Yen weakens broadly in Asian session despite data showing that inflation hit a four-decade high. Speculations on any BoJ move should cool for a while, given that there is no meeting until March. There is room for Yen to correct lower to digest recent rally. Meanwhile, the Japanese currency is also the worst performer for the week, followed by Aussie and Loonie. Sterling is currently the best, followed by Swiss Franc. Dollar and Euro are mixed.

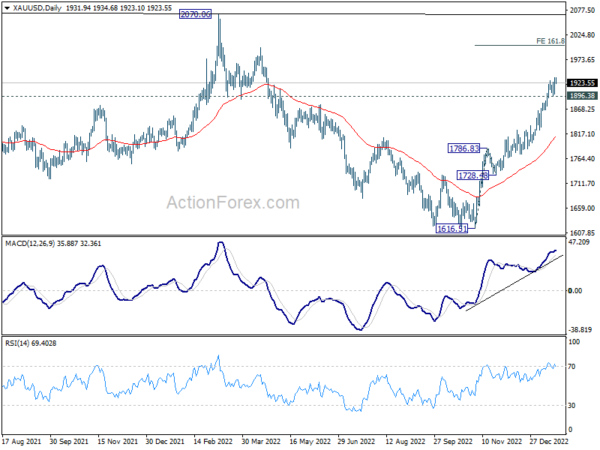

Technically, Gold’s up trend from 1616.51 is still in progress despite being overbought. For now, further rise is expected as long as 1896.38 support holds. Next target is 161.8% projection of 1616.51 to 1786.83 from 1728.48 at 2004.05. Any rebound in Dollar could be capped if Gold’s rally is continuing.

In Asia, at the time of writing, Nikkei is up 0.32%. Hong Kong HSI is up 1.00%. China Shanghai SSE is up 0.54%. Singapore Strait Times is up 0.55%. Japan 10-year JGB yield is down -0.0031 at 0.401. Overnight, DOW dropped -0.76%. S&P 500 dropped -0.76%. NASDAQ dropped -0.96%. 10-year yield rose 0.022 to 3.397.

Fed Williams: Monetary policy still has more work to do

New York Fed President John Williams said overnight, “with inflation still high and indications of continued supply-demand imbalances, it is clear that monetary policy still has more work to do to bring inflation down to our 2% goal on a sustained basis.”

“Bringing inflation down is likely to require a period of below-trend growth and some softening of labor market conditions,” he added. “Restoring price stability is essential to achieving maximum employment and stable prices over the longer term, and it is critical that we stay the course until the job is done.”

Fed Brainard: Policy will need to be sufficiently restrictive for some time

Fed Vice Chair Lael Brainard said in a speech yesterday, “even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2 percent on a sustained basis.”

“The FOMC moved policy into restrictive territory at a rapid pace and subsequently downshifted the pace of increases in the target range at its most recent meeting,” She noted. “This will enable us to assess more data as we move the policy rate closer to a sufficiently restrictive level, taking into account the risks around our dual-mandate goals.”

Japan CPI core rose to 4% yoy in Dec, highest since 1981

Japan CPI core (all items ex-fresh food) accelerated from 3.7% yoy to 4.0% yoy in December, matched expectations. That’s also the highest level in four decades since 1981. CPI core-core (all items ex-food and energy) also accelerated from 2.8% yoy to 3.0% yoy, hitting the highest level since 1991. Headline inflation rose from 3.8% yoy to 4.0% yoy.

Food prices jumped 7.4% while energy prices rose 15.2%. “The impact on CPI from higher energy prices was large in 2022 but contributions from food prices are now bigger,” a government official said.

NZ BusinessNZ manufacturing unchanged at 47.2, further slippage expected in Q1

New Zealand BusinessNZ Performance of Manufacturing Index was unchanged at 47.2 in December. Looking at some details, production ticked up from 49.5 to 49.7. Employment rose from 46.9 to 48.8. New orders rose from 42.2 to 46.1. Finished stocks dropped from 55.5 to 50.1. Deliveries dropped from 49.6 to 48.4.

BNZ Senior Economist, Doug Steel stated that the latest PMI result “broadly fits with the clear decline we already expect for manufacturing GDP in Q4 with further slippage expected in Q1”.

Looking ahead

UK retail sales and Germany PPI will be released in European session. Later in the day, Canada retail sales is the main focus while US will release existing home sales.

USD/JPY Daily Outlook

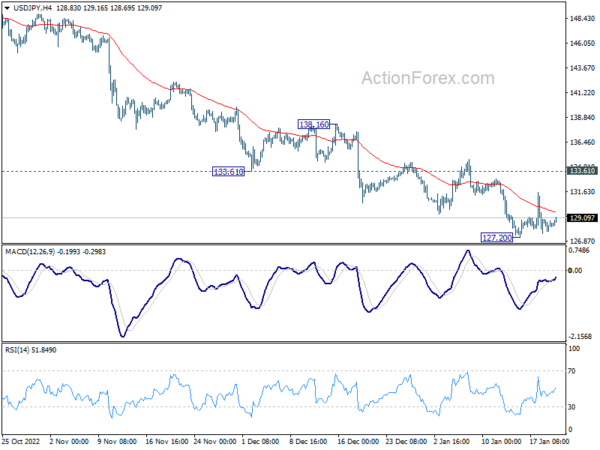

Daily Pivots: (S1) 127.13; (P) 129.35; (R1) 131.14; More…

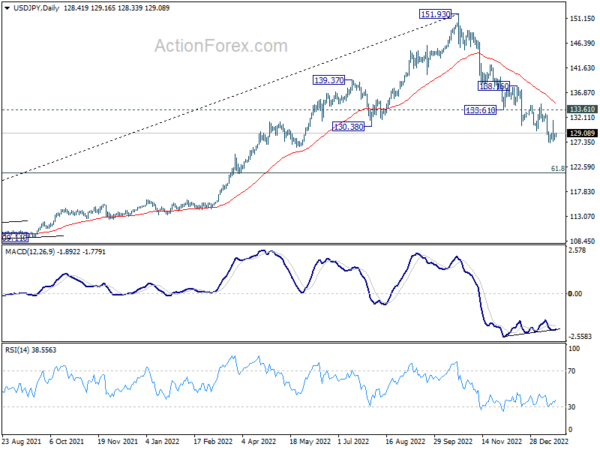

USD/JPY is staying in range above 127.20 and intraday bias remains neutral. Outlook remains bearish with 133.61 support turned resistance intact. Break of 127.20 will resume larger fall from 151.93 to 121.43 fibonacci level next. On the upside, though, firm break of 133.61 will indicate short term bottoming and bring stronger rebound.

In the bigger picture, the firm break of 55 week EMA (now at 131.59) raises the chance of medium term bearish reversal, but that’s not confirmed yet. Strong support could be seen around 61.8% retracement of 102.58 to 151.93 at 121.43 and 38.2% retracement of 38.2% retracement of 75.56 to 151.93 at 122.75 to bring rebound. But break of 134.76 resistance is needed to indicate bottoming first. Otherwise further fall will remain in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Dec | 47.2 | 47.4 | 47.2 | |

| 23:30 | JPY | National CPI Y/Y Dec | 4.00% | 4.40% | 3.80% | |

| 23:30 | JPY | National CPI Core Y/Y Dec | 4.00% | 4.00% | 3.70% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Dec | 3.00% | 2.90% | 2.80% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -45 | -41 | -42 | |

| 07:00 | GBP | Retail Sales M/M Dec | 0.40% | -0.40% | ||

| 07:00 | GBP | Retail Sales Y/Y Dec | -4.20% | -5.90% | ||

| 07:00 | GBP | Retail Sales ex-Fuel M/M Dec | 0.40% | -0.30% | ||

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Dec | -4.40% | -5.90% | ||

| 07:00 | EUR | Germany PPI M/M Dec | -1.20% | -3.90% | ||

| 07:00 | EUR | Germany PPI Y/Y Dec | 20.80% | 28.20% | ||

| 13:30 | CAD | Retail Sales M/M Nov | -0.50% | 1.40% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Nov | -0.90% | 1.70% | ||

| 15:00 | USD | Existing Home Sales M/M Dec | 3.95M | 4.09M |