Markets:

- Gold up $34 to $1867

- US 10 year yields down 17 bps to 3.55%

- WTI crude oil flat at $73.67

- S&P 500 up 95 points to 3924

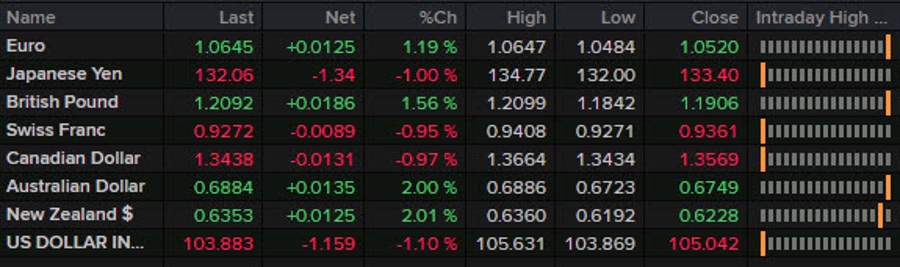

- NZD leads, USD lags

We’re only four days into 2023 trading and we’ve already had some twists and turns, including some big ones today.

The dollar was strong heading into non-farm payrolls in an indication that market participants had been swayed by this week’s ADP report and were leaning towards a stronger headline. Indeed the headline came in stronger and with a drop in unemployment but the market instead focused on significantly slower wage growth and the reaction was dovish, with the US dollar sagging.

However that reaction didn’t last long. US equities opened strong but quickly gave back all the gains and some risk aversion kicked in sending EUR/USD down to 1.0510 from 1.0544 at the post-jobs peak. Other pairs also experienced varying degrees of retracements.

The final big twist came on a terrible ISM services report. That’s a forward-looking indicator and it gave the market confidence that the Fed is nearing the end of the line with hikes. Treasury yields crumbled alongside the dollar and from 1.0510 the euro rallied all the way to 1.0646.

The USD/JPY range was also extremely wide today from 134.77 just before non-farm payrolls all the way down to a late-day session low of 132.07.

The loonie was also in focus as USD/CAD rallied early in the day to 1.3650 then tumbled to 1.3439 because of an extremely strong Canadian jobs report. Pricing now suggests an additional 25 bps hike from the BOC later this month. Notably, CAD significantly underperformed its commodity cousins despite the strong report. Some of that is China-leverage for the antipodeans but there’s also the growing risk that the BOC overtightens and housing/consumer spending collapses.

Have a great weekend.