The forex markets turned mixed with an ultra-light economic calendar today, while the US is on holiday. Dollar is recovering slightly but it’s outperformed by Swiss Franc and Canadian. Yen is paring some of recent gains, as eyes turn to Wednesday’s BoJ policy decision. Sterling and Aussie are turning softer together with Euro. Overall, though, most major pairs and crosses are staying inside Friday’s range.

Technically, AUD/JPY could be a pair to watch in the upcoming Asian session with a batch of China data featured. So far, price actions from 87.00 are corrective looking. Rejection by 55 day EMA also keeps outlook bearish. Retest of 87.00 low should be seen on next move. Firm break there will resume whole fall form 99.32 to 38.2% retracement of 59.85 (2020 low) to 99.32 at 84.24.

In Europe, at the time of writing, FTSE is up 0.10%. DAX is up 0.41%. CAC is up 0.37%. Germany 10-year yield is up 0.0250 at 2.165. Earlier in Asia, Nikkei dropped -1.14%. Hong Kong HSI rose 0.04%. China Shanghai SSE rose 1.01%. Singapore Strait Times dropped -0.31%. Japan 10-year JGB yield rose 0.0026 to 0.514.

WEF: 63% chief economists expect global recession in 2023

In the Chief Economists Outlook of the World Economic Forum, 63% of survey respondents said a global recession is likely this year, with 18% saying that it’s “extremely likely”.

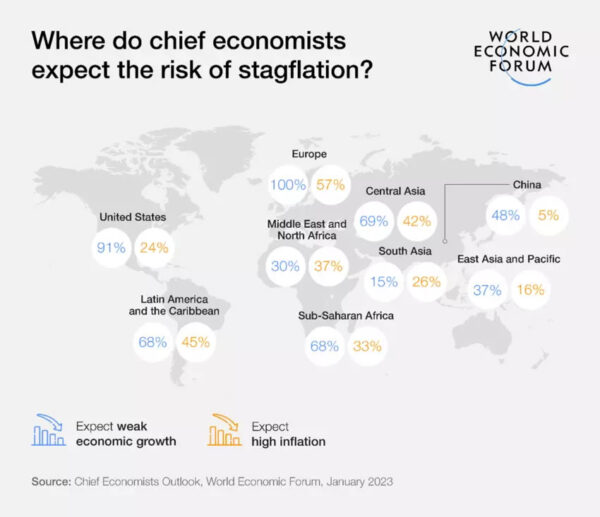

Prospect for growth was also bleak, all respondents expecting weak growth in Europe, (68% very weak and 32% weak). 91% expect weak growth in the US (9% very weak, and 82% weak. Even for China, 48% expect weak growth (10% very weak, 38% weak).

Inflation expectations saw significant variation across regions. All respondents expect high inflation in Europe (43% high, 57% very high). Also, all respondents expect high inflation in the US (76% high, 24% very high). But only 53% expect high inflation in China (48% high, 5% very high).

Canada manufacturing sales flat at CAD 72.3B in Nov

Canada manufacturing sales were flat at CAD 72.3B in November, below expectation of 2.3% mom growth. higher sales of durable goods (+1.8%), led by motor vehicles (+12.7%) and fabricated metal products (+2.7%), were offset by lower sales of non-durable goods (-1.7%), led by the chemical (-4.4%) and petroleum and coal product (-2.1%) industries.

Japan PPI up 10.2% yoy in Dec, second highest on record

Japan PPI rose 10.2% yoy in December, accelerated from 9.7% yoy, above expectation of 9.5% yoy. The reading topped 10% handle for the second time in 2022, marking the second-largest gains on record, following the 10.3% yoy jump in September.

For 2022, wholesale prices rose 9.7% on average, hitting a new record high since comparable data became available in 1981. It’s also twice as fast as in 2021 when a 4.6% increase was reported.

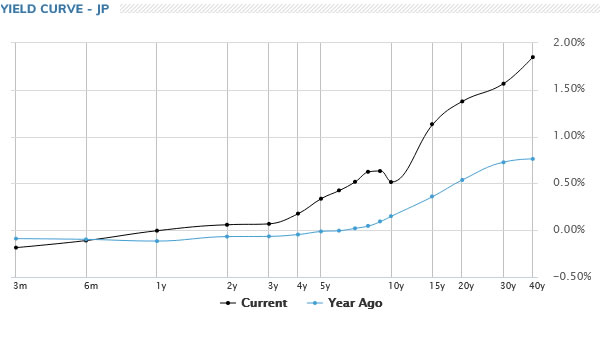

Japan yield curve distortion worsens, Nikkei down

Japanese stocks, bonds and currency market remain rather nervous today, as traders are eyeing BoJ policy decision on Wednesday. The yield curve “distortion”, as described by the central bank, was getting more serious after 8- and 9-year yield surged past 0.6% handle last week. At the same time, 10-year JGB yield, closed at 0.514, is still firmly tied to the 0.5% cap. Both 8- and 9-year yield closed down but stayed above 10-year’s level at 0.624 and 0.632.

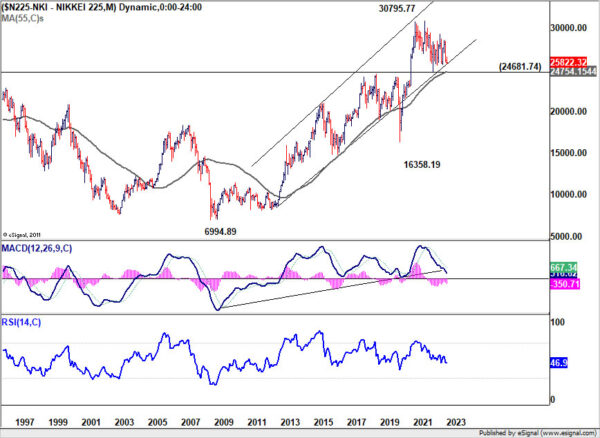

As speculation on a YCC tweak to rectify the distortion intensified , Nikkei declined -1.14% to close at 25822.32. Technically speaking, while deeper decline is possibly for the near term, strong support should be seen around 24681.74 to contain downside. The level is close to 55 month EMA, which stands at 24754.15. Nikkei has been continuously supported by the EMA, as well as the long term channel, for a decade, barring the initial two months of the pandemic. But a firm break of 24681.74 will indicate something rather substantial is happening.

EUR/USD Mid-Day Outlook

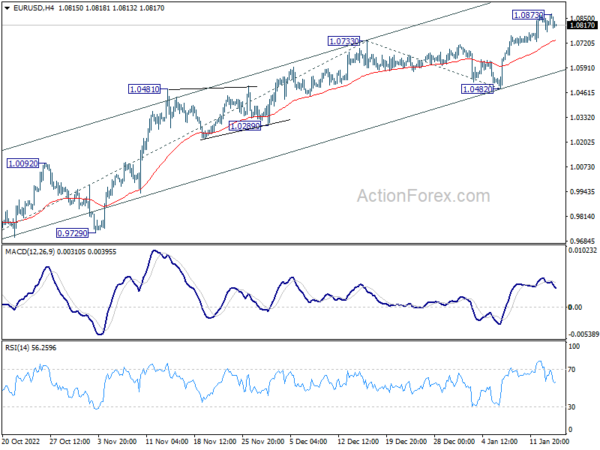

Daily Pivots: (S1) 1.0787; (P) 1.0827; (R1) 1.0874; More…

A temporary top is formed at 1.0873 with current retreat. Intraday bias in EUR/USD is turned neutral for consolidations first. But further rally is expected as long as 1.0482 support holds. On the upside, break of 1.0873 will resume larger rally from 0.9534 to 61.8% projection of 0.9630 to 1.0733 from 1.0482 at 1.1164 next.

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rally is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Dec | 10.20% | 9.50% | 9.30% | 9.70% |

| 00:00 | AUD | TD Securities Inflation M/M Dec | 0.20% | 1.00% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Dec P | 1.00% | -7.70% | ||

| 13:30 | CAD | Manufacturing Sales M/M Nov | 0.00% | 2.30% | 2.80% | 2.40% |

| 15:30 | CAD | BoC Business Outlook Survey |