The major US stock indices are opening with declines. Each are working on winning streaks with the NASDAQ at five days and the S&P and Dow at three days. A snapshot of the market six minutes into the opening is showing:

- Dow Industrial Average down -221.84 points or -0.65% at 33968.14

- S&P index -29.65 points or -0.74% at 3953.51

- NASDAQ index -70.12 points or -0.64% at 10930.98

- Russell 2000-10.05 points or -0.54% at 1866.00

looking at the US debt market, yields are trading higher after moving lower yesterday after the CPI:

- two year 4.167%, +1.8 basis points

- five year 3.554%, +1.5 basis points

- 10 year 3.463%, +1.8 basis points

- 30 year 3.59% +1.2 basis points

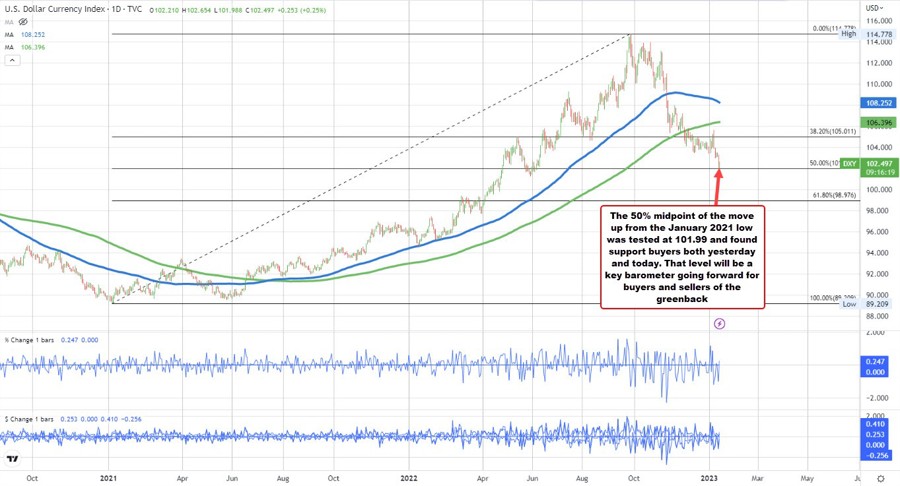

The USD index (DXY) is trading higher today by 0.25%, after testing the the 50% midpoint of the move up from the January 2021 low to the September 2022 high (see daily chart below), and finding buyers

The 50% midpoint comes in at 101.994. The low today reached down to 101.988 (right at the level) before rebounding back to the upside. Yesterday the price low reached 102.078, and also found willing buyers against the risk defining level.

The 50% midpoint will be a barometer for both buyers and sellers of the US dollar going forward. Be aware.

The USD index (DXY) tested ski 50% midpoint and found buyers