Dollar rebounds broadly in early US session, following benchmark treasury yields higher. But at the time of writing, Aussie is the strongest as supported by positive risk sentiment. Euro follows as it pares back some gains despite more hawkish ECB comments and an upbeat Bundesbank monthly report. Yen is currently the worst performer for the day, followed by Sterling.

Technically, while it’s still early to tell, it won’t be a surprise to see 10-year yield bottomed at 3.373 and stage and a sizeable rebound. The level was close to 61.8% projection of 4.333 to 3.402 from 3.905 at 3.373, as well as medium term trend line support. Sustained trading above 55 day EMA (now at 3.636) should indciate the whole correction from 4.333 has completed in a three wave form. Further rally could then be seen back to 3.905 and above. Such development, if happens, with give the greenback some support, and takes USD/JPY higher in particular.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.11%. CAC is up 0.27%. Germany 10-year yield is up 0.381 at 2.211. Earlier in Asia, Nikkei rose 1.33%. Japan 10-year JGB yield dropped -0.0264 to 0.378. Hong Kong, China, and Singapore were on holiday.

ECB Kazimir: We need to deliver two more hikes by 50bps

ECB Governing Council member Peter Kazimir said, “An inflation drop in two consecutive months is good news. But it is not a reason to slow the tempo of raising interest rates… I am convinced that we need to deliver two more hikes by 50 basis points.”

“For me, the most important is core inflation trend,” Kazimir said. “We are halfway through. If it were up to me, I would enter summer holidays with the tightening cycle completed. But don’t ask me today, how high we will go with the rates, and how long will they need to stay there to tame inflation as needed.”

ECB Stournaras: Adjustment of interest rates needs to be more gradual

ECB Governing Council member Yannis Stournaras said “in my opinion, the adjustment of interest rates needs to be more gradual, taking into account the slowdown in growth of the euro area economy,”

“Given the high uncertainty, ongoing geopolitical and macroeconomic turmoil, and volatility in the markets, it is very difficult to accurately predict the level at which interest rates need to be set,” he added.

Bundesbank: Germany GDP likely to have roughly stagnated in Q4

Bundesbank said in the monthly report that real GDP was “likely to have roughly stagnated in the final quarter of 2022, exceeding earlier expectations”. Real GDP grew 1.9% in 2022 as a whole, comparing to 2021. “It thus slightly exceeded the pre-pandemic level again.”

Consumer price momentum “continued to weaken” in December, due to “significantly lower energy prices”. However, “non-energy components such as food, industrial goods and services continued to rise sharply”.

BoJ Minutes: Meeting suspended at government’s request

published minutes of the December 19-20 meeting today, where the 10-year JGB yield cap was raised from 0.25% to 0.50%.

“Many members noted that there was a distortion in the price formation of 10-year bonds, and that the functioning of bond markets had deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships between spot and futures markets,” the minutes said”.

“Members concurred that, with regard to the conduct of yield curve control, the measure to expand the range of 10-year JGB yield fluctuations to between around plus and minus 0.5 percentage points from the target level, while significantly increasing the amount of JGB purchases, was appropriate.”

Meanwhile, government representatives requested to adjourn the meeting after the discussions. They’re probably surprised by the agreed adjustment to YCC. The meeting was adjourned from 10:51 a.m. to 11:28 a.m. before concluding at 11:54 a.m.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0819; (P) 1.0839; (R1) 1.0876; More…

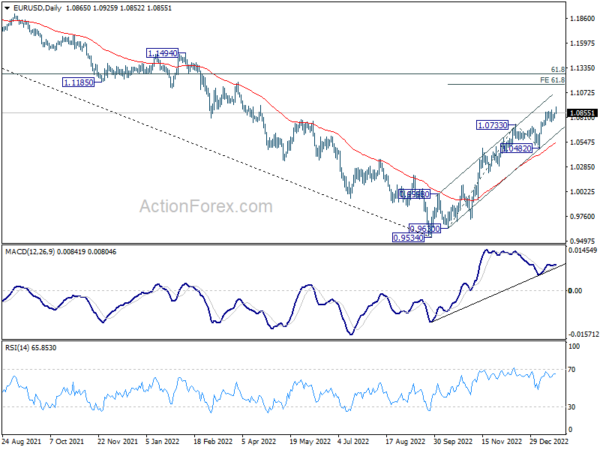

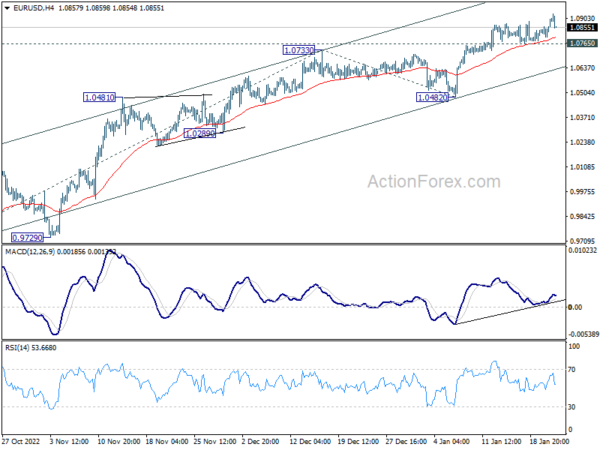

EUR/USD retreats slightly after rising to 1.0925, but stays well above 1.0765 support. Intraday bias stays on the upside first. Current rise from 0.9534 should target 61.8% projection of 0.9630 to 1.0733 from 1.0482 at 1.1164 next. On the downside, though, break of 1.0765 support should now indicate short term topping, and turn bias back to the downside for 55 day EMA (now at 1.0544).

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.0% | -0.2% | -0.20% | |

| 15:00 | EUR | Eurozone Consumer Confidence Jan P | -20 | -22 |