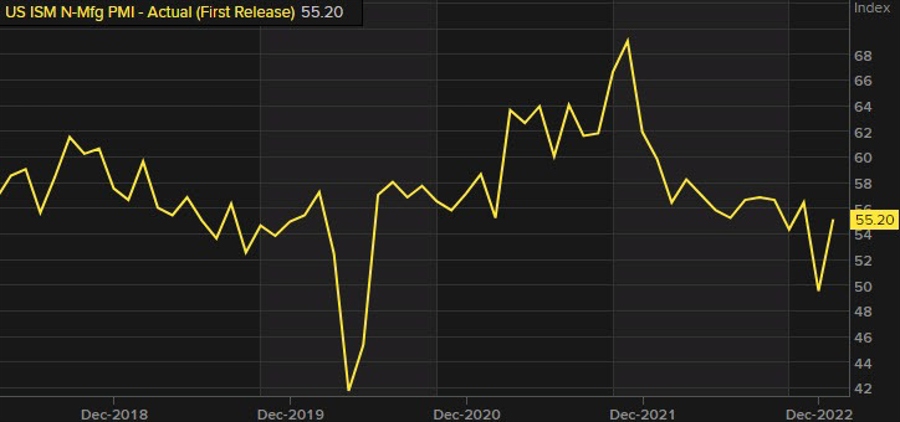

ISM Non Manufacturing index

- Nonmanufacturing PMI index 55.2 versus 50.4 estimate. Prior month 49.2

- nonmanufacturing business activity index 60.4 versus 54.5 estimate. Prior month 53.5

- employment index 50.0 versus 49.4 last month

- new orders index 60.4 versus 45.2 last month

- prices paid index 67.8 versus 68.1 last month

- new export orders 59.0 versus 47.7 last month

- imports 53.0 versus 52.7 last month

- backlog of orders 52.9 versus 51.5 last month

- inventories 49.2 versus 45.1 last month

- supplier deliveries 50.0 versus 48.5 last month

- inventory sentiment 55.8 versus 55.9 last month

biggest monthly gain since June 2020.

What contraction? Coupled with the US jobs report from earlier today, the year is getting off to a solid start. The Fed members have been concerned about the service sector inflation. This report, along with the US jobs report does not appease that concern and will keep the Fed in play for hikes like it or not.

For the full report CLICK HERE.

Some comments:

“Raw material availability and lead times have improved but still pose a challenge. In our outlook, we are positive about growth. Consumer confidence is returning, and people are more willing to spend money on luxury items.” [Accommodation & Food Services]

“Orders are strong, but it’s difficult to support customers’ expectations on delivery due to challenges in the supply chain.” [Other Services]

“Modest increase in sales activity following the holiday slowdown. Still seeing warning signs of a national/international recession. Higher interest rates having an impact. Outlook for the first quarter of 2023 is still projected lower than the same period in 2022.” [Professional, Scientific & Technical Services]

“New residential housing market is still reeling from mortgage rate increases. Sales have fallen off dramatically at entry-level price points, as costs are trending flat.” [Construction]

/inflation