Dollar falls broadly after ADP job data missed expectations, while traders await FOMC rate decision. There is no doubt that Fed will hike interest rate by 25bps today and signals that tightening is not finished. The key questions about the terminal rate, and how long interest rate will stay there, will not be answered, at least until March economic projections. As for today, Canadian is the worst, followed by Dollar and then Swiss Franc. Yen is the strongest, followed by Aussie and then Euro.

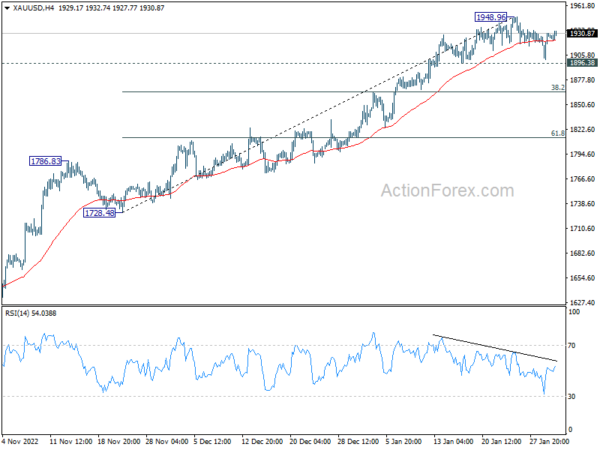

Technically, Gold recovered ahead of 1896.38 minor support, suggests that it’s ready for an extended correction yet. Immediate focus is back on 1948.96 resistance. Firm break there will resume larger rise from 1616.51. If that happens, it could be accompanied by EUR/USD’s break of 1.0928 resistance.

In Europe, at the time of writing, FTSE is up 0.10%. DAX is up 0.39%. CAC is up 0.16%. Germany 10-year yield is down -0.012 at 2.281. Earlier in Asia, Nikkei rose 0.07%. Hong Kong HSI rose 1.05%. China Shanghai SSE rose 0.90%. Singapore Strait Times rose 0.36%. Japan 10-year JGB yield dropped -0.0166 to 0.482.

US ADP employment grew 106k Jan, disrupted by weather

US ADP private employment grew 106k in January, below expectation of 168k. By sector, goods-producing jobs dropped -3k. Service-providing jobs rose 109k. BY establishment size, small companies cut -75k jobs, but medium companies added 64k and large added 128k. Pay growth for job stayers was held at 7.3% yoy for the second month, with most industries little changed.

Nela Richardson Chief Economist, ADP said: “In January, we saw the impact of weather-related disruptions on employment during our reference week. Hiring was stronger during other weeks of the month, in line with the strength we saw late last year.”

Eurozone CPI slowed sharply to 8.5% yoy in Jan, core unchanged at 5.2% yoy

Eurozone CPI slowed sharply from 9.2% yoy to 8.5% yoy in January, well below expectation of 9.0% yoy. CPI core (all items less energy, food, alcohol & tobacco) was unchanged at 5.2% yoy, above expectations of 5.1% yoy.

Looking at the main components, energy is expected to have the highest annual rate in January (17.2%, compared with 25.5% in December), followed by food, alcohol & tobacco (14.1%, compared with 13.8% in December), non-energy industrial goods (6.9%, compared with 6.4% in December) and services (4.2%, compared with 4.4% in December).

Eurozone PMI manufacturing finalized at 48.8 in Jan, picture considerably brighter

Eurozone PMI Manufacturing was finalized at 48.8 in January, up from December’s 47.8, also a 5-month high. Manufacturing Output index was finalized at 48.9, up from December’s 47.8, a 7-month high.

Readings in all member states improved, including France at 50.5 (5-month high), Italy at 50.4 (7-month high), Ireland at 50.1 (3-month high), the Netherlands at 49.6 (5-month high), Greece at 49.2 (4-month high), Austria at 48.4 (4-month high), Spain at 48.4 (4-month high), and Germany at 47.3 (4-month high).

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “Although euro area manufacturers continued to report falling output and deteriorating order books in January, sustaining the sector’s downturn for an eighth successive month, the picture is considerably brighter than the lows seen back in last October heading into the winter. Not only has the rate of output decline moderated now for three consecutive months, but business optimism about the year ahead has also surged higher over the past three months.”

UK PMI manufacturing finalized at 47 in Jan, some shoots of positivity developing

UK PMI Manufacturing was finalized at 47.0 in January, up from December’s 31-month low of 45.3. S&P Global noted that output and new orders fell across all three product categories. Input price inflation eased to 27-month low.

Rob Dobson, Director at S&P Global Market Intelligence, said:“There were some shoots of positivity developing, however. Rates of contraction are generally lower than before the turn of the year, a possible sign that we may be past the worst of the downturn in industry.

“Cost inflation also eased further, while supply chain delays were the least pronounced for three years. Manufacturers’ confidence is also reviving from recent lows, hitting a nine-month high, though the mood continued to be darkened by concerns about inflation and the possibility of recession.”

China Caixin PMI manufacturing ticked up to 49.2, optimism improving

China Caixin PMI Manufacturing ticked up from 49.0 to 49.2 in January. Caixin noted there were softer falls in output and new orders. Supply chain pressures eased. Confidence around the outlook hit the highest level since April 2021.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the pandemic continued to take a toll on the economy in January. Supply and demand weakened, overseas demand was sluggish, employment declined, and logistics hadn’t fully recovered, while the quantity of purchases shrank, inventories dropped, and manufacturers faced growing pressure on profitability. But optimism in the sector continued to improve as businesses expected a post-Covid economic recovery.”

Japan PMI manufacturing finalized at 48.9 in Jan, but some positive signals

Japan PMI Manufacturing was finalized at 48.9 in January, unchanged from January’s 48.9. S&P Global also noted that reductions in output and new orders were slowest since last October. Supply chain disruptions were least widespread for nearly two years. Prices charged inflation cooled to its lowest for 16 months.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “Subdued global economic conditions continued to hold back customer demand across the Japanese manufacturing sector in January, but there were a number of positive signals from the latest PMI survey. The rates of decline for output and new orders were the smallest since last October, whilst marginal employment growth was maintained as manufacturers sought to boost capacity in line with long-term investment plans.”

NZ employment rose 0.2% in Q4, unemployment rate rose to 3.4%

New Zealand employment rose 0.2% in Q4, below expectation of 0.3%. Employment rate was unchanged at 69.3%. Unemployment rate rose from 3.3% to 3.4%, above expectation of 3.3%. Participation rate was unchanged at 71.7%. Labor cost index rose 1.1% qoq, below expectation of 1.3% qoq.

“The unemployment rate, as measured by the Household Labour Force Survey (HLFS), has remained at or near historic lows since the September 2021 quarter,” work and wellbeing statistics senior manager Becky Collett said.

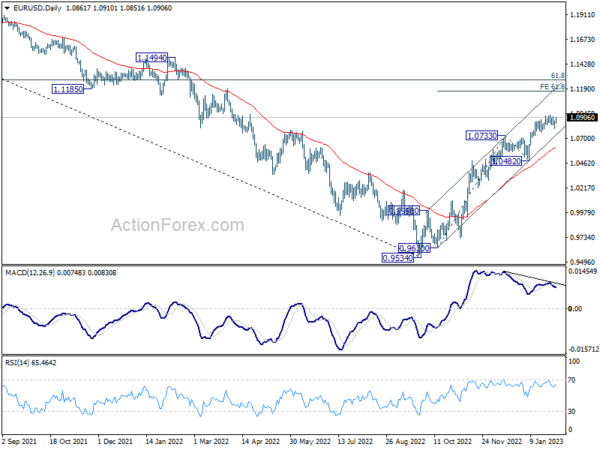

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0818; (P) 1.0846; (R1) 1.0891; More…

Immediate focus is back on 1.0928 resistance in EUR/USD with today’s recovery. Decisive break there will resume larger rise to 61.8% projection of 0.9630 to 1.0733 from 1.0482 at 1.1164 next. On the downside, though, break of 1.0800 support should confirm short term topping, and turn bias back to the downside for 55 day EMA (now at 1.0601).

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.20% | 0.30% | 1.30% | |

| 21:45 | NZD | Unemployment Rate Q4 | 3.40% | 3.30% | 3.30% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q4 | 1.10% | 1.30% | 1.10% | |

| 00:30 | JPY | Manufacturing PMI Jan F | 48.9 | 48.9 | 48.9 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jan | 49.2 | 49.2 | 49 | |

| 08:30 | CHF | Manufacturing PMI Jan | 49.3 | 54.3 | 54.1 | |

| 08:45 | EUR | Italy Manufacturing PMI Jan | 50.4 | 49.6 | 48.5 | |

| 08:50 | EUR | France Manufacturing PMI Jan F | 50.5 | 50.8 | 50.8 | |

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 47.3 | 47 | 47 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 48.8 | 48.8 | 48.8 | |

| 09:30 | GBP | Manufacturing PMI Jan F | 47 | 46.7 | 46.7 | |

| 10:00 | EUR | Eurozone CPI Y/Y Jan P | 8.50% | 9.00% | 9.20% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan P | 5.20% | 5.10% | 5.20% | |

| 13:15 | USD | ADP Employment Change Jan | 106K | 168K | 235K | |

| 14:30 | CAD | Manufacturing PMI Jan | 49.2 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 46.8 | 46.8 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 48.7 | 48.4 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 41.9 | 39.4 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 51.4 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.00% | 0.20% | ||

| 15:30 | USD | Crude Oil Inventories | -1.0M | 0.5M | ||

| 19:00 | USD | Fed Rate Decision | 4.75% | 4.50% | ||

| 19:30 | USD | FOMC Press Conference |