Markets are generally stuck in tight range in Asian session today, with better than expected data from China providing no inspirations. Dollar is staying in consolidations in tight range, with no sign of a sustainably rebound yet. Similarly, Yen is in retreat in rather shallow manner. Volatility might start to jump with UK employment and Canada CPI featured today, while the US will be back from holiday.

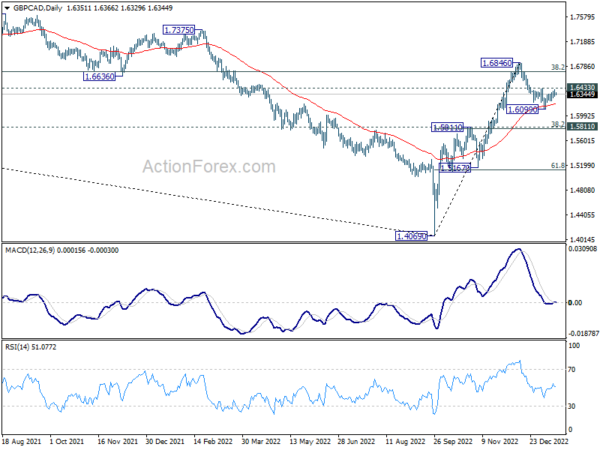

Technically, GBP/CAD would be an interesting one to watch today. Pull back from 1.6846 short term top is contained by 55 day EMA so far. Break above 1.6433 minor resistance will argue that such correction has completed, and bring stronger rise to retest 1.6846 high. On the other hand, break of 1.6099 will extend the fall from 1.6846 to 1.5811 cluster support (38.2% retracement of 1.4069 to 1.6846), even as a corrective move.

In Asia, Nikkei closed up 1.23%. Hong Kong HSI is down -1.07%. China Shanghai SSE is down -0.13%. Singapore Strait Times is down -0.16%. Japan 10-year JGB yield is down -0.0056 at 0.509.

ECB Lane: Interest rates have to be higher under vast majority of scenarios

ECB Chief Economist Philip Lane said in an FT interview published today, “we’re not yet at the level of interest rates needed to bring inflation back to 2 per cent in a timely manner”, and “it still requires work”.

Under the “vast majority” of the scenarios, “interest rates do have to be higher than they are now”. “Risks are not yet two-sided, and under a wide range of scenarios, it’s still safe to bring interest rates above where they are now,” he said.

“The question is how do you get from mid-threes at the end of 2023 to the 2% target in a timely manner,” Lane said. “That’s where interest rate policy is going to be important… to make sure that the last kilometer of returning to target is delivered.”

Lane also noted, the self-reinforcing low inflation environment in Eurozone was gotten rid of as a “byproduct” of the inflation shock. He added, “the chronic low-inflation equilibrium we had before the pandemic will return.”

BoE Bailey: Labor force shrinkage the major risk to UK inflation

BoE Governor Andrew Bailey told a parliamentary committee yesterday that inflation could fall back substantially this year. Still, there are risks from labor shortage and China.

“The biggest single reason inflation has risen to that level is the war in Ukraine. It is also the most likely reason that we’re going to see a rapid fall in inflation in the year ahead, because we are not seeing energy prices rising further. In fact, they’re coming down,” he said.

“Going forwards, the major risk to inflation coming down in the way that it will is the supply side,” Bailey said. “In this country particularly the question of the shrinkage of the labor force,” which has pushed up wages.

“First of all in the economic outlook it think it’s quite likely we will see a negative impact in the short run in China from what’s going on at the moment from the release of the Covid restrictions and the impact that’s having,” Bailey said. “I’m not sure that would be very long lasting.”

China GDP growth slowed to 2.9% yoy in Q4, but beat expectations

China’s GDP growth slowed to 2.9% yoy in Q4, down from Q3’s 3.9% yoy but beat expectation of 1.8% yoy. For 2022 as a whole, GDP grew 3.0%, sharply lower than 2021’s 8.4%, but was better than 2020’s 2.2%. That’s still the second worst on record nonetheless.

In December, industrial production rose 1.3% yoy, above expectation of 0.3% yoy. Retail sales declined -1.8% yoy, much better than expectation of -9.5% yoy. Fixed asset investment grew 5.1% ytd yoy, above expectation of 5.1%.

“The foundation of domestic economic recovery is not solid as the international situation is still complicated and severe while the domestic triple pressure of demand contraction, supply shock and weakening expectations is still looming,” NBS said in a release.

Also released, China’s population decreased by -850k in 2022, the first contraction in more than six decades. Birthrate was at 6.77 births per 1000 people, sharply down from 2021’s 7.52 births, and marked the lowest level on record. Death rate rose from 7.18 to 7.37 per 1000 people, highest since 1976.

NZ NZIER business sentiment hit record low

New Zealand NZIER Quarterly Survey of Business Opinion showed, in Q4 on a seasonally adjusted basis, a net 73% of businesses expect general economic conditions to deteriorate over the coming months. That’s the worst level in the survey’s history.

A net 13% of businesses reported a decline in their own activity over the past quarter, worst since Q2 2020 during the full impact of the first pandemic lockdown. A net 33% expected decline in activity in the coming quarter.

“Firms have also reduced investment plans substantially, particularly when it comes to investment in buildings,” NZIER said. Retail businesses were feeling “very downbeat”, it found.

Australia Westpac consumer sentiment rose 5% in Jan

Australia Westpac Consumer Sentiment rose 5.0% mom to 84.3 in January, the largest monthly gain since April 2021. It’s also the second straight month of improvement, with combined rise of 8.1%. Current Conditions index rose 2.8% mom while Expectations Index rose 6.3% mom. Unemployment Expectations also improved 8.4% mom.

Westpac said: “One likely explanation for the lift in confidence is that January was the first month since April last year that did not see an increase in the RBA cash rate. While that was because there was no RBA Board meeting in the month rather than an explicit decision by the Bank to leave rates unchanged, the break in the tightening cycle looks to have provided some relief.”

Regarding RBA rate decision, Westpac expects another 25bps hike on February. It also expects clear message from RBA that the February increase will not be the last in the tightening cycle, because of a lift in annual inflation, strong retail sales growth and ongoing tight labor market.

Looking ahead

UK employment and Germany ZEW economic sentiment are the major focuses in European session. Later in the day, Canada CPI is the main feature.

USD/CAD Daily Outlook

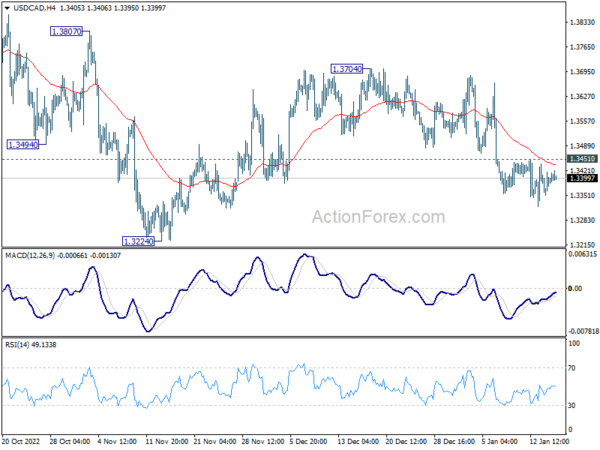

Daily Pivots: (S1) 1.3368; (P) 1.3393; (R1) 1.3433; More….

Intraday bias in USD/CAD remains neutral and outlook is unchanged. Further decline could still be seen, but downside should be contained above 1.3224 key support level. Above 1.3451 minor resistance will turn bias back to the upside for 1.3704 resistance. However, sustained break of 1.3222/4 cluster support will resume the whole fall from 1.3976 and carry larger bearish implications.

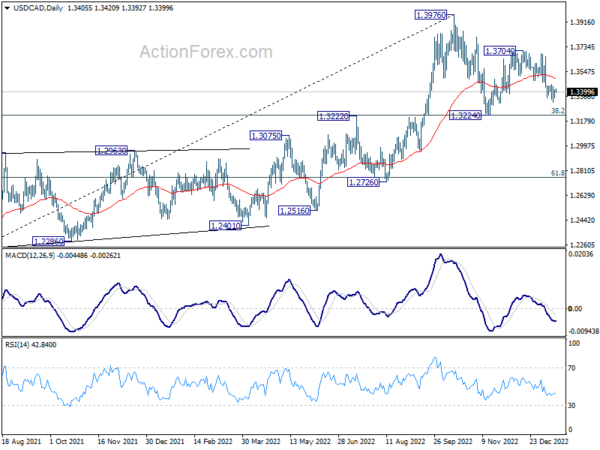

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q4 | -70 | -42 | ||

| 23:30 | AUD | Westpac Consumer Confidence Jan | 5.00% | 3.00% | ||

| 02:00 | CNY | GDP Y/Y Q4 | 2.90% | 1.80% | 3.90% | |

| 02:00 | CNY | Industrial Production Y/Y Dec | 1.30% | 0.30% | 2.20% | |

| 02:00 | CNY | Retail Sales Y/Y Dec | -1.80% | -9.50% | -5.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 5.10% | 5.00% | 5.30% | |

| 04:30 | JPY | Tertiary Industry Index M/M Nov | -0.20% | 0.20% | 0.20% | 0.50% |

| 07:00 | GBP | Claimant Count Change Dec | 19.8K | 30.5K | ||

| 07:00 | GBP | ILO Unemployment Rate (3M) Nov | 3.70% | 3.70% | ||

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Nov | 6.10% | 6.10% | ||

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Nov | 6.30% | 6.10% | ||

| 07:00 | EUR | Germany CPI M/M Dec F | -0.80% | -0.80% | ||

| 07:00 | EUR | Germany CPI Y/Y Dec F | 8.60% | 8.60% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | -15.5 | -23.3 | ||

| 10:00 | EUR | Germany ZEW Current Situation Jan | -57 | -61.4 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | -14.3 | -23.6 | ||

| 13:15 | CAD | Housing Starts Y/Y Dec | 265K | 264K | ||

| 13:30 | CAD | CPI M/M Dec | -0.60% | 0.10% | ||

| 13:30 | CAD | CPI Y/Y Dec | 6.30% | 6.80% | ||

| 13:30 | CAD | CPI Median Y/Y Dec | 4.90% | 5.00% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 5.20% | 5.30% | ||

| 13:30 | CAD | CPI Common Y/Y Dec | 6.60% | 6.70% | ||

| 13:30 | USD | Empire State Manufacturing Index Jan | -8.2 | -11.2 |