Dollar recovers broadly today as risk sentiment turns negative again. Hawkish comments from Fed officials this week reminded people that even though a smaller hike is possible for February, interest rates are going to stay high for “a long time”. Euro is currently the second strongest for the day, followed by Canadian. On the other hand, Aussie’s rally is losing momentum quickly and trade as the worst for the day, followed by Sterling and Yen. Now, let’s see what reactions Fed Chair Jerome Powell would trigger.

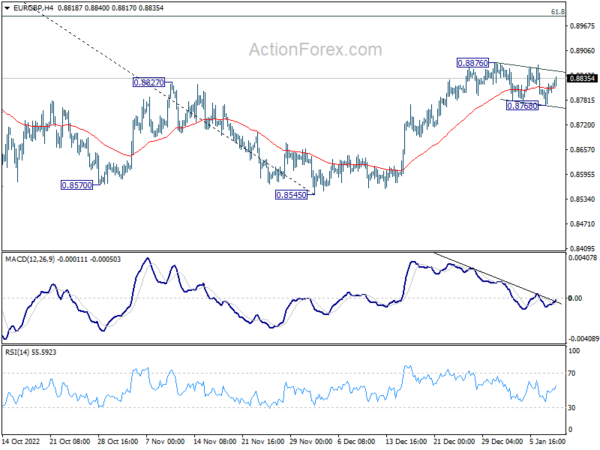

Technically, EUR/GBP’s corrective pattern from 0.8876 might be close to completion. Retest of 0.8876 could be seen soon. Firm break there will resume whole rise from 0.8545 to 61.8% retracement of 0.9276 to 0.8545 at 0.8997. If that happens, it’s a bit uncertain whether stronger rally would be seen in EUR/USD together, or in other Euro crosses.

In Europe, at the time of writing, FTSE is down -0.28%. DAX is down -0.46%. CAC is down -0.66%. Germany 10-year yield is up 0.047 at 2.276. Earlier in Asia, Nikkei rose 0.78%. Hong Kong HSI dropped -0.27%. China Shanghai SSE rose 0.38%. Singapore Strait Times dropped -1.29%. Japan 10-year JGB yield rose 0.0062 to 0.512, above expectation’s 0.5% cap.

US NFIB Small Business Optimism Index declined to 89.8 in Dec

US NFIB Small Business Optimism Index declined -2.1 pts to 89.8 in December, below expectation of 91.6. That’s also the 12th consecutive month the index was below 49-year average of 98.

“Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate,” said NFIB Chief Economist Bill Dunkelberg. “Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

ECB Schnabel: Inflation will not subside by itself

ECB Executive Board member Isabel Schnabel said in a speech “inflation will not subside by itself”. She added that preliminary data for December “point to a persistent build-up of underlying price pressures even as energy price inflation has started to subside from uncomfortably high levels.”

“To resolve today’s inflation problem, financing conditions will need to become restrictive,” she said. “Tighter financing conditions will slow growth in aggregate demand, which is needed to reduce the upward pressure on prices that has resulted from the long-lasting damage to the euro area’s production capacity inflicted by the energy crisis.”

“Monetary policy would need to raise interest rates even more forcefully to restore trust in the economy’s nominal anchor. In the 1970s, financing conditions tightened to an extent that made capital accumulation prohibitively expensive.”

BoJ Kuroda: Central banks cannot unconditionally respond to climate change

At an event in Stockholm, BoJ Governor Haruhiko Kuroda said, “central banks, which are independent from governments cannot unconditionally respond to climate change,” and must “autonomously decide their actions within their mandate” from a long-term perspective.

He added that central banks must try to affect the overall economy, but not specific industries.

While BoJ doesn’t have specific mandata on climate change, it’s “generally accepted by the public” that the central bank’s measures are in line with the government. Back in 2021, BoJ launched a scheme to offer zero-interest loans to boost green and sustainable loans.

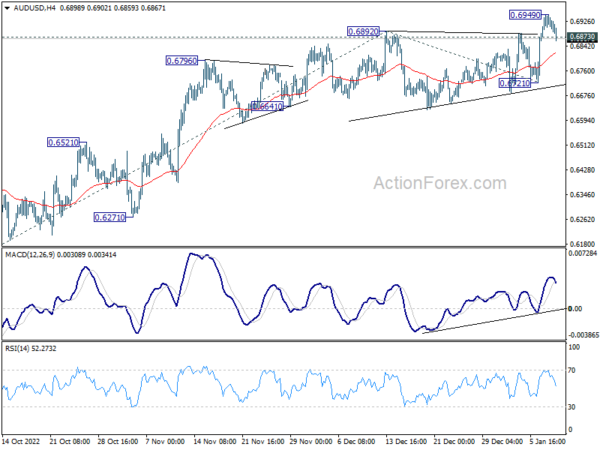

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6875; (P) 0.6913; (R1) 0.6950; More…

A temporary top is formed at 0.6949 in AUD/USD and intraday bias is turned neutral for some consolidations first. But outlook will stay bullish as long as 0.6721 support holds. Break of 0.6949 will resume larger rise from 0.6169 to 61.8% projection of 0.6169 to 0.6892 from 0.6721 at 0.7444 next. However, firm break of 0.6721 will indicate near term reversal and turn bias back to the downside.

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.6871. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Dec | 4.00% | 3.80% | 3.60% | |

| 23:30 | JPY | Household Spending Y/Y Nov | -1.20% | 0.60% | 1.20% | |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Dec | 6.50% | 4.10% | ||

| 07:45 | EUR | France Industrial Output M/M Nov | 2.00% | 0.90% | -2.60% | -2.50% |

| 11:00 | USD | NFIB Business Optimism Index Dec | 89.8 | 91.6 | 91.9 | |

| 15:00 | USD | Wholesale Inventories Nov F | 1.00% | 1.00% |